The stock market witnessed significant fluctuations during the week of November 18-22. VN Index rebounded from the 1,200 support level after successive adjustments. Large-cap stocks, including several bank stocks, led the recovery with synchronized momentum, driving the overall market’s rebound. However, the upward trend was short-lived, as the broad index showed signs of slowing down during the week’s final session due to short-term profit-taking. By the week’s end, the VN Index had gained 9.53 points (+0.78%) from the previous week, closing at 1,228 points.

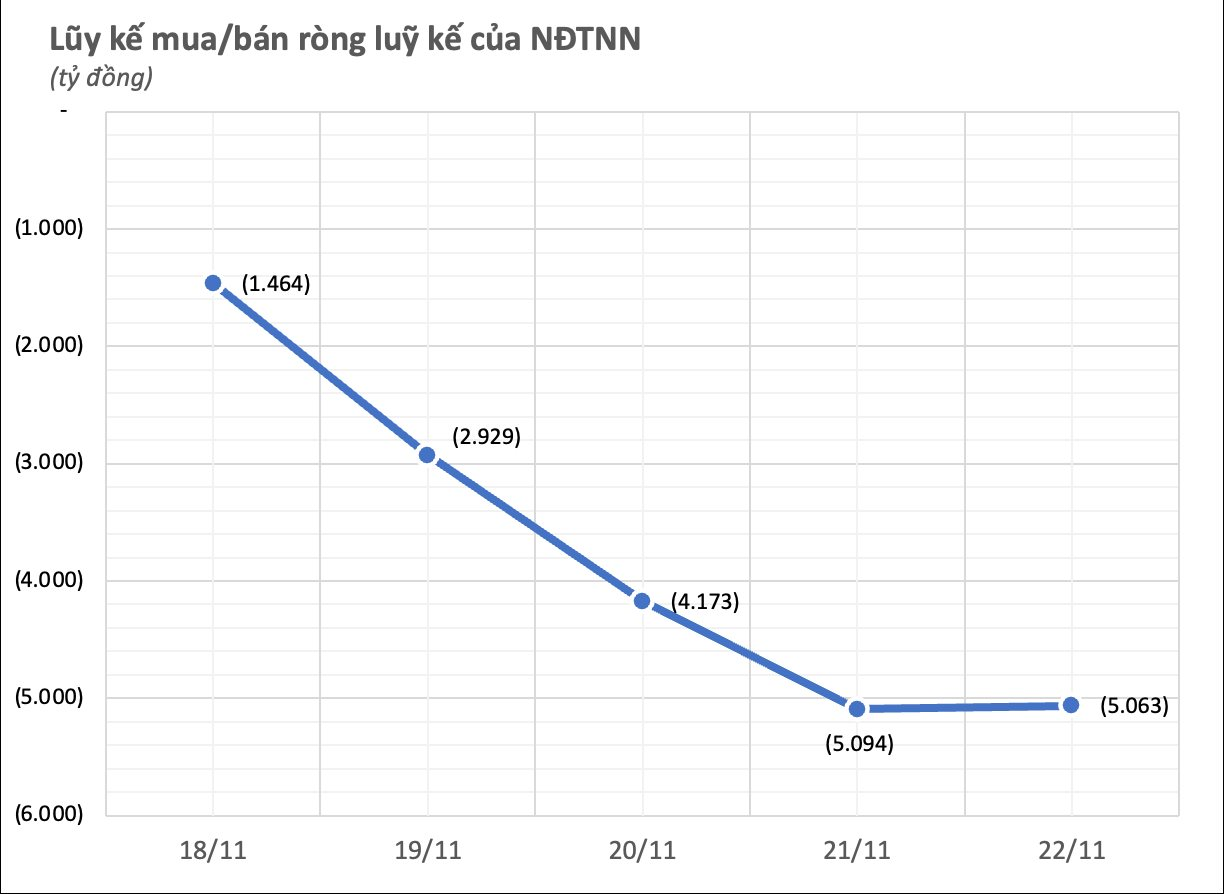

In terms of foreign investment, capital outflows remained a significant concern, with selling pressure still relatively high. However, a bright spot emerged in the final session when foreign investors turned net buyers after 30 intense selling sessions. Overall, for the week, foreign investors sold a net total of VND 3,806 billion across all markets.

Breaking down by exchange, foreign investors sold a net VND 5,149 billion on HoSE, VND 159 billion on HNX, and bought a net VND 261 billion on UPCoM.

