Market liquidity decreased compared to the previous session, with the VN-Index matching volume reaching over 409 million shares, equivalent to a value of more than 9.2 trillion VND; HNX-Index reached over 34.7 million shares, equivalent to a value of more than 587 billion VND.

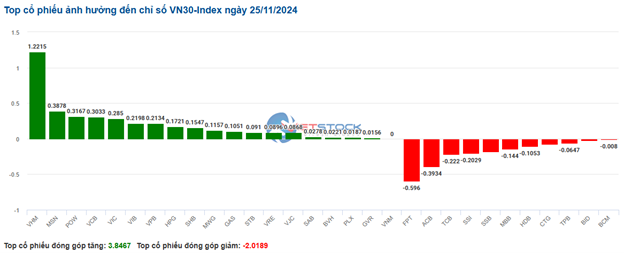

VN-Index continued to fluctuate around the reference level at the beginning of the afternoon session and unexpectedly, strong buying force emerged in the ATC session, but the supply also quickly appeared, causing the index to still be unable to break through. In terms of impact, VHM, VCB, VIC, and POW were the codes with the most positive impact on the VN-Index, with an increase of more than 3 points. On the contrary, BID, MBB, ACB, and TMP were the codes with the most negative impact, but the impact was not significant.

| Top 10 stocks with the strongest impact on VN-Index on November 25, 2024 |

Similarly, the HNX-Index also had a positive performance, with the index being positively impacted by PVS (+2.7%), IDC (+1.85%), PVI (+1.48%), and NVB (+2.33%)…

|

Source: VietstockFinance

|

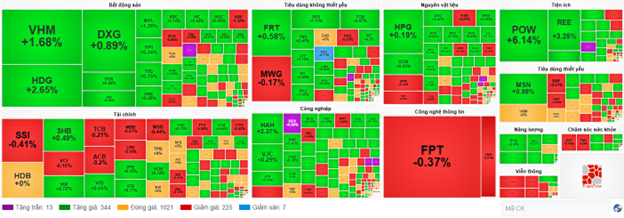

The energy sector was the group with the strongest increase of 1.34%, mainly from oil and gas codes such as PVS (+2.7%), PVD (+1.49%), BSR (+1.04%), and PVB (+1.12%). This was followed by the real estate and utilities sectors, with increases of 1.08% and 0.87%, respectively. On the contrary, the telecommunications sector had the strongest decrease in the market with 0.31%, mainly from the code VGI (-0.36%), YEG (-1.4%), TTN (-0.6%), and MFS (-1.27%).

In terms of foreign trading, they net sold more than 12 billion VND on the HOSE floor, focusing on KDC (69.54 billion VND), HDB (40.13 billion VND), HPG (38.79 billion VND), and CMG (32.91 billion VND). On the HNX floor, foreigners net bought more than 65 billion VND, focusing on PVS (52.85 billion VND), DHT (18.71 billion VND), IDC (8.56 billion VND), and TNG (2.48 billion VND).

| Foreign net buying and selling movements |

Morning session: Power stocks shine, POW hits ceiling price

VN-Index fluctuated around the 1,230-point threshold this morning, with green dominating slightly, but the money flow was still not too vibrant. Power stocks are currently the most notable highlight in the context of the current quiet liquidity. At the end of the morning session, the VN-Index temporarily stood at 1,233.66 points (+0.45%); HNX-Index increased by 0.3%, reaching 221.94 points. The market breadth recorded 378 advancing stocks and 250 declining stocks.

The matching volume of the VN-Index remained low, reaching over 186 million units, equivalent to a value of more than 4 trillion VND in the morning session. The HNX-Index recorded a matching volume of over 17 million units, with a value of nearly 285 billion VND.

In terms of impact, VCB, VHM, and GAS were the three pillars that had the most positive impact on the VN-Index, contributing more than 2.5 points. On the contrary, there was no notable name on the downside, and the total impact of the 10 most negative stocks currently took away less than 1 point from the overall market.

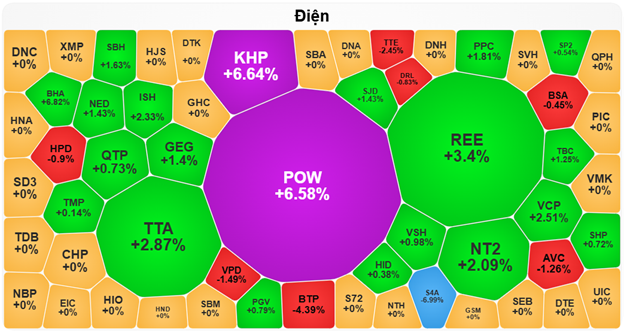

Although the capitalization value was not too overwhelming to have a strong impact on the VN-Index, the highlight this morning must mention the group of power stocks. Many codes attracted large buying demand, typically POW and KHP hitting the ceiling price, REE (+3.4%), NT2 (+2.09%), TTA (+2.87%), GEG (+1.4%), PPC (+1.81%), TBC (+1.25%), SJD (+1.43%), and VCP (+2.51%).

