Bitcoin Surges Towards $100,000: Opportunities and Risks for Investors in Vietnam

On November 22, Bitcoin surged towards the $100,000 mark in the international market, surpassing the expectations of investors. Bitcoin has doubled in value this year, especially with a 40% increase in the two weeks following Donald Trump’s election as President of the United States.

Billion-dollar profits in just three months?

Bitcoin’s impressive performance has attracted investors worldwide, including in Vietnam, to pour their money into this digital currency.

Mr. Do Hoang Phong, a close follower of the digital currency market in Ho Chi Minh City, shared that he had made over $1 billion in profit in just three months through investing in Bitcoin. Specifically, in August, he purchased one Bitcoin for $50,000, equivalent to 2.4 billion VND. Not long after, he sold it for $75,000 per coin, reaping a profit of over $1 billion VND.

Bitcoin has surpassed 2.5 billion VND per coin, but many people are still investing, anticipating further price increases.

“After selling, I saw Bitcoin rise to $99,000, and I felt a bit regretful. But I switched to buying Ethereum (ETH) and am currently profiting by 30-40%. I bought ETH at $2,500 per coin, and now the price has increased to $3,500. I expect the price to continue rising,” Mr. Phong expressed.

Many Vietnamese investors are also holding large amounts of PI Network, anticipating a significant increase in the value of this virtual currency when the system officially “opens the mainnet” at the end of this year. Currently, even though PI has not been officially listed, its price has already increased considerably. Since the beginning of the year, PI’s price has risen from $40 to $80 per PI.

Mr. Phan Duc Nhat, Chairman of Coin.Help & BHO Network, stated that immediately after Donald Trump’s reelection as President, Bitcoin and many other digital currencies surged in value. An important reason for this was Trump’s change in attitude, from criticism to support for Bitcoin.

Trump pledged that if elected, he would promote Bitcoin’s development by rebuilding mechanisms and policies and firing Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC). Additionally, Trump also intends to make the US the largest Bitcoin-holding nation globally.

Experts from the European and American digital currency markets also expressed optimism about Bitcoin’s future. They predicted that Bitcoin could reach $100,000 before the end of 2024, thanks to positive signals from the market and policy changes.

Standard Chartered Bank forecast that Bitcoin could reach $250,000 in this cycle. Furthermore, Cathie Wood, CEO of Ark Invest, and Nicholas Sciberras, an expert at Collective Shift, believed that Bitcoin’s price could even hit $1 million by 2030!

Quick to “Burn Out” as Well

With a series of positive news related to digital currencies, many people have experienced FOMO (fear of missing out) and jumped into this field following the trend. However, not a few have quickly “burned out,” similar to what happened during the COVID-19 pandemic.

Ms. Le Hoa, a resident of District 7 in Ho Chi Minh City, recalled, “I saw my friends investing a lot and making high profits, so I decided to buy digital currency without thoroughly researching it. In December 2021, I invested 200 million VND to purchase REAL, listed on the Bybit exchange, at $22 per coin. Later, when REAL’s price dropped significantly, I panicked and deleted the application.”

Recently, as digital currencies started gaining value again, Ms. Hoa reopened the application only to discover that REAL’s price had plummeted to just $0.2. Her account, which once held 200 million VND, now had only 200,000 VND left. “Even though I know the chances of recovering my capital are very slim, I still hope that REAL’s price will rise again,” she said wistfully.

Learning from her experience, Ms. Hoa advised that newcomers to the digital currency market who don’t know where to invest should choose more prominent and reputable coins, such as Bitcoin, Ethereum, Binance Coin (BNB), Solana (SOL), or Stellar (XLM). In her opinion, one should avoid FOMO, as it can easily lead to a “burn out” situation.

Mr. Pham Duong, a long-time digital currency investor from Binh Thanh District in Ho Chi Minh City, shared that in the past, many people bought virtual currencies merely following the trend without conducting their research or analysis. “Four to five years ago, countless people went bankrupt due to a lack of knowledge. A friend of mine invested over 1 billion VND. After being advised to use leverage, they lost everything in just two weeks. By the time they realized what had happened, it was too late to recover,” he illustrated.

Observing the recent market trends, Mr. Duong assessed, “Bitcoin’s price surge is largely attributed to Donald Trump’s support. However, in Vietnam, individual investors are less likely to buy Bitcoin due to its high value, which requires substantial capital. Instead, many people prefer investing in altcoins with lower values to ride the waves more easily.”

Many investors choose altcoins due to their lower value compared to Bitcoin but often feel impatient when profits don’t meet their expectations. According to Mr. Duong, there could be a shift of capital from Bitcoin to altcoins in the future. He is also waiting for this moment to make his investment decision.

For newcomers to the digital currency market, experts advise starting with a small capital to minimize risks and avoiding excessive leverage, as it can lead to total loss. One should not borrow money to invest in digital currencies, as it creates financial pressure and can lead to misguided decisions.

“It’s crucial that each investment decision is based on personal analysis and evaluation rather than relying solely on others’ advice. Investors need to maintain a calm mindset and not let greed or emotions influence their choices, as the financial market is only for those who are level-headed and have a clear strategy,” emphasized a financial expert.

Underlying Risks of Capital Loss

According to Mr. Phan Duc Nhat, assets typically increase in value over time but are accompanied by deep and prolonged price corrections. In the case of Bitcoin, investing requires analysis and a suitable plan for each phase. Currently, Bitcoin is no longer in the accumulation phase but has entered the distribution stage. This means that large organizations are selling the Bitcoin they previously purchased. Small investors who want to accumulate at this point will have to buy at a high price, making it challenging to achieve the expected profits and potentially leading to the risk of capital loss over an extended period.

While “surfing” with Bitcoin can still be profitable, this approach is only suitable for experts or experienced investors who closely monitor market movements. Without proper capital management skills, investors may face significant losses.

The Power to Persevere: DBC’s Journey to the Top

The livestock industry in Vietnam continues to face challenges due to the ongoing epidemic situation. Despite these difficulties in 2022-2023, Dabaco Vietnam Joint Stock Company (HOSE: DBC) has emerged stronger than ever, embarking on a journey of expansion to meet the domestic market’s consumption demands.

Introducing the “Vietnam Pavilion – National Pavilion of Vietnam” on the Alibaba E-Commerce Platform

To support international businesses, especially European enterprises, in seeking product information, business partners, and market expansion in Vietnam, the Trade Promotion Agency – Ministry of Industry and Trade of Vietnam is pleased to introduce the “Vietnam National Pavilion – Vietnam Pavilion” on the Alibaba.com e-commerce platform.

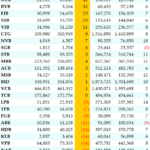

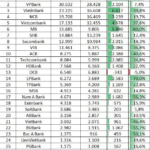

An Essential Circular on the Classification and Retention of Loan Groups in the Banking Sector is Nearing its Expiry

The Circular 02 issued by the State Bank of Vietnam (SBV), which provides guidelines on debt restructuring and allows for the retention of the original debt classification, will expire on December 31, 2024.