I. MARKET ANALYSIS OF STOCKS ON 11/18/2024

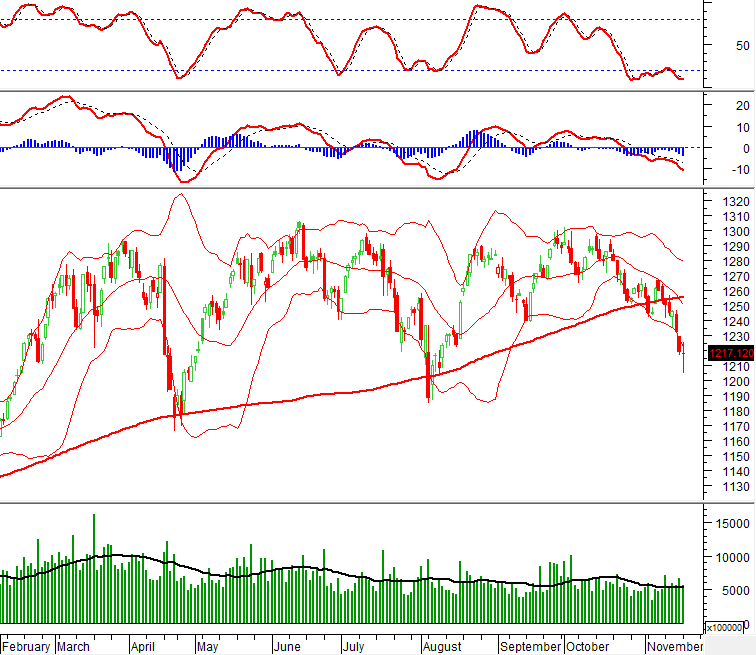

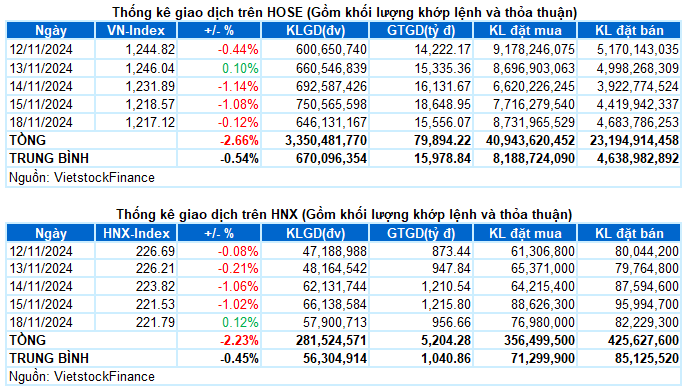

– On the trading day of November 18, the VN-Index closed 0.12% lower at 1,217.12 points, while the HNX-Index rose slightly by 0.12% to finish at 221.79 points.

– The trading volume on the HOSE reached nearly 556 million units, a decrease of 16.8% compared to the previous session. On the HNX, the trading volume decreased by 13.2%, with over 53 million units traded.

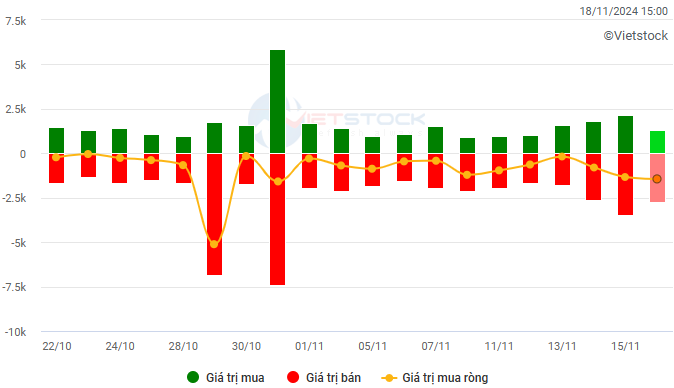

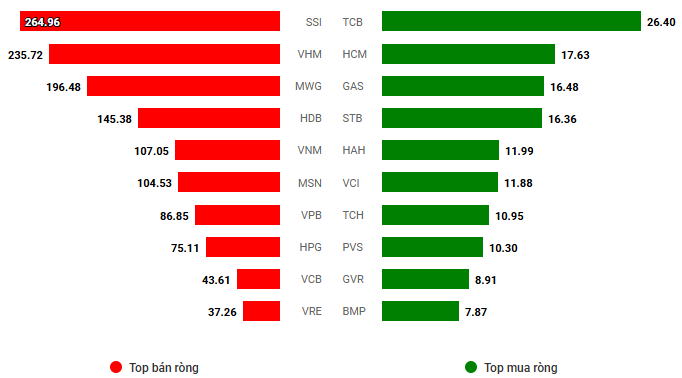

– Foreign investors continued to sell heavily on the HOSE, with a net sell value of more than VND 1.4 trillion, and also net sold over VND 17 billion on the HNX.

