Nam Long Investment Joint Stock Company (Stock Code: NLG, HoSE) has just announced Resolution No. 56a/2024/NQ/HĐQT/NLG of the Board of Directors on approving the company’s bond issuance plan.

Accordingly, the Board of Directors of Nam Long Investment has approved the plan to issue corporate bonds in the form of private placement with a total issuance value of up to VND 1,000 billion at par value.

The expected total volume is 10,000 bonds, which are non-convertible corporate bonds without warrants, and will be secured by assets after the issuance date and the establishment of Nam Long Investment’s direct debt obligations.

The bond’s par value is VND 100 million/bond, with a term of 36 months from the issuance date, expected to be offered in a single batch in Q4/2024 or Q1/2025. The specific issuance date will be decided by the Chairman of the Board of Directors.

Illustrative image

Nam Long Investment plans to use the proceeds from the bond offering to restructure the company’s debt. Specifically, Nam Long Investment will use VND 500 billion to repay the entire principal amount of the early repurchase of bonds with the code NLGH2229001 (Stock Code: NLG12205) issued by the company on June 14, 2022, due on March 28, 2029.

In addition, the company plans to use VND 500 billion to repay the entire principal amount of the early repurchase of bonds with the code NLGH2229002 (Stock Code: NLG12203) issued by the company on December 13, 2022, due on March 28, 2029. The expected time of capital usage is in Q4/2024 or Q1/2025.

The Board of Directors of Nam Long Investment has also approved the use of the company’s assets to secure the obligations for this bond issuance. Specifically, the company will use its assets, including shares of Nam Long VCD Joint Stock Company, shares of Southgate Joint Stock Company, capital contributions to Dong Nai Waterfront City Company Limited, and other assets owned by Nam Long Investment and/or third parties (if any) at each time according to the decision of the competent authority as prescribed.

Among these, the value of more than 78.6 million shares in Nam Long VCD at the time of pledge is over VND 2,000 billion, equivalent to VND 25,441/share, based on Appraisal Certificate No. 391/2024/39 dated October 23, 2024, issued by IValue Appraisal Joint Stock Company.

Regarding the payment of interest and principal on bonds issued and debts due in the 3 consecutive years before this bond offering, Nam Long Investment always pays on time.

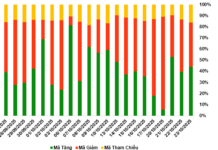

In 2023, the company’s bond debt at the beginning of the year in par value was VND 3,060 billion, the total volume of bonds issued was VND 500 billion, VND 450 billion of principal was repaid, the bond debt at the end of the year was VND 3,110 billion, and VND 278.5 billion of bond interest was paid.

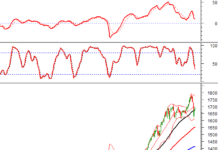

In terms of business results, Nam Long Investment has just announced its Q3/2024 consolidated financial statements with a post-tax loss of over VND 40 billion, while the same period last year still made a profit of nearly VND 80 billion.

Notably, Nam Long reported a loss while revenue still grew by 4% to nearly VND 371 billion. Due to a higher increase in cost of goods sold, gross profit decreased by 14% to over VND 128 billion.

For the first 9 months of the year, Nam Long’s revenue was VND 827.5 billion, down 46% over the same period. Thanks to the results of the first two quarters of the year, net profit reached nearly VND 92 billion, down 83% over the same period.

As of September 30, 2024, Nam Long’s total assets were VND 29,829.2 billion, up 4% from the beginning of the year. Inventories accounted for the largest proportion, at 68% of total assets, reaching VND 20,303 billion, up 17% from the beginning of the year.

On the other side of the balance sheet, Nam Long’s total liabilities were VND 16,585 billion, up 10% in the past 9 months. Of which, short-term borrowings increased by more than VND 500 billion to VND 2,935 billion, while long-term borrowings slightly decreased to VND 3,655 billion.

The Radiant East Holding Stock (RDP) Falls into Trading Halt

Rạng Đông Holding (RDP) has once again found itself in hot water with regulators due to non-compliance with information disclosure regulations. As a result, the Ho Chi Minh Stock Exchange (HoSE) has taken decisive action by moving to suspend trading of RDP shares, shifting them from restricted trading to a trading halt.

Unlocking Legal Hurdles for Aqua City Project: Novaland Shares Surge as Over 12 Million Units Change Hands

Novaland witnessed a trading volume of over 12 million shares, the highest in the last four sessions.

The Steel Baron: SMC’s Spiraling Losses in a Troubled Industry

As per the disclosure on November 11th, SMC acknowledged the disappointing Q3/2024 profit results, despite their implemented strategies to enhance performance.