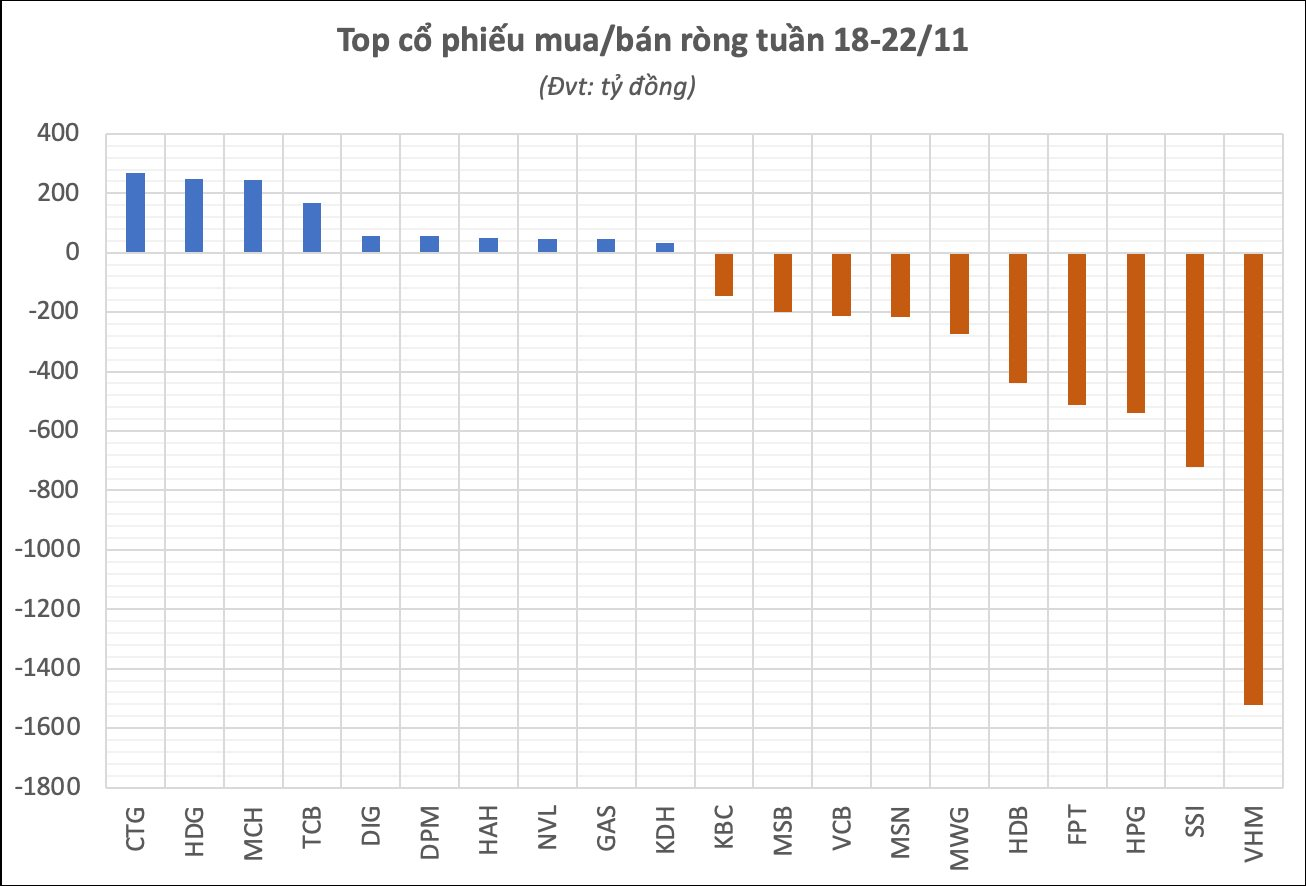

Analyzing by stock, foreign investors continued to sell VHM the most, offloading VND 1,522 billion. SSI and HPG also witnessed strong net selling, with respective values of VND 722 billion and VND 541 billion. FPT was another stock that experienced significant net selling during the week, with a total of VND 514 billion sold across five sessions. HDB and MWG were also among the top sold stocks, with respective net selling values of VND 439 billion and VND 274 billion. The list of stocks sold by foreign investors in the hundreds of billions also included names like MSN, VCB, MSB, and KBC…

On the other hand, CTG, a bank stock, attracted foreign capital inflows and was the most bought stock by foreign investors during the week, with a net purchase of VND 267 billion. They also net bought HDG for VND 248 billion and MCH for VND 245 billion. Other stocks that witnessed net buying during the five sessions included DIG, DPM, TCB, and HAH…