MB Securities JSC (MBS: MCK, HNX) has announced its plan to conduct a private placement to raise charter capital in 2024. This decision was approved by the CEO and is in line with Resolution No. 01/NQ-MBS-ĐHĐCĐ dated March 28, 2024, of the Annual General Meeting of Shareholders and Resolution No. 60/NQ-MBS-HĐQT dated August 12, 2024, of the Board of Directors of MB Securities.

MB Securities plans to offer over 25.7 million shares to professional securities investors as stipulated by law. The expected offering price is VND 23,040 per share, and the number of prospective investors is four. The payment deadline for purchasing these shares is from November 20, 2024, to 3:00 PM on November 28, 2024.

Illustrative image

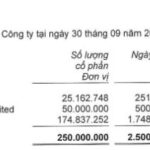

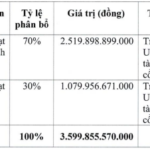

With a par value of VND 10,000 per share, the total value of the expected share issuance exceeds VND 257.3 billion, equivalent to 4.704% of MB Securities’ charter capital after the previous issuance of bonus shares to existing shareholders. If this issuance is successful, the number of MB Securities’ shares will increase from 547.1 million to over 572.8 million.

The purpose of this private placement is to strengthen MB Securities’ business operations. Accordingly, the expected proceeds of nearly VND 592.9 billion will be allocated as follows: almost VND 492.9 billion for margin lending activities and VND 100 billion for proprietary trading. The company plans to utilize this capital during 2024–2025, adhering to its business plan.

Recently, the Hanoi Stock Exchange (HNX) approved the listing of over 109.4 million MBS common shares offered to the public, with a total value of nearly VND 1,094.1 billion based on the par value.

Following this additional listing, the total number of listed MBS shares has increased to nearly 547.1 million, with a total value of nearly VND 5,470.8 billion based on the par value.

Prior to this private placement, MB Securities had issued over 109 million shares to existing shareholders to increase its charter capital. Specifically, the company issued over 109.4 million new shares at a ratio of 4:1 (for every four shares held, one new share could be purchased). These shares are freely transferable, and the expected offering price was VND 10,000 per share.

The company anticipated proceeds of nearly VND 1,094.2 billion, with allocations as follows: VND 50 billion for information technology system development, VND 450 billion for proprietary trading and underwriting, and nearly VND 594.2 billion for margin lending.

Is Kafei Securities Upping its Capital Raising Game to 5,000 Billion VND?

The company Kafi is seeking shareholder approval for a new proposal. From November 18 to November 28, 2024, Kafi will be soliciting written feedback from its shareholders regarding a proposed alternative to the previously approved plan. This new proposal aims to present a revised strategy that better aligns with the company’s long-term vision and goals.

The Race to Surpass: HSC Aims High with a Proposed Capital Increase to Over VND 10 Trillion

The Ho Chi Minh City Securities Corporation (HSC) is planning to offer its existing shareholders a treat. According to the company’s recent extraordinary general meeting documents, the board of directors is seeking approval for a share sale proposal. The offer price? A tempting 10,000 VND per share, equivalent to the par value. And the timing? Well, HSC is eyeing 2025 for this enticing opportunity.

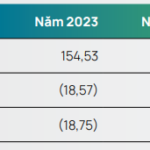

The Tapping Potential: Unlocking Opportunities Beyond Quarter 3, 2024.

In a landscape of booming securities lending, several securities firms are facing a crunch with their lending capacity lagging behind their peers. This disparity puts these firms under pressure to bolster their capital reserves in the near future.