The Vietnam stock market witnessed a resurgence of green on November 20th, as the VN-Index climbed to 1,216.54, an increase of 11.39 points from the previous session. This recovery came after some consecutive adjustments, bringing a positive turn to the market. However, foreign trading was a detractor, with net selling of 1,244 billion VND across the market.

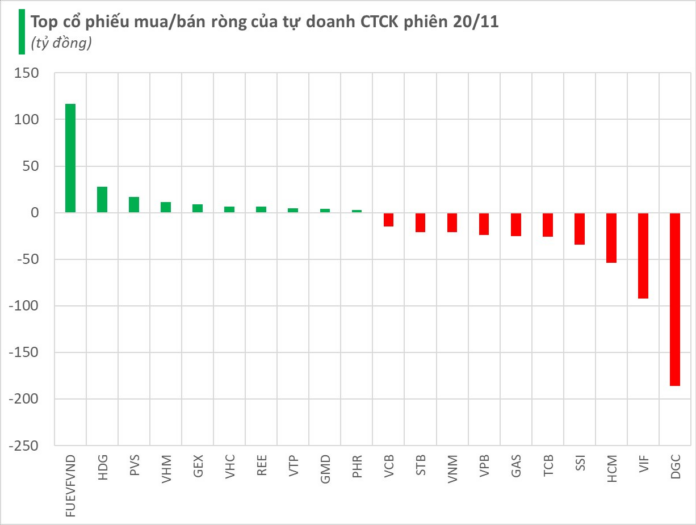

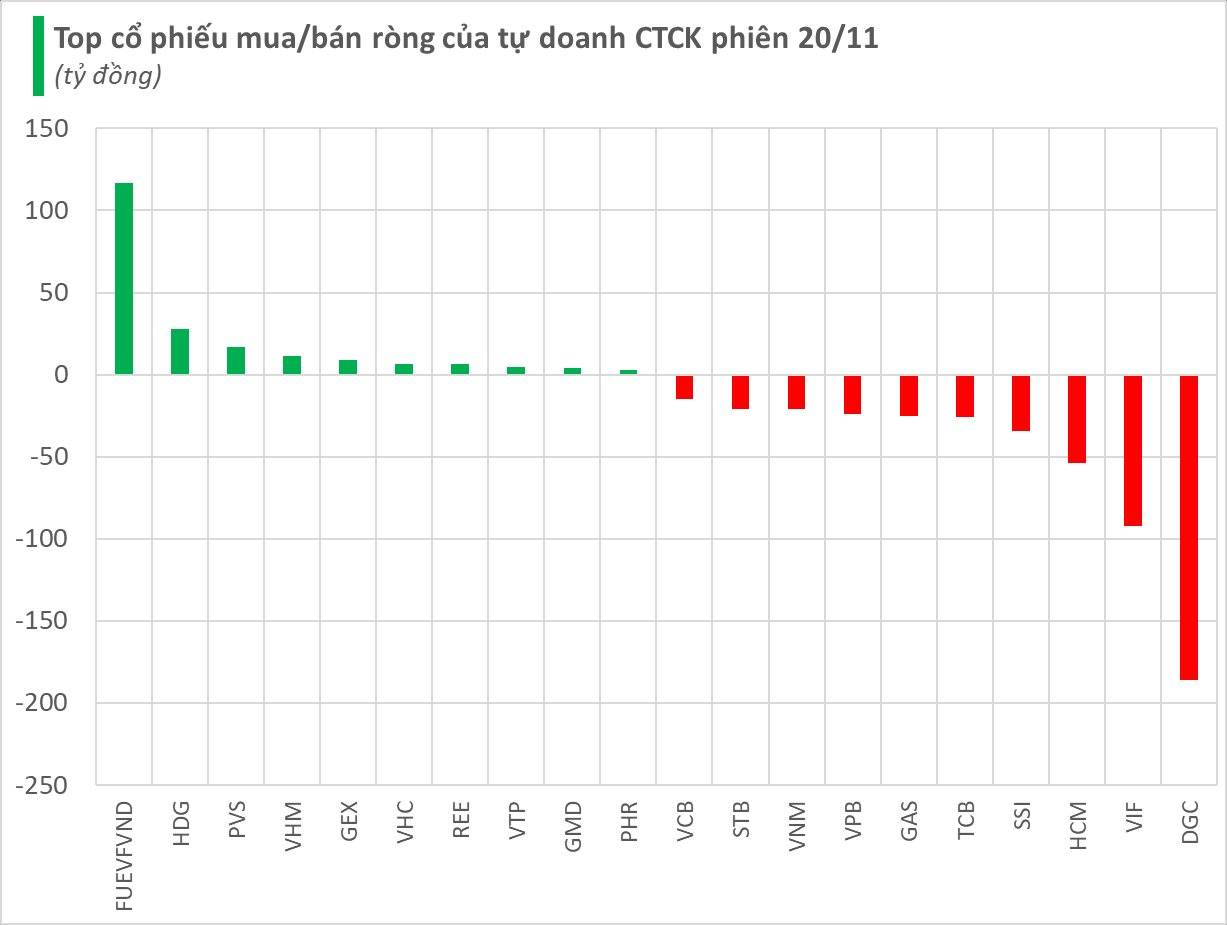

Securities companies’ proprietary trading saw significant net selling of 482 billion VND across the market.

On the HoSE, securities firms’ proprietary trading sold a net of 395 billion VND, including 280 billion VND on the matching channel and 115 billion VND on the negotiated channel. DGC witnessed the heaviest net selling by this group, amounting to 186 billion VND. HCM and SSI followed with net selling of 54 billion VND and 35 billion VND, respectively. Other stocks that faced net selling in today’s session included TCB, GAS, VPB, and VNM.

On the buying side, securities firms’ proprietary trading showed a sudden spike in net buying of 117 billion VND in FUEVFVND, while HDG saw net buying of 28 billion VND. Additionally, stocks like VHM, GEX, VHC, and REE also experienced net buying during the November 20th session.

On the HNX, securities firms’ proprietary trading sold a net of 75 billion VND, focusing on VIF with net selling of 92 billion VND, while PVS was net bought for nearly 17 billion VND.

On the UPCoM, securities firms’ proprietary trading sold a net of 12 billion VND, with SEA and VEA facing net selling of over 8 billion VND and 7 billion VND, respectively. In contrast, VGI was net bought for nearly 2 billion VND.

The VN-Index Retreats to Near 1,200 Points, Domestic Individuals and Institutions Seize the Opportunity to Snap Up Nearly VND2,000 Billion.

Individual investors bought a net amount of 1,386.7 billion VND, of which 1,112.0 billion VND was net bought in matched orders. Domestic institutional investors also net bought 439.6 billion VND, with 539.7 billion VND net bought in matched orders.

The Foreign Selling Spree: Unraveling the 7/11 Session’s Massive Sell-off of Over VND 400 Billion

The aforementioned stocks, MWG, STB, and TCB, witnessed robust buying activity from foreign investors on the HOSE exchange. The foreign buying interest in these stocks was evident, with respective net buying values of 48 billion, 43 billion, and 41 billion VND.