Vietnam’s stock market witnessed a volatile trading session, ending in the red. The VN-Index closed slightly lower on November 22, losing 0.23 points to settle at 1,228. Trading volume remained subdued, with the value of transactions on HOSE exceeding 12,700 billion VND.

Foreign investors turned net buyers, ending a 30-session long net selling streak, with a net purchase value of 31 billion VND across the market.

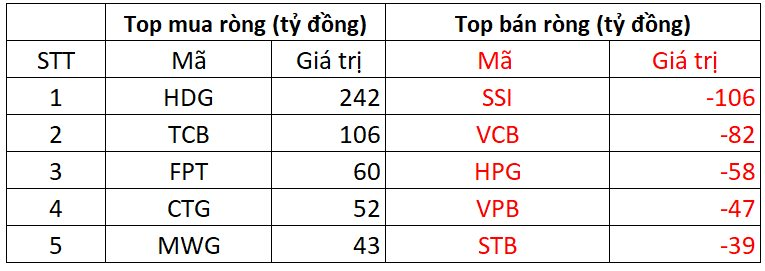

On HOSE, foreign investors net bought 31 billion VND.

HDG topped the list of stocks purchased by foreign investors on HOSE, with a net buy value of over 242 billion VND. TCB and FPT followed suit, with net purchases of 106 billion VND and 60 billion VND, respectively. CTG and MWG were also favored by foreign investors, with net buys of 52 billion VND and 43 billion VND, respectively.

On the selling side, SSI and VCB faced the strongest foreign selling pressure, with nearly 106 billion VND and 82 billion VND, respectively. HPG and VPB also witnessed net selling of 58 billion VND and 47 billion VND, respectively.

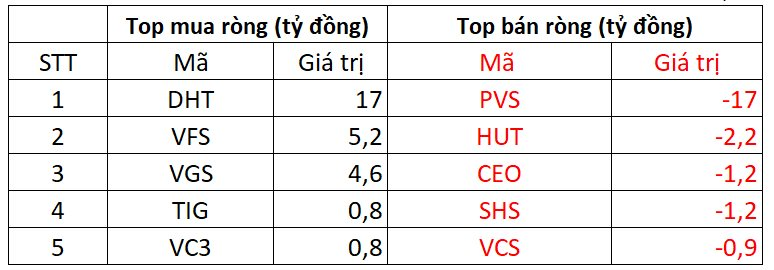

On HNX, foreign investors net bought 6.5 billion VND

DHT was the most purchased stock by foreign investors on the HNX, with a net buy value of 17 billion VND. VFS followed suit, with net purchases of 5.2 billion VND. Foreign investors also net bought a few billion VND worth of VGS, TIG, and VC3.

Conversely, PVS faced the highest net selling pressure from foreign investors, with a net sell value of nearly 17 billion VND. HUT, CEO, and SHS also witnessed net selling of a few billion VND each.

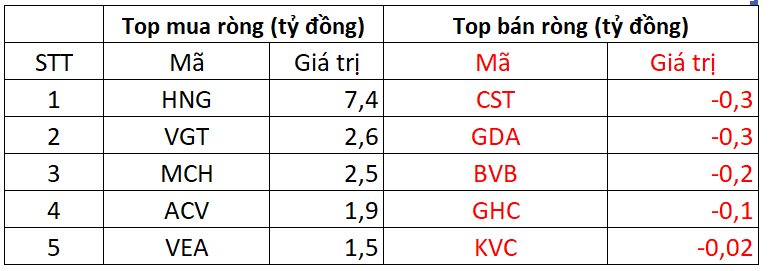

On UPCOM, foreign investors net sold 6.5 billion VND

In terms of purchases, foreign investors favored HNG, MCH, and VGT, net buying a few billion VND worth of shares in each company.

Conversely, CST faced net selling of 0.3 billion VND from foreign investors. Foreign investors also net sold GDA, BVB, and a few other stocks.

The 9-Million Account Market: Why is the VN-Index Stuck Around the 1,200 Point Mark?

The domestic and global macroeconomic factors present a positive picture, boding well for the stock market’s upward trend. However, with 9 million accounts, the VN-Index continues to hover around the 1,200-point mark.

The Radiant East Holding Stock (RDP) Falls into Trading Halt

Rạng Đông Holding (RDP) has once again found itself in hot water with regulators due to non-compliance with information disclosure regulations. As a result, the Ho Chi Minh Stock Exchange (HoSE) has taken decisive action by moving to suspend trading of RDP shares, shifting them from restricted trading to a trading halt.

The Foreign Block: A 28-Session Sell-Off Streak and the Continued Unwinding of the Million-Dollar ETF

The week of November 11–18, 2024, marks yet another significant period of aggressive selling by the VanEck Vectors Vietnam ETF (VNM ETF). This is the fourth consecutive week of net selling by the fund, coinciding with a prolonged period of foreign investor selling spanning dozens of sessions.