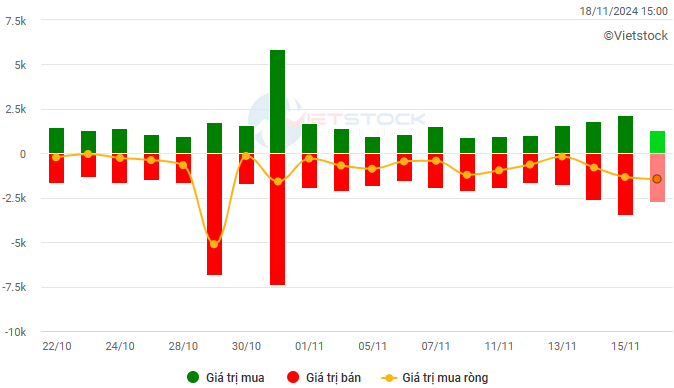

Trading value of foreign investors on the HOSE, HNX, and UPCOM for November 18, 2024. Unit: VND billion

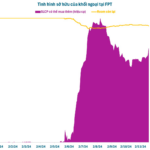

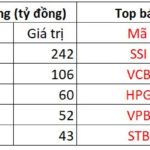

Net trading value by stock ticker. Unit: VND billion

– Starting the new trading week, strong selling pressure from large-cap stocks and foreign investors pushed the VN-Index deeper into negative territory amid weak liquidity. The index lost more than 10 points by the end of the morning session and was approaching the historical milestone of 1,200 points. In the afternoon session, bottom-fishing forces emerged stronger after the VN-Index fell below the 1,205-point level, especially with positive signals in the VN30 group, helping the index recover quite quickly, and even rose more than 6 points at some point. Although it couldn’t maintain the green to the end of the session, this development may ease investors’ pessimism in the current challenging situation. On November 18, the VN-Index edged down 0.12% to close at 1,217.12 points.

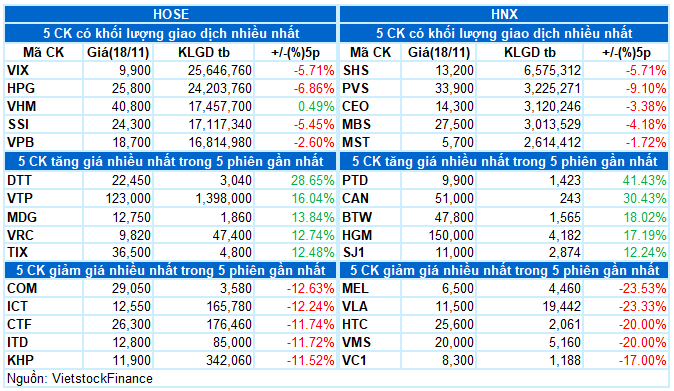

– In terms of impact, VCB was the most negative stock today, taking away nearly 1 point from the VN-Index. This was followed by MWG, BID, and KBC, which also had a difficult trading session, taking away an additional 1 point from the overall index. On the other hand, VHM, TPB, and CTG made the most significant contributions to the recovery effort, helping the VN-Index gain more than 1 point.

– The VN30-Index closed 0.08% lower at 1,270.23 points. Compared to the morning session, which was dominated by sellers, the basket showed more balance in the afternoon with 12 gainers, 14 losers, and 4 stocks unchanged. Among them, TPB, SSI, and VHM recorded the best recovery, rising 2.6%, 1.5%, and 1.4%, respectively. On the opposite side, PLX, MWG, VJC, BCM, and BVH remained under selling pressure, falling over 1%. The remaining stocks in the basket only fluctuated slightly around the reference price.

Green returned to half of the industry groups. The industrial and telecommunications groups led the market with the outstanding performance of ACV (+3.18%), VEF (+1.97%), PHP (+13.71%), PC1 (+1.13%), VTP (+0.41%), and VGI (+2.17%).

