An Overview of Vietnam’s F&B and Quick Service Restaurant Market in the First Half of 2024

According to a report by iPOS.vn (2024), over 30,000 F&B businesses have shut down, indicating intense competition and market pressure. However, the F&B industry has still witnessed significant growth. In the first six months of 2024, the Vietnamese F&B industry generated a revenue of 403,900 billion VND, accounting for 68.46% of the total revenue in 2023. Vietnamese consumers’ dining-out frequency remains stable, with a 4.1% increase in the number of customers dining out 1-2 times a week compared to the previous year.

Additionally, factors such as rising disposable income and the modern consumption habits of Gen Y and Gen Z have played a crucial role in driving the industry’s growth. However, the market also faces several challenges. Post-COVID-19, Vietnamese consumers’ preferences have shifted towards prioritizing health-conscious and traceable products. This has compelled quick-service restaurants to innovate their menus or localize their offerings to meet customer demands. Moreover, competition from affordable, diverse, and convenient street food options has also posed significant pressure on large chain stores.

This year, several international brands have struggled, leading to the closure of long-standing outlets, including Starbucks Reserve Han Thuyen, Burger King, and McDonald’s Ben Thanh. These events not only highlight the intense market pressure but also serve as a reminder to brands about the importance of flexibility and sustainable development strategies.

Jollibee Vietnam: A Success Story Amid Challenges

In a dynamic market, Jollibee Vietnam has demonstrated its ability to adapt and achieve sustainable growth, becoming one of the most prominent brands in the quick-service restaurant industry. Since its entry into Vietnam in 2005, Jollibee has continuously expanded its scale and improved its quality to cater to the diverse tastes of its customers.

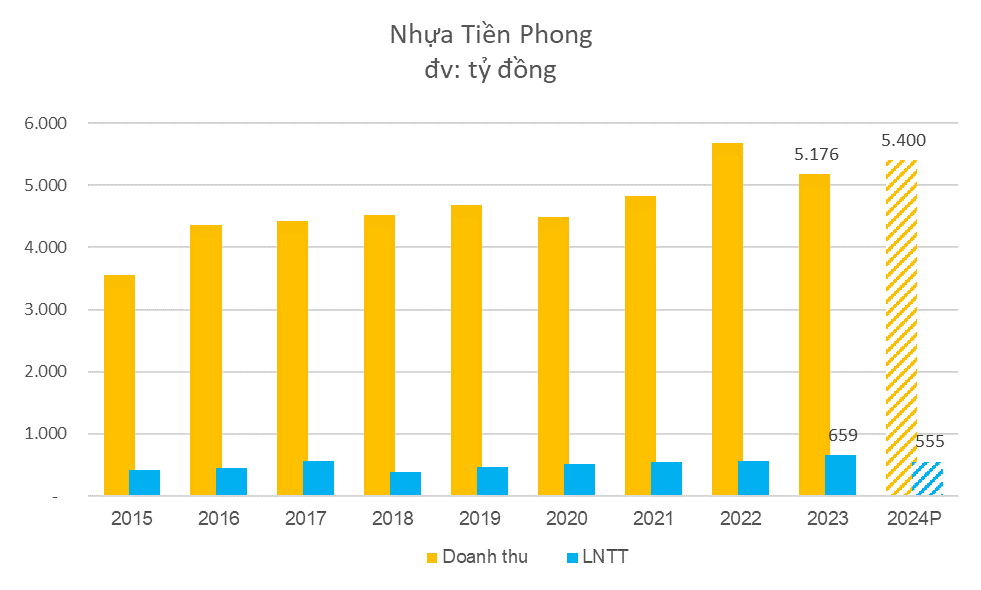

Vietdata’s report on the revenue of several restaurant chains in Vietnam from 2020 to 2022 (Image: Internet)

Between 2020 and 2023, Jollibee achieved notable milestones in terms of revenue and profitability. According to Vietdata, Jollibee’s revenue fluctuated over the past three years. In 2020, the company recorded a revenue of more than 1,100 billion VND, but it decreased by 12% in 2021 due to the pandemic. Jollibee quickly recovered, achieving a 90% growth rate in 2022, with a revenue of nearly 1,900 billion VND and an after-tax profit of over 68 billion VND, resulting in a profit margin of approximately 3.6%. These impressive figures positioned Jollibee as the most profitable quick-service restaurant brand in Vietnam during the 2020-2022 period.

Moreover, according to the latest report by Campaign Asia and Milieu Insight, Jollibee surpassed global competitors such as KFC, McDonald’s, and Burger King to become the leading food brand in Southeast Asia in 2024. In Vietnam, Jollibee’s store network has also expanded significantly, growing from 150 stores in early 2022 to nearly 200 stores in 2024, capturing a 15% market share in the F&B industry. These numbers not only reflect the stability of their business but also showcase the brand’s appeal to Vietnamese consumers.

Sustainable Strategies Propel Jollibee Vietnam’s Success:

A critical factor contributing to Jollibee’s sustained growth amid challenges is its commitment to sustainable development and business agility. Since 2019, Jollibee has owned a factory in the Tan Kim Expanded Industrial Park, Can Giuoc, Long An, spanning an area of 4,000 square meters. This factory not only meets domestic demands but also ensures consistent product quality, giving the brand a competitive edge in the industry.

Jollibee’s factory in Can Giuoc, Long An

Notably, Jollibee prioritizes understanding the consumption habits of Vietnamese consumers to localize its menu effectively. Dishes such as Crispy Chicken or Beef Pasta have been adjusted to suit local tastes while maintaining reasonable prices. This responsiveness to customer needs has enabled Jollibee to attract a diverse range of customers, especially Gen Z individuals who appreciate innovation and modernity.

Jollibee maintains its growth momentum and continues to expand amidst challenges

Furthermore, Jollibee’s expansion strategy goes beyond major urban areas, as they also focus on opening stores in smaller provinces and cities. This approach allows for efficient resource allocation and facilitates customer reach nationwide, even during market fluctuations.

Jollibee Vietnam’s success in reaching the 200-store milestone is a testament to their sustainable development strategy and adaptability to challenges. Despite the ongoing difficulties in Vietnam’s quick-service restaurant industry, Jollibee has solidified its position as a trusted partner, delivering not only business value but also spreading culinary joy to every Vietnamese family.