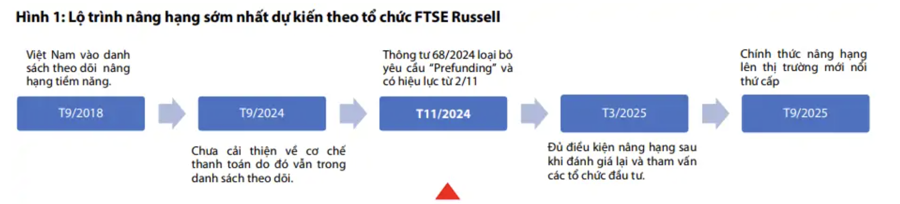

In the October 2024 review, FTSE Russell maintained Vietnam on its watchlist for potential reclassification to Secondary Emerging Market status. Vietnam has been on this list since September 2018, but several factors have prevented its upgrade to a secondary emerging market.

The primary reason for the delay in upgrade is Vietnam’s non-compliance with the “Delivery versus Payment (DvP)” criterion, currently rated as “Restricted” due to the market’s requirement for pre-confirmation of available funds before executing trades.

Additionally, improvements are needed in the new account registration process, as the current market practice prolongs the registration timeline. Facilitating trading for foreign investors in stocks that are foreign-owned or nearing foreign ownership limits is also considered crucial.

Regarding the recent outlook for reclassification, Rong Viet Securities (VDSC) opined that while the FTSE Russell Index Governing Board decided to retain Vietnam on the Watchlist during the annual review in September 2024 due to two remaining unmet criteria since the March 2024 assessment, this time, FTSE Russell acknowledged the efforts of the Vietnamese government and the Securities Commission for market reform, citing Circular 68/2024 issued on September 18, 2024, and effective from November 2, 2024.

Specifically, the Circular allows foreign institutional investors to purchase stocks without pre-funding requirements. This addresses the final two criteria for reclassification.

The time frame between the Circular’s effectiveness and the March 2025 periodic review is sufficient for relevant parties to implement and communicate this new policy to international investors. Therefore, VDSC anticipates that the Vietnamese stock market, with all criteria met, will be reclassified when assessed by FTSE Ressell in the March 2025 review and officially take effect from the September 2025 review.

Upgrading the market to “Secondary Emerging Market” status, as per FTSE Rusell’s evaluation, will attract a modest amount of capital from funds referencing the FTSE Emerging Market Index compared to those referencing the MSCI Emerging Market Index.

FTSE and MSCI are two organizations trusted by global investment funds for benchmarking investment performance based on market category investment objectives. In addition to MSCI, FTSE LSEG is a leading global financial services company providing financial market infrastructure, data, analytics, and news, especially index products, to over 40,000 customers in more than 170 countries.

FTSE’s Global Equity Index Series (FTSE GEIS) offers a comprehensive global equity index framework, including over 19,000 securities across large, mid, small, and micro-cap segments from 49 developed and emerging markets worldwide.

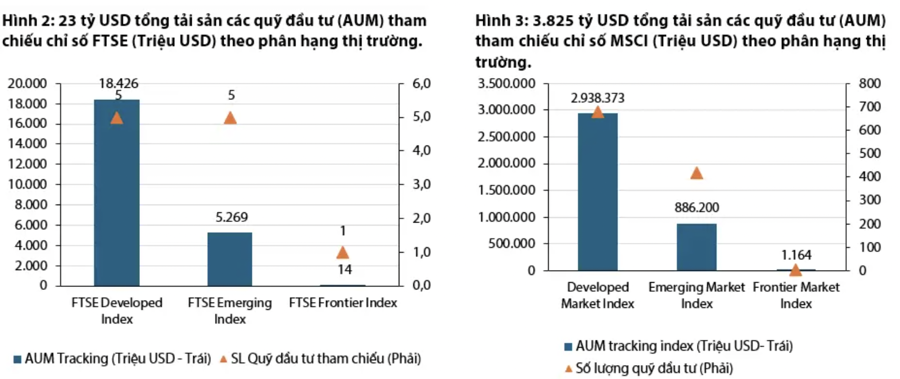

There is over $2.21 trillion in assets under management (AUM) tracking the FTSE GEIS, used as a benchmark for actively managed strategies and a foundation for passively managed investment vehicles such as ETFs. Only $23 billion of this references FTSE’s index products by market classification, a modest figure compared to the scale of funds referencing similar MSCI products. While FTSE’s market share in index-referencing products is not significantly lower than MSCI’s, there is a significant disparity in the scale of assets attracted by their respective emerging market indices.

This discrepancy may stem from FTSE’s strength in country-specific index products, with Vietnam as a case in point. Many funds investing in Vietnam prefer to use FTSE as their benchmark index rather than MSCI.

Therefore, an upgrade to “Secondary Emerging Market” status, as per FTSE’s evaluation, will likely attract a modest amount of capital from funds referencing the FTSE Emerging Market Index. However, VDSC believes that this reclassification will enhance the reputation of Vietnam’s stock market quality and potentially attract significant additional capital to the FTSE Vietnam Index funds.

The Battle for Survival: A Small Ride-Hailing App’s Struggle

Despite their best efforts to stay afloat, smaller ride-hailing apps are finding it challenging to gain traction and break through in the market. The odds are stacked against them as they compete with well-established players who have a head start in terms of resources, brand recognition, and network effects. It seems an uphill battle for these smaller players to make a significant dent in the industry and capture a substantial market share.

What’s Behind the Surge in Coffee Prices?

Coffee prices have surged to new heights amidst the harvest season, yet many farmers remain reluctant to sell their produce, hoping for further price increases.

The Ultimate Powerhouse: Apple’s New iPad Pro Available Early in Vietnam, Starting at VND 11.39 Million

The iPad Mini 7 is an impressive upgrade to its predecessor, boasting a powerful CPU that’s 30% faster and graphics that are a remarkable 25% quicker. This sleek and compact tablet delivers an exceptional performance boost, ensuring a seamless and highly responsive user experience. With its enhanced processing power and stunning visuals, the iPad Mini 7 takes your everyday tasks and entertainment to new heights. It’s a true testament to Apple’s commitment to innovation and performance.

“Revolutionizing the Insurance Industry: The Power of Automated Document Processing”

In recent times, several insurance companies have leveraged VinBigdata’s next-generation Optical Character Recognition (OCR) technology to automate their document processing. This cutting-edge technology has revolutionized the industry by drastically reducing insurance claims processing times while enhancing customer experience and boosting competitive advantages.