The VN-Index shone in the afternoon session, despite a sluggish start, thanks to strong gains in pillar stocks. At the close of the November 21 trading session, the VN-Index rose 11.79 points to 1,228.33. However, liquidity on HoSE remained stagnant at low levels, with a meager VND10.5 trillion in matched orders.

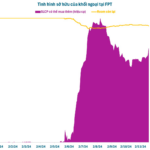

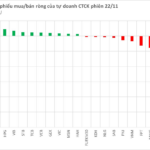

Foreign investors continued their aggressive selling spree, offloading Vietnamese stocks en masse. They net-sold a massive VND921 billion across all markets.

Foreigners net-sold a hefty VND858 billion on HoSE

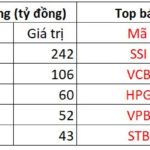

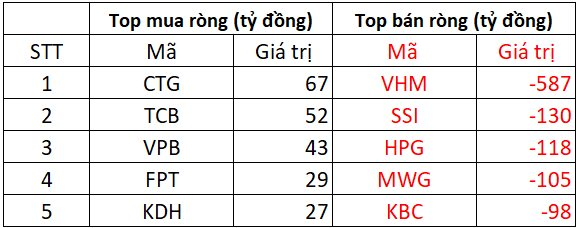

On the selling side, VHM faced the most significant net selling by foreign investors, amounting to VND587 billion. Additionally, several blue-chip stocks witnessed substantial net selling, including SSI (-VND130 billion), HPG (-VND118 billion), and MWG (-VND105 billion).

Conversely, CTG, TCB, VPB, and FPT were among the top stocks that foreign investors net purchased. However, the values were only in the range of a few dozen billion VND for each code.

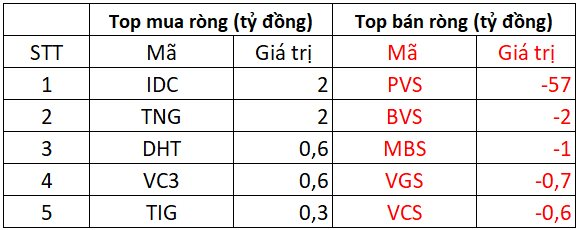

Foreigners net-sold approximately VND57 billion on the HNX

On the buying side, IDC and TNG witnessed the highest net buying, with a value of VND2 billion each. Following them, DHT, VC3, and TIG saw net purchases of a few hundred million VND each.

Conversely, PVS faced the most substantial net selling, amounting to VND57 billion. BVS, MBS, VGS, and VCS were also among the top net-sold stocks, with net selling values ranging from a few hundred million to a few billion VND.

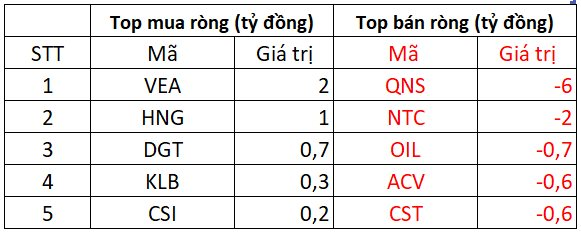

Foreigners net-sold about VND7 billion on UPCOM

In terms of net buying on UPCOM, VEA and HNG were the top stocks, with net purchases of VND2 billion and VND1 billion, respectively. Additionally, DGT, KLB, and CSI witnessed net buying of less than VND1 billion each.

On the other hand, QNS faced net selling of approximately VND6 billion. Numerous stocks, including NTC, OIL, ACV, and CST, were also net sold by foreign investors, but the values were not significant.

Unlocking Vietnam’s Largest Private Enterprise: Exploring Over 3% Foreign Ownership Potential

Foreign ownership of FPT has dipped below 46%, marking the lowest point in two months since mid-September.

The 9-Million Account Market: Why is the VN-Index Stuck Around the 1,200 Point Mark?

The domestic and global macroeconomic factors present a positive picture, boding well for the stock market’s upward trend. However, with 9 million accounts, the VN-Index continues to hover around the 1,200-point mark.