On November 22, the National Assembly discussed the draft Law on Special Consumption Tax (amended) at the group level. The issue of increasing consumption tax on alcohol and beer was enthusiastically discussed as these are popular items, part of a supply chain involving dozens of industries in both production and trade, as well as services.

Accordingly, most opinions agreed with the increase in special consumption tax on alcohol and beer. However, many National Assembly deputies proposed that the drafting agency of the Law on Special Consumption Tax (amended) should supplement the scientific basis when assessing the impact of the two proposed tax increases in four aspects: (1) the ability to regulate consumption behavior; (2) the impact on jobs and social security; (3) the impact on budget revenue; and (4) the impact on economic growth.

NEED TO SUPPLEMENT IMPACT ASSESSMENT IN 4 ASPECTS

According to Prof. Dr. Hoang Van Cuong, a deputy of the National Assembly delegation of Hanoi, the primary goal of the special consumption tax is to change the behavior of consumers; to discourage the use of products that are harmful to individual health or have a negative impact on the environment. The main objective of the special consumption tax is not to increase state revenue.

“However, when we propose a solution to increase taxes, I suggest that we still need to assess the ability to meet both goals: (1) changing consumption behavior and (2) the impact on budget revenue. If the solution we propose does not achieve the expected behavioral change and does not result in sustainable budget revenue, then we need to reconsider,” said Prof. Dr. Hoang Van Cuong.

Prof. Dr. Hoang Van Cuong noted some issues regarding the proposal to increase the special consumption tax on alcohol and beer.

First, in the impact assessment report presented by the drafting agency, there was no mention of how many consumers would change their behavior if the tax on beer was increased according to the two proposed options.

“We know that beer is not an addictive product. In the past, only alcohol addiction was prevalent, and beer addiction was very rare. To be honest, before Decree 100 (on handling violations of people participating in traffic with alcohol content in the blood and breath – PV) was issued, most men would stop by a bar for a drink or two of beer after work, like a regular soft drink. In fact, the penalties imposed by Decree 100 have already significantly changed consumer behavior, but it is unclear how much of an impact the tax increase on beer will have,” said Mr. Cuong.

Second, Mr. Hoang Van Cuong noted that since the implementation of Decree 100, the consumption of alcohol and beer has decreased significantly, greatly affecting the catering and tourism services.

“We know that services and tourism are a critical component of consumption that has a significant impact on economic growth. Currently, the government is stimulating consumption to ensure economic growth. In the past few years, our growth has mainly been due to exports, while domestic consumption has been slow. Now, if we increase the price of any consumer item in the catering and tourism services, it will immediately affect economic growth. I think it is necessary to reconsider this issue,” said Mr. Cuong.

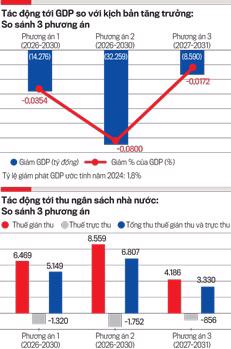

Prof. Dr. Hoang Van Cuong cited data from a report by the Central Institute for Economic Management (CIEM) that assessed that with the proposed increases in the special consumption tax on alcohol and beer by the Ministry of Finance, there would be a decrease in GDP.

“We are not prepared for the restructuring of the beer and alcohol industries and the industries that provide input products for these sectors. If we suddenly decide to increase taxes in 2026, it will lead to a series of problems related to jobs, budget revenue, and investors will feel very uncertain.”

Deputy Hoang Duc Thang, Quang Tri delegation.

“These numbers may or may not be reliable, but they are calculated using fairly scientific methods, indicating that tax increases will lead to reduced consumption and services, which will negatively affect GDP. And if GDP decreases, budget revenue will also decrease,” said Mr. Cuong.

Sharing the same view, Deputy Hoang Duc Thang, from the Quang Tri Provincial Delegation, emphasized: “I support the restriction on the consumption of alcohol and beer. This is indisputable as we already have a Law on Prevention and Control of Alcohol-Related Harms. However, we must also consider this equation: almost every province/city in our country has a beer factory, providing a large number of jobs. According to a CIEM report, more than 20 industries are involved in producing a bottle of beer. Therefore, we must balance the goal of reducing alcohol and beer consumption with job creation, social security, and state budget revenue.”

PROPOSAL TO POSTPONE THE INCREASE IN SPECIAL CONSUMPTION TAX ON ALCOHOL AND BEER UNTIL 2027

Many National Assembly deputies proposed postponing the increase in the special consumption tax on alcohol and beer until 2027.

According to Prof. Dr. Hoang Van Cuong, if the primary goal of the special consumption tax is to change behavior, consumers must be made aware that this tax will directly affect their rights and interests and that if they do not change their behavior, they will be significantly impacted.

Therefore, Mr. Cuong proposed that for both tobacco and alcohol, the tax should be increased significantly from the first time, but there must be a grace period for all parties to prepare.

“For the Law on Special Consumption Tax, I propose that we enact it in 2025 but postpone its implementation by one year compared to the draft (2027 – PV) to give consumers time to change their behavior. They cannot change their behavior overnight if they are already used to smoking and drinking. During this grace period, the government should communicate to consumers that if they do not change their behavior by the specified time, they will have to pay higher taxes,” said Mr. Cuong.

“Don’t think that changing the behavior of Vietnamese consumers through taxation is the main solution. We must change their behavior through other methods. For example, the recent implementation of Decree 100 has effectively curbed drunk driving.

The same approach should be applied to tobacco control by restricting smoking spaces to make it more difficult for people to smoke. This should be accompanied by synchronized communication solutions to change perceptions.”

According to Mr. Cuong, during this one-year period, relevant authorities should promote communication to change consumers’ behavior and at the same time, allow businesses to prepare and research options to shift production to products that have less impact on health and may even be encouraged.

“Implement a high tax rate from the first time and then stop for five years. For example, in 2027, we start imposing high taxes on alcohol and beer, and then in 2032, we impose taxes again so that consumers and businesses have time to change their behavior instead of increasing taxes evenly every year,” emphasized Prof. Dr. Hoang Van Cuong.

“I support the increase in the special consumption tax on alcohol and beer, but the roadmap must be carefully calculated, considering that we have just gone through several years of Covid and Storm Yagi. Secondly, we are not prepared for the restructuring of the beer and alcohol industries and the industries that provide input products for these sectors. If we suddenly decide to increase taxes in 2026, it will lead to a series of problems related to jobs, budget revenue, and investors will feel very uncertain,” said Deputy Thang from Quang Tri.

Mr. Thang proposed that the drafting agency carefully consider two issues: (1) a reasonable tax rate and (2) the timing of the tax increase, which should be postponed to give the alcohol and beer industry time to prepare and restructure.

“Postpone the increase in the special consumption tax rate on alcohol and beer until after 2026, starting in 2027. At the same time, the government must anticipate and address two issues: (1) controlling the smuggling of alcohol and beer from other countries, and (2) controlling the production and sale of handcrafted, unofficial alcohol products,” proposed Deputy Hoang Duc Thang.

Deputy Phan Duc Hieu, from the Thai Binh Provincial Delegation, also “earnestly proposed that the special consumption tax on beer should only be imposed after 2026, starting in 2027.”

Mr. Hieu gave three reasons for postponing the increase in the special consumption tax on beer. First, in the past few years and in the near future, the state has been and will continue to support businesses through fiscal policies, i.e., reducing taxes. Therefore, increasing taxes in 2026 would contradict the policy of supporting businesses. Second, when increasing the special consumption tax on alcohol and beer with the goal of regulating consumption, there must be a grace period for businesses to restructure their products. They cannot change their production overnight. If they are not given a reasonable amount of time, they will have no choice but to decline gradually. Third, the stability of the investment environment is very important. Policies should not be implemented abruptly and hastily, causing investors to panic.

In addition, Mr. Hieu supported the increase in the special consumption tax on beer according to Option 1 proposed by the Ministry of Finance. Deputy Le Thi Song An, from the Long An Provincial Delegation, also chose Option 1 for two reasons.

First, Deputy An said that in reality, the consumption of alcohol and beer in Vietnam is currently decreasing thanks to the strong regulations of the Law on Prevention and Control of Alcohol-Related Harms and the Law on Road Traffic Safety; and the high compliance with the regulation that prohibits driving under the influence of alcohol.

Second, people are increasingly aware of the importance of protecting their health by limiting the consumption of alcoholic beverages.

“Therefore, I choose Option 1 proposed by the Ministry of Finance to ensure that small and medium-sized enterprises in the alcohol and beer supply chain, which account for a large proportion in Vietnam, will not be affected by sudden changes,” said Deputy An.

Ms. Le Thi Song An also proposed that the government should issue policies to strengthen market management to reduce alcohol and beer smuggling, thereby increasing state budget revenue and protecting consumers’ health. Enhance communication so that people and businesses understand the benefits of increasing the special consumption tax. Implement timely support policies for small and medium-sized enterprises in the value chain of production, trade, and services in the alcohol and beer industry.

“Donald Trump’s Election Victory: Currency Manipulation and Exchange Rates”

In the recent US presidential election, Donald Trump’s victory was not just a win, but a Republican sweep of both houses of Congress. This outcome has profound implications, not just for the United States but for the entire world. Among the many consequences is the impact on exchange rates, particularly for countries with significant trade surpluses with the US, and Vietnam presents a rather unique case in this regard.

“HAG Chairman Invites Shareholders Holding Over 200,000 Shares to Tour Projects in Vietnam and Laos”

“From 11:30 am on Friday, December 13th, to 5:00 pm on Sunday, December 15th, 2024, we are inviting you to embark on an extraordinary journey of words and wit. Prepare to be captivated by a showcase of exceptional writing talent, as we unveil a masterpiece that will revolutionize the way you perceive content. This is not just another paragraph; it’s an experience that will leave a lasting impression.”

“The Cultural Extravaganza: Sun Group’s Grand Boulevard in Ha Nam”

Along the 1.5-km-long and 150-m-wide road that runs along the King Le Canal in the Sun Urban City integrated resort city, Sun Group will soon awaken the proud cultural stories of Ha Nam Province to embellish and preserve invaluable heritages with the aspiration of a contemporary generation: bringing national culture into life to honor and conserve it.

The Housing Act: Governing the Real Estate Market and Social Housing Development

On November 23rd, as part of the 8th Session of the National Assembly, a resolution was passed to “Continue enhancing the effectiveness of policies and laws related to the management of the real estate market and the development of social housing.” This session was presided over by Vice Chairman of the National Assembly, Nguyen Duc Hai.