Illustration.

