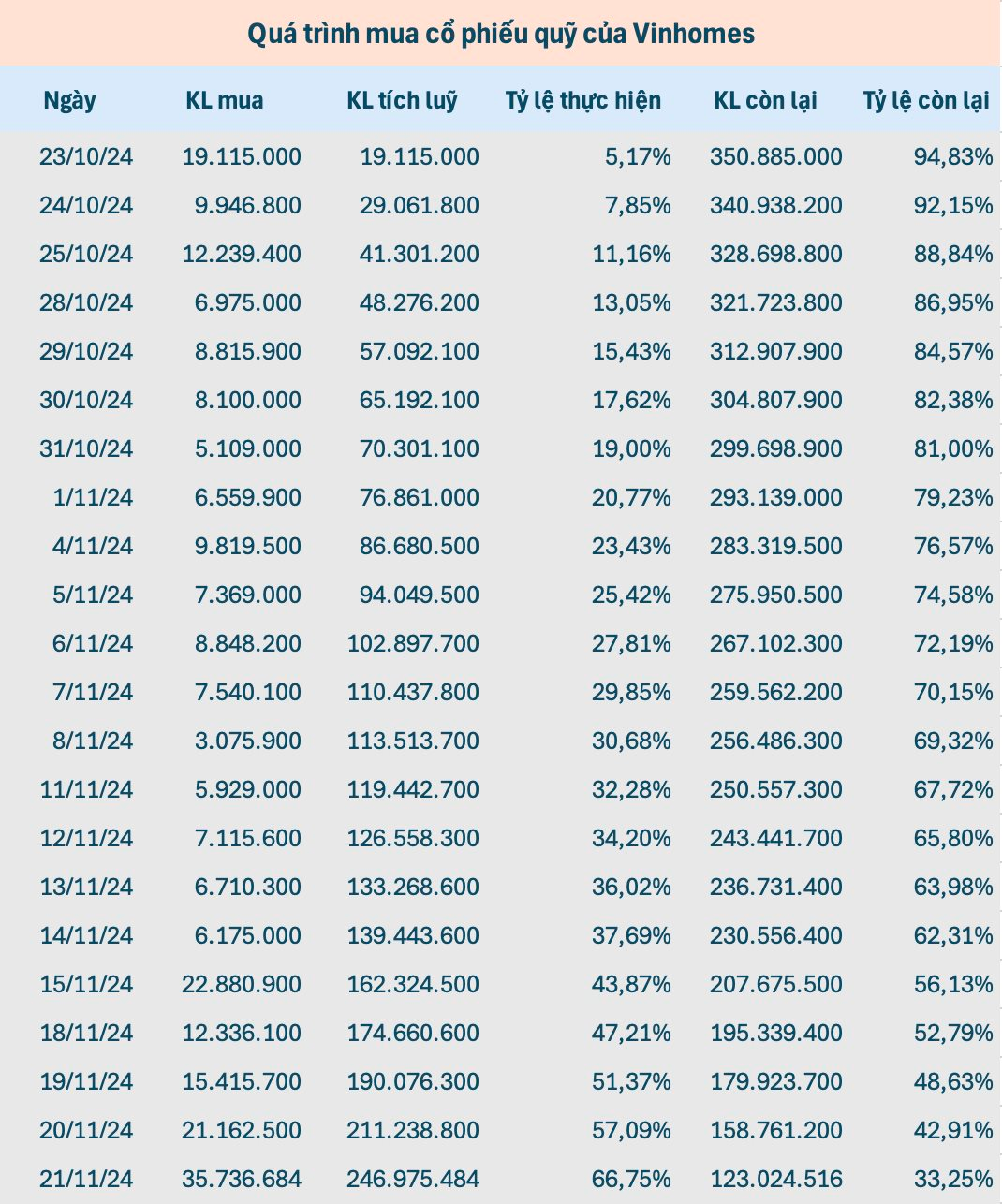

On November 21, Vinhomes (VHM) concluded its unprecedented share repurchase campaign. On the last day, the number of shares acquired by Vinhomes surged to 35.7 million units, with the majority purchased through the matching order channel and the remaining nearly 9 million shares bought through negotiated deals with foreign investors.

