Southeast Asia’s IPO market has witnessed a recent slowdown, with only 122 deals and approximately $2.9 billion raised as of mid-November, according to Deloitte’s latest report. This marks the lowest amount raised in nine years, a significant drop from the $5.8 billion raised through 163 deals in 2023.

Vietnam, in particular, had just one IPO deal in the first ten months of 2024, with DNSE Securities successfully raising around $37 million. This fintech IPO was Vietnam’s first in this sector and outperformed the entire Vietnamese market in 2023.

“While the Vietnamese stock market faces certain challenges in 2024, it also presents a great opportunity to seize due to favorable macroeconomic conditions and a low-interest-rate environment,” said Mr. Bui Van Trinh, Deputy General Director of Assurance Services at Deloitte Vietnam.

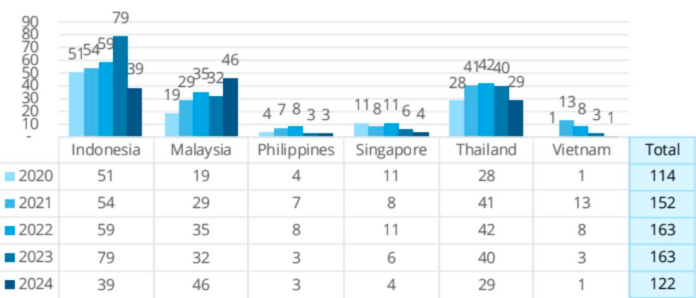

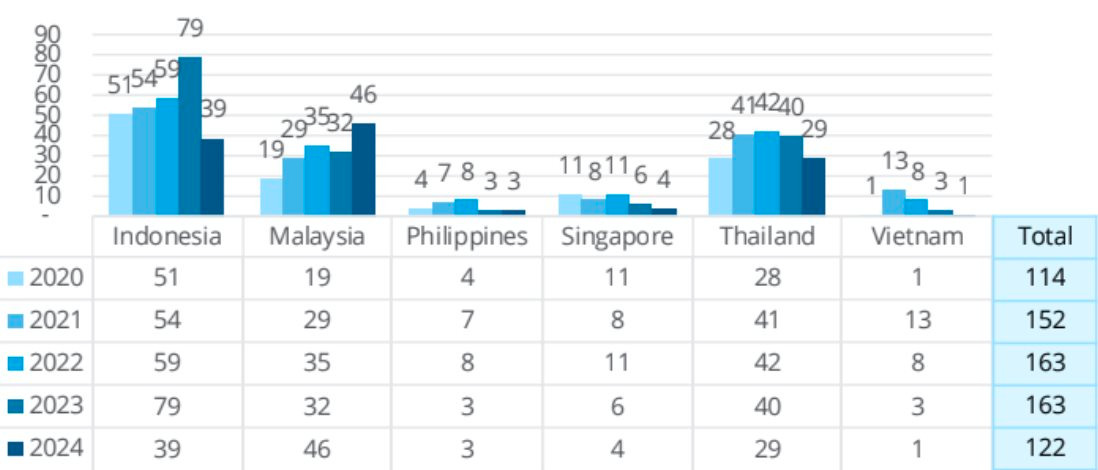

Number of IPO deals in the reported markets. Source: Deloitte

The report also highlights the performance of other Southeast Asian markets, including Malaysia, Thailand, Indonesia, and Singapore.

Malaysia stood out with a record year, hosting 46 IPOs and raising $1.5 billion, the highest in six years, along with $6.6 billion in IPO market capitalization, accounting for half of the region’s total IPO funds raised this year.

Thailand witnessed a decrease in IPO deals compared to the previous year, with 29 deals in 2024, but the total amount raised – $756 million – accounted for 26% of the region’s total, making it one of the top three markets in Southeast Asia.

Indonesia’s IPO market in 2024 experienced a significant decline, with 39 deals raising $368 million, compared to 79 deals that raised $3.6 billion in 2023. Smaller companies approached IPOs with more cautious fundraising goals due to various political and global macroeconomic factors.

Singapore saw four IPOs on the Catalist board, raising approximately $34 million in the first ten and a half months. These listings belonged to the Consumer, Industrial Products, Life Sciences, and Healthcare sectors.

According to Deloitte, the slowdown in the region’s IPO activity compared to the previous year is mainly due to the absence of mega-deals. In 2024, only one IPO deal raised more than $500 million, unlike 2023, which saw four such transactions.

Looking at sectors, Consumer and Energy and Resources dominated the region, accounting for 52% of total IPO deals and 64% of total IPO proceeds raised.

As we look ahead, Ms. Hwee Ling, the leader of Assurance Accounting and Reporting Services at Deloitte Southeast Asia, predicts that expected interest rate cuts and lower inflation could create a more favorable environment for IPOs in the coming years. The region’s strong consumer base, growing middle class, and strategic importance in sectors like real estate, healthcare, and renewable energy continue to attract investors.

“With foreign direct investment continuing to flow into the region, 2025 is shaping up to be a year for new IPOs across Southeast Asia,” she added.