Source: VietstockFinance

|

This was followed by the energy group with an increase of nearly 1%, with green covering a large area such as BSR (+0.52%), PVS (+2.4%), PVD (+1.27%), PVB (+1.49%), TVD (+2.88%), and PSB (+3.64%).

The remaining industry groups mostly rose slightly, and the stocks in the industry rose and fell alternately. Only 2 groups were dominated by sellers, namely telecommunications and information technology, mainly affected by VGI (-0.72%), FOX (-0.44%), ELC (-1.19%); FPT (-0.22%) and CMG (-2.44%).

The trading situation of foreign investors was also in a sluggish state, with both buying and selling forces this morning being at a low level, and there were no stocks that stood out in the foreign investors’ trading. This group is currently net selling more than 82 billion VND on the HOSE and net buying nearly 15 billion VND on the HNX floor.

10:40 am: Financial group performs in divergence, VN-Index unable to break through

The hesitant psychology reappeared, causing the main indices to fluctuate around the reference level and unable to break through. As of 10:30, the VN-Index increased by 4.24 points, trading around 1,232 points. HNX-Index increased by 1.04 points, trading around 222 points.

Most of the stocks in the VN30 basket were dyed in green quite positively. In particular, VHM, MSN, POW, and VCB contributed 1.22 points, 0.38 points, 0.31 points, and 0.3 points to the VN30 index, respectively. On the contrary, FPT, ACB, TCB, and SSI were the stocks still under selling pressure, taking away more than 1.4 points from the index.

Source: VietstockFinance

|

The real estate group of stocks, although still slightly divergent, was dominated by green. Specifically, HDG rose by 2.65%, DXG increased by 1.19%, VHM climbed by 1.92%, and PDR went up by 0.48%… The rest were a few codes that were in a stagnant state, and a few codes still faced light selling pressure, such as TCH, TIG, TCH, and AAV…

Following this was the financial sector, which also contributed to the market’s upward momentum despite the strong fluctuations and the mix of green and red colors. On the buying side, there were stocks such as VIB up by 0.27%, VIX climbing by 0.62%, VPB rising by 0.52%, and STB increasing by 0.46%… As for the selling side, there were codes such as SSI falling by 0.41%, HDB decreasing by 0.2%, VCI dropping by 0.45%, and MSB declining by 0.87%…

Meanwhile, the telecommunications group performed poorly, with codes such as VGI down by 0.84%, CTR falling by 0.17%, ELC decreasing by 0.79%, and TTN dropping by 1.19%.

Compared to the beginning of the session, the buying side still had the upper hand. The number of rising stocks exceeded 340, while the number of declining stocks was over 220.

Source: VietstockFinance

|

Opening: Gain at the beginning of the session

At the beginning of the November 25 session, as of 9:30, the VN-Index turned green right from the start, reaching 1,231.39 points. Besides, the HNX-Index slightly increased, maintaining 221.67 points.

Green temporarily dominated the VN30 basket, with 5 falling stocks, 16 rising stocks, and 9 stagnant stocks. Among them, CTG, BID, and MBB were the stocks that dropped the most. On the contrary, SAB, GAS, and VHM were the stocks that increased the most.

The energy group of stocks is currently one of the most prominent industries at the beginning of today’s session. Many stocks rose positively right from the start, such as PSB climbing by 3.64%, BSR increasing by 0.52%, PVD going up by 0.42%, PVS rising by 0.9%, PVC advancing by 0.96%,…

Along with this, the essential consumer goods group also contributed positively to the market’s points this morning. In particular, stocks such as MCH rose by 0.27%, VNM increased by 0.31%, MSN climbed by 0.28%, SAB went up by 1.08%, SBT advanced by 1.69%, DBC rose by 0.19%,…

On the contrary, the information technology group of stocks opened in a negative direction. Stocks in the industry, such as FPT and CMG, both showed slight red right from the beginning of the session, with decreases of 0.15% and 0.56%, respectively.

“Unleashing the Power of Words: Vietstock Weekly 25-29/11/2024: Navigating Through Hidden Risks”

The VN-Index has staged a strong recovery since last week’s sharp decline. However, trading volume remains below the 20-week average, indicating that investors are still cautious. At present, the MACD indicator is signaling a sell, and it could potentially drop to the zero threshold. If it does breach this level, the risk of a short-term correction increases.

The Market Pulse: Adjustment Pressures Linger

The VN-Index closed with a slight decline amid a volatile session that saw significant fluctuations. The index also formed a High Wave Candle pattern, indicating investor indecision. The Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that the short-term outlook remains bearish.

What Stocks are Propping Up the Stock Market?

Yesterday’s trading session (November 20) saw a boost in investor confidence with bottom-fishing funds pushing the VN-Index up by 11 points, leading to a market recovery with improved liquidity. However, many securities firms remain cautious about the market’s outlook for short-term investors and advise a prudent approach to trading.