Financial Health of Hoa Phat Group with the Implementation of the “Super Project” Dung Quat 2

Dung Quat 2 Project Image

The financial health and situation of the Hoa Phat Group is a topic of interest as they embark on their “super project,” Dung Quat 2. Ms. Pham Thi Kim Oanh, the group’s Chief Financial Officer, provided insights into their financial strategy and the project’s progress.

According to Ms. Oanh, the group’s projects, especially Dung Quat 2, are on schedule. The latter is expected to produce its first products by the end of this year, stabilizing their cash flow. By 2025, the plant is anticipated to make a significant contribution to the group’s business results. Additionally, Hoa Phat is benefiting from a 30% decrease in raw material prices, which has positively impacted their profit margins.

“These advantages have strengthened Hoa Phat’s financial position. When it comes to health, we’re talking about finances. I assure you that we are closely monitoring our debt-to-equity ratio and optimizing our cash flow to bring the best profits to the group,”

emphasized Ms. Oanh.

The group maintains a disciplined approach to finance management. Ms. Oanh shared that after 2025, the financial pressure for Dung Quat 2 will ease, and the company will enter a new phase of accumulation to focus on upcoming projects.

The timely execution of the project will contribute to Hoa Phat’s increasing financial strength and resilience.

Export Plans for Dung Quat 2’s Steel Production

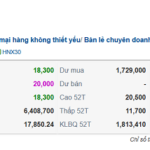

As revealed by the CFO, Hoa Phat has disbursed approximately 70,000 billion VND in fixed capital for the Dung Quat 2 project. The remaining amount will be disbursed in 2025. While a small portion of commercial products will be launched by the end of 2024, they will not significantly impact the group’s business results.

Furthermore, Ms. Oanh shared that half of the project’s funding comes from loans (approximately 35,000 billion VND), and the disbursement process is ahead of schedule. 2025 will mark the peak of the group’s debt as banks disburse the remaining funds. Nonetheless, the net debt-to-EBITDA ratio remains favorable and well within control.

Dung Quat 2’s first blast furnace is expected to operate at 50-60% capacity in 2025, producing an estimated 1.5 million tons of HRC. By 2026, the project could reach 80% capacity for the first furnace and 50% for the second. The entire project is anticipated to be operational by 2028.

According to the CFO’s projections, if HRC can be sold at a price of 480-500 USD/ton, and Dung Quat 2 reaches full capacity in four years, Hoa Phat’s revenue could surpass the 10 billion USD mark (approximately 255,000 billion VND). The profit margin is expected to be around 7%-8%.

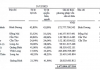

Regarding depreciation, Ms. Oanh disclosed a chosen average of 18 years for the total investment of 70,000 VND, translating to nearly 3,900 billion VND per year. The depreciation value will not reach its highest level in 2025-2026, and it is projected to attain the 3,900 billion VND mark in 2027.

“Many people have asked me if such depreciation will erode the group’s profits. I believe that if our profits continue to grow at a double-digit rate, it won’t have a significant impact. Currently, our depreciation cost is 7,000 billion VND per year. With the addition of Dung Quat 2, this figure will increase to 10,000-11,000 billion VND for depreciation. As a result, our resources will become even stronger in the future, and shareholders need not worry,”

assured the CFO, adding that the depreciation funds will be reinvested in production.

With Dung Quat 2, Hoa Phat faces the challenge of increased sales pressure. Once the project reaches full capacity, their steel production will surge from 3 million tons to 8.6 million tons. Currently, 30% of their revenue comes from exports, and they aim to maintain this ratio for HRC exports as well.

The remaining products will be sold in the domestic market. Hoa Phat’s subsidiaries, including those specializing in construction steel, containers, home appliances, and high-quality steel, have a substantial demand for HRC.

What is a Credit Score?

Credit scores are a familiar term in finance, but for those who have never borrowed money, it may be an unfamiliar concept.