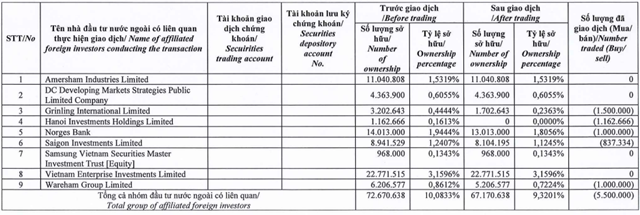

Specifically, 5 out of 9 member funds of the Dragon Capital group sold a total of 5.5 million DXG shares on November 20, 2024, including Grinling International Limited with 1.5 million shares, Hanoi Investments Holdings Limited with nearly 1.2 million shares, and Norges Bank and Wareham Group Limited with 1 million shares each. Saigon Investments Limited divested over 837,000 shares.

Following these transactions, Dragon Capital’s holdings in DXG decreased from nearly 72.7 million shares (representing a stake of almost 10.1%) to approximately 67.2 million shares (over 9.3%).

|

Dragon Capital Group Sold 5.5 Million DXG Shares on November 20, 2024

Source: DXG

|

Notably, on November 20, the DXG share price surged by 6.2% to reach VND 17,100 per share. Based on the closing price of that session, the foreign shareholder group is estimated to have pocketed VND 94 billion.

| DXG Share Price Surged on the Day Dragon Capital Sold Shares |

In other related news, DXG has received approval from the People’s Committee of Hau Giang Province for its investment proposal and as an investor in the new Mai Dam urban area project in Mai Dam town, Chau Thanh district, Hau Giang province.

According to the provincial People’s Committee’s decision on November 8, the project covers an area of approximately 96.8 hectares. Of this, over 3.5 hectares are allocated for the expanded route of Nam Song Hau Road (National Highway 91C), and nearly 93.3 hectares for the new urban area.

The tentative total investment capital for the project is VND 4,356 billion. This includes VND 3,180 billion for project implementation, VND 780 billion for compensation, support, and resettlement, and VND 396 billion for contingency expenses. The project will be funded with VND 756 billion in capital contribution from the investor and VND 3,600 billion in mobilized capital.

The project has a duration of 50 years from the date the investor is granted the land or lease decision, including two phases.

Unlocking Capital: Quang Ngai’s Swift Disbursement of Public Investment Funds

As of late October 2024, disbursed public investment capital amounted to VND 1,940 billion, equivalent to 28.1% of the assigned plan. This significant milestone underscores the diligent efforts and efficient management that have characterized our approach to utilizing public investment funds. With a keen eye on strategic allocation and a commitment to timely execution, we are well on track to achieving our financial goals and making a tangible impact.

The Future of Retail: AEON MALL’s 5.4 Trillion VND Investment in Can Tho City

The project is located in Binh Nhut, Long Hoa Ward, Binh Thuy District, Can Tho City. This area is known for its vibrant community and beautiful surroundings, offering a unique blend of urban convenience and natural beauty. With easy access to essential amenities and a thriving local culture, it presents an exciting opportunity for those seeking a balanced lifestyle in a captivating setting.

“Record-Breaking Foreign Investment: Vietnam Attracts Nearly $25 Billion in FDI in Nine Months”

According to the Foreign Investment Agency under the Ministry of Planning and Investment, as of September 30, 2024, the total newly registered, adjusted, and contributed capital of foreign investors (FDI) reached over $24.78 billion, an increase of 11.6% compared to the same period in 2023.