Over 22 trading sessions (from October 23 to November 21), Vinhomes bought a total of nearly 247 million treasury shares, with a transaction value estimated at VND 11,000 billion. The number of shares purchased accounts for 66.75% of the registered volume. Thus, Vinhomes officially fell short of buying the registered number, with approximately 123 million units remaining. Nonetheless, this remains the largest share repurchase deal in the history of Vietnam’s stock market.

Notably, the number of treasury shares Vinhomes has just purchased accounts for 5.7% of the company’s total outstanding shares. This figure is something even giants like Apple and Samsung would find challenging to achieve.

Samsung recently announced a plan to repurchase shares worth approximately KRW 10 trillion (~ USD 7.2 billion), equivalent to about 2.7% of the total outstanding shares (estimated based on the current market capitalization). In the initial phase, Samsung will buy back KRW 3 trillion worth of shares starting from November 18, 2024, until February 2025, all of which will be delisted. The Board of Directors will consider the best approach to implement the repurchase of the remaining KRW 7 trillion worth of shares.

Earlier in May, Apple announced that it would spend up to USD 110 billion to buy back its shares, marking the largest buyback in US history. According to data from Birinyi Associates, this transaction will break the record held by the iPhone maker itself. Apple has not finalized the timeline for this transaction. Based on the current market capitalization, the expected number of treasury shares to be purchased by Apple will account for approximately 3.2% of the total outstanding shares.

Returning to Vinhomes, according to regulations, the company must cancel the repurchased shares and reduce its charter capital accordingly within ten days from the end of the transaction. As a result, Vinhomes’ charter capital will decrease from VND 43,544 billion to over VND 41,000 billion, remaining the largest in the real estate group listed on the Vietnam stock exchange.

Regarding the purpose of the share repurchase, Vinhomes believes that the market price of VHM is lower than the company’s actual value. The repurchase of shares aims to protect the interests of the company and its shareholders. The company affirms that the repurchase plan will be financed by available cash and operating cash flow from the sales of several projects.

In the market, VHM is experiencing a strong rebound in the final days of the registered trading period after a deep decline from its one-year high. The share price currently stands at VND 43,300 per share, up nearly 26% from its all-time low in early August. Its market capitalization is approximately VND 189,000 billion.

In terms of financial performance for Q3 2024, Vinhomes recorded consolidated net revenue of VND 33,323 billion, a slight increase of nearly 2% compared to the same period last year. After expenses, net profit after tax reached over VND 8,980 billion. For the first nine months of the year, Vinhomes’ consolidated net revenue was VND 69,910 billion, and net profit after tax was VND 20,600 billion.

As of Q3 2024, Vinhomes’ total assets and equity were VND 524,684 billion and VND 215,966 billion, respectively, increasing by 18% and 18.3% compared to the end of 2023. The amount of cash, cash equivalents, and bank deposits stood at VND 22,055 billion (~USD 1 billion).

The Master Craftsman: When AI Transforms Every Frame into a Masterpiece

The Samsung Neo QLED 8K 2024 is a masterpiece of innovative technology, redefining the standards of home entertainment. With its superior artificial intelligence, sleek design, and subtle personalization capabilities, this TV is an icon of perfection for the audiovisual experience.

Samsung Launches BED-H Series: Tailored TV Solutions for SMEs

The Samsung BED-H Series commercial TVs are renowned for their energy efficiency and operational prowess, catering to a diverse range of business needs. From retail stores and cafes to restaurants and complex digital content management systems, these TVs offer a dynamic solution. With their exceptional performance and energy-saving capabilities, the BED-H Series TVs are the perfect choice for any enterprise seeking a seamless blend of functionality and efficiency.

The Latest iPhone Model is Here: All the Features of the iPhone 16, But at a Fraction of the Cost!

Apple’s upcoming affordable iPhone model is set to offer a refreshed design and a host of enticing upgrades, all at a very competitive price point.