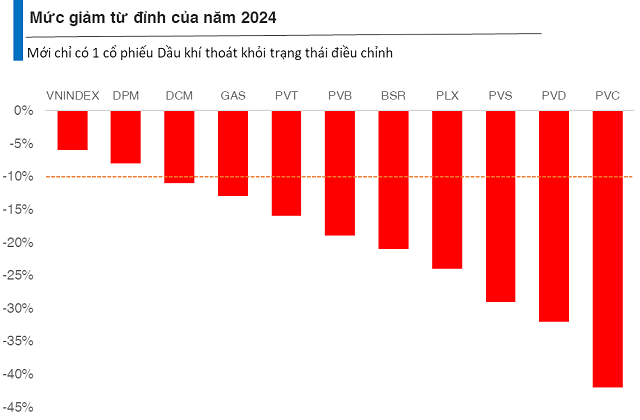

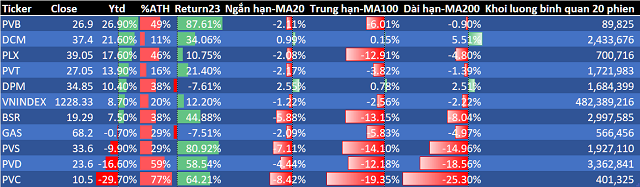

Oil and gas stocks have not fared well during the recent bearish spell in the stock market. As the VN-Index witnessed a decline of 6-7% from its peak, most oil and gas stocks experienced unfavorable movements, with some entering a correction phase (down 10-20%) or even a bear market (down over 20%).

Several stocks have witnessed drawdowns of 10-20% from their yearly highs, including DCM (-11%), GAS (-13%), PVT (-16%), and PVB (-19%). Meanwhile, BSR (-21%), PLX (-24%), PVS (-29%), PVD (-32%), and PVC (-42%) have all declined by more than 20%. GAS, PVD, BSR, PVC, and PLX have been the fastest-falling stocks in recent times.

Statistics as of the trading session on November 21st.

|

Currently, eight oil and gas stocks have lost their short-term and long-term upward trends, while only two, DPM and DCM, have managed to regain positive momentum.

Price strength of oil and gas stocks as of the trading session on November 21st.

|

In terms of price performance, five out of ten oil and gas stocks have outperformed the VN-Index (+8.7%): PVB, DCM, PLX, PVT, and DPM. PVB leads the pack with an impressive 26.9% return.

Polarized Business Results

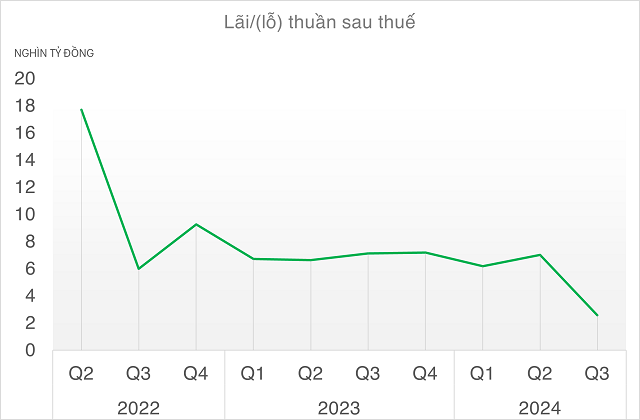

A compilation of data from the above-mentioned ten enterprises in the third quarter of 2024 reveals a 6.3% decrease in revenue compared to the same period last year, totaling 138.2 thousand billion VND.

The combined after-tax profit declined by 64% to 2,574 billion VND, mainly due to the impact on downstream enterprises such as PLX and BSR.

In reality, the oil and gas industry is relatively broad and encompasses different segments, including upstream, midstream, and downstream operations.

For upstream enterprises, industry giants like PVD and PVS recorded profit growth of over 30% compared to the previous year. Specifically, PVD’s after-tax profit increased by 35% thanks to a 14% rise in rig rental rates, contributions from newly rented rigs, and profits from associated companies. Meanwhile, PVS posted a 34% surge in profits, amounting to 192.7 billion VND in the third quarter of 2024. Vietcap Securities (VCI) recently forecasted that PVS would register significant profits in the fourth quarter of 2024 and beyond due to receiving 587 billion VND in advance payment for the Lac Da Vang project on September 30 and the official commencement of EPC Package 1 of Lot B in early September.

On the other hand, smaller and more specialized enterprises in the industry, such as PVC and PVB, have yet to record positive business results as the Lot B project only commenced in September. PVC experienced a 96% plunge in profits compared to the previous year, while PVB incurred a loss of over 6 billion VND during the same period.

In the midstream segment, GAS (+7.2%) and PVT (+62.63%) both witnessed profit growth, with PVT’s performance being particularly notable due to increased oil tanker freight rates and contributions from newly acquired tankers.

Among downstream enterprises, DPM (-3%) remained relatively stable, while DCM achieved an impressive 63% growth thanks to the full depreciation of its plant in the previous year. However, the two largest downstream players, BSR and PLX, dragged down the overall profit picture. PLX’s profit declined by 82% due to the impact of Typhoon Yagi and a 6% drop in oil prices compared to the previous quarter. Additionally, the absence of extraordinary financial gains, such as the divestment from PG Bank in the third quarter of 2023, also contributed to the decrease. Meanwhile, BSR recorded a loss of 1.2 trillion VND due to the impact of oil prices in the last quarter.

According to Vietcap (VCI), following the election of Donald Trump as the President of the United States, the potential for tougher trade policies with China and possible retaliatory measures could reignite a trade war, exerting pressure on global trade and oil consumption. VCI predicts that the average Brent oil price for 2025 could drop by more than 10% to 70 USD/barrel, with BSR being the company most affected by this price change.

Quân Mai

The Market Pulse: Adjustment Pressures Linger

The VN-Index closed with a slight decline amid a volatile session that saw significant fluctuations. The index also formed a High Wave Candle pattern, indicating investor indecision. The Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that the short-term outlook remains bearish.

What Stocks are Propping Up the Stock Market?

Yesterday’s trading session (November 20) saw a boost in investor confidence with bottom-fishing funds pushing the VN-Index up by 11 points, leading to a market recovery with improved liquidity. However, many securities firms remain cautious about the market’s outlook for short-term investors and advise a prudent approach to trading.

The 9-Million Account Market: Why is the VN-Index Stuck Around the 1,200 Point Mark?

The domestic and global macroeconomic factors present a positive picture, boding well for the stock market’s upward trend. However, with 9 million accounts, the VN-Index continues to hover around the 1,200-point mark.