The financial sector made a significant contribution to preventing the market from a steep decline today. The main highlight was the recovery of securities stocks, with ORS hitting the ceiling price, and gains in HCM (+3.6%), SSI (+1.46%), VCI (+2.17%), VND (+1.09%), MBS (+3.77%), FTS (+2.1%), VIX (+2.06%), BSI (+3.12%), CTS (+3.96%), and AGR (+3.36%), among others. Although the banking stocks were still somewhat divided, the green ticks of TPB, OCB, CTG, ACB, STB, VIB, etc., contributed considerably to the overall recovery.

The real estate group followed a similar pattern, with many stocks ending the session with gains of over 1%, such as VHM, NVL, PDR, DXG, CEO, DXS, NTL, and TCH, which hit the ceiling price. However, several stocks continued to face strong selling pressure, including BCM (-1.47%), KBC (-5.96%), IDC (-1.07%), SIP (-4.88%), NLG (-1.99%), SNZ (-4.9%), and SZC (-1.54%).

The non-essential consumer group lagged the market with a decline of more than 0.7%. This was mainly due to the performance of MWG (-1.67%), PLX (-1.82%), GEX (-1.9%), DGW (-1.7%), VGT (-1.43%), SAS (-3.68%), and PET (-1.37%).

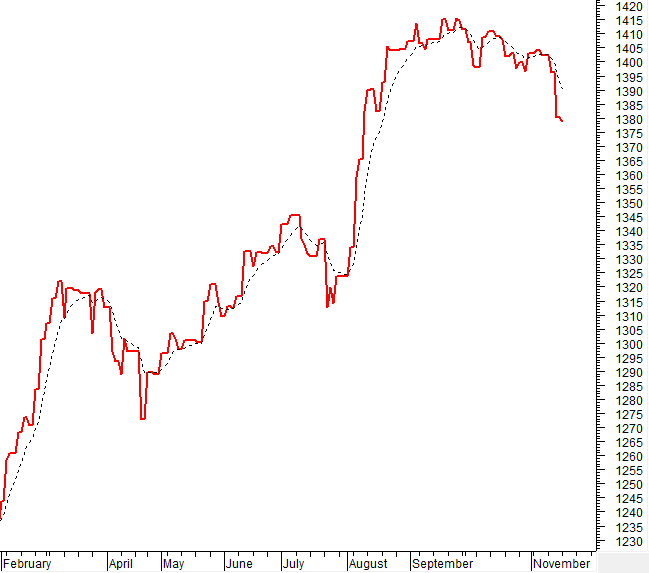

The VN-Index posted a slight loss amid volatile trading, with a relatively wide range of fluctuations. Additionally, the index formed a High Wave Candle pattern, indicating investors’ indecision. At present, the Stochastic Oscillator and MACD indicators continue to decline after generating sell signals, suggesting that the short-term outlook remains unfavorable.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – High Wave Candle Pattern Emerges

The VN-Index posted a slight loss amid volatile trading, with a relatively wide range of fluctuations. Additionally, the emergence of a High Wave Candle pattern indicates investors’ indecision.

At present, the Stochastic Oscillator and MACD indicators continue to decline after generating sell signals, suggesting that the short-term outlook is still not optimistic.

HNX-Index – MACD Indicator Gives a Sell Signal Again

The HNX-Index paused its consecutive losing streak in the past with a slight gain, accompanied by a trading volume above the 20-day average.

However, the MACD indicator has given a sell signal again after crossing below the Signal Line. At the same time, the Stochastic Oscillator also reflects a similar signal, indicating that the short-term outlook remains unfavorable.

Analysis of Money Flow

Changes in Smart Money Flow: The Negative Volume Index indicator of the VN-Index has crossed below the 20-day EMA. If this condition persists in the next session, the risk of a sudden drop (thrust down) will increase.

Changes in Foreign Investment Flow: Foreign investors continued to be net sellers in the trading session on November 18, 2024. If foreign investors maintain this behavior in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS FOR NOVEMBER 18, 2024

Economics & Market Strategy Analysis Department, Vietstock Consulting

What Stocks are Propping Up the Stock Market?

Yesterday’s trading session (November 20) saw a boost in investor confidence with bottom-fishing funds pushing the VN-Index up by 11 points, leading to a market recovery with improved liquidity. However, many securities firms remain cautious about the market’s outlook for short-term investors and advise a prudent approach to trading.

The Foreign Sell-Off Continues: Vietnam’s Real Estate Stock Takes a 600 Billion Hit

Foreign investors continued their net-selling streak, offloading Vietnamese shares worth over 921 billion VND today.