Sifting Through the Sand for Gold

Source: VTV Money

|

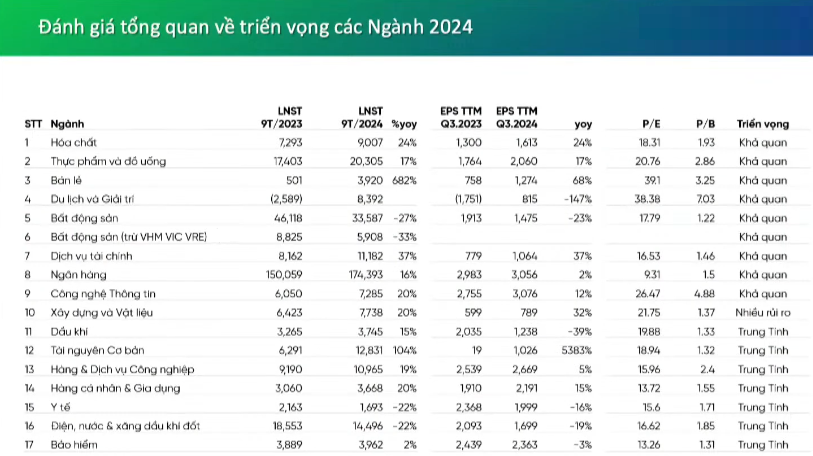

Several sectors are showing positive signals, notably the chemical industry, which posted a 24% year-on-year profit increase in the first nine months of 2024, and currently has a relatively stable outlook.

The food and beverage industry, influenced by several large-cap companies, achieved approximately 17% growth in the same period. Mr. Duong assesses this recovery as relatively stable, driven by leading stocks and overall consumer trends in the sector.

The retail sector witnessed a recovery for the third consecutive quarter, especially among leading ICT and CE enterprises, indicating (1) the resilience of ICT and CE systems in a saturated market, and (2) a focus on efficiency and governance among retailers. By the second and third quarters of 2024, large-cap stocks demonstrated a return to profitability, and specialized segments such as Bach Hoa Xanh and Long Chau are also improving their gross margins.

The real estate sector (excluding VinGroup-related companies) saw a 30% year-on-year profit decline in the first nine months, but there are still some bright spots as negative factors have been factored in.

In residential real estate, there is a resurgence in the activation of sales for mid-range and high-end apartment and land projects, evident in the rising inventory levels and short-term debt, which bodes well for revenue in the next 1-2 quarters.

The supply of residential real estate is currently very exploratory, and absorption rates are recovering slowly. Successful absorption of these properties will result in significant revenue and profit compared to the current low base.

A concern in this sector is debt pressure, but according to Mr. Duong, the bond pressure is not significant. Approximately VND 25 trillion in bonds will mature in Q4 2024, and about VND 106 trillion in 2025. For listed companies, it’s around VND 5.5 trillion due in Q4 2024 and over VND 13 trillion in 2025.

Source: VTV Money

|

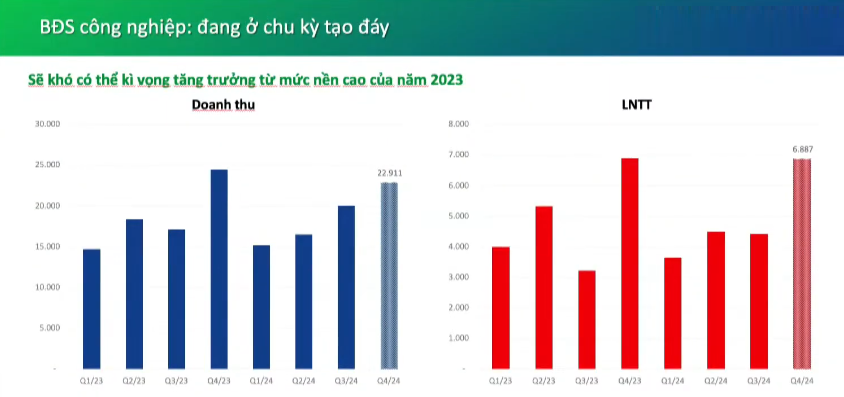

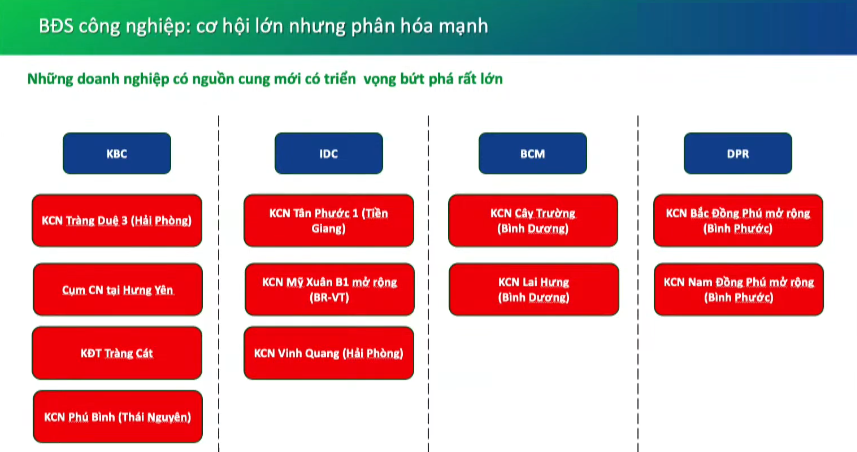

For industrial real estate, companies in the North will have abundant new supply in Q4 2024 and throughout 2025, which will boost revenue and profits and impact stock prices.

The projected pre-tax profit for the entire industrial real estate sector could reach nearly VND 7,000 billion in Q4 2024, a significant increase from the previous quarters, largely dependent on the progress of project handovers.

Source: VTV Money

|

Source: VTV Money

|

How should a mid-term portfolio be constructed reasonably?

According to Mr. Duong, the first step is to assess one’s risk tolerance, which will inform the allocation of weights to different sectors, and never to put “all eggs in one basket.”

For an investor with a relatively low-risk appetite, the first consideration is a low valuation coupled with a bottomed-out outlook, which typically entails less risk.

Secondly, the size and position of the stock and industry are crucial; a higher position warrants a higher portfolio weight. Examples include banking, real estate, and basic materials sectors. There are also sectors that can offer higher profits, such as real estate, securities, and retail, which show potential for breakthrough growth or bottoming out.

Lastly, with a low valuation base, investors can also consider sectors with stable growth, such as information technology.

A Rewarding Prelude: IDV’s Generous Interim Dividend of VND 1,500 per Share Ahead of the Annual General Meeting

The Vinh Phuc Infrastructure Development Joint Stock Company (VPID), listed on the Hanoi Stock Exchange as IDV, is preparing for its upcoming Annual General Meeting (AGM) scheduled for January 18, 2025, at its headquarters in Khai Quang Industrial Park, Vinh Yen, Vinh Phuc. Shareholders eligible to attend and vote at the meeting must be registered by December 16, 2024.

The Market Beat: A Surprising Rebound Led by Banking and Real Estate Sectors

The VN-Index staged a strong recovery in the afternoon session, buoyed by gains in the banking and real estate sectors. It closed the day up 5.85 points, or 1.264.48%. The HNX-Index also turned green, rising 0.49 points to 226.36, while the UPCoM-Index edged slightly lower, falling 0.08 points to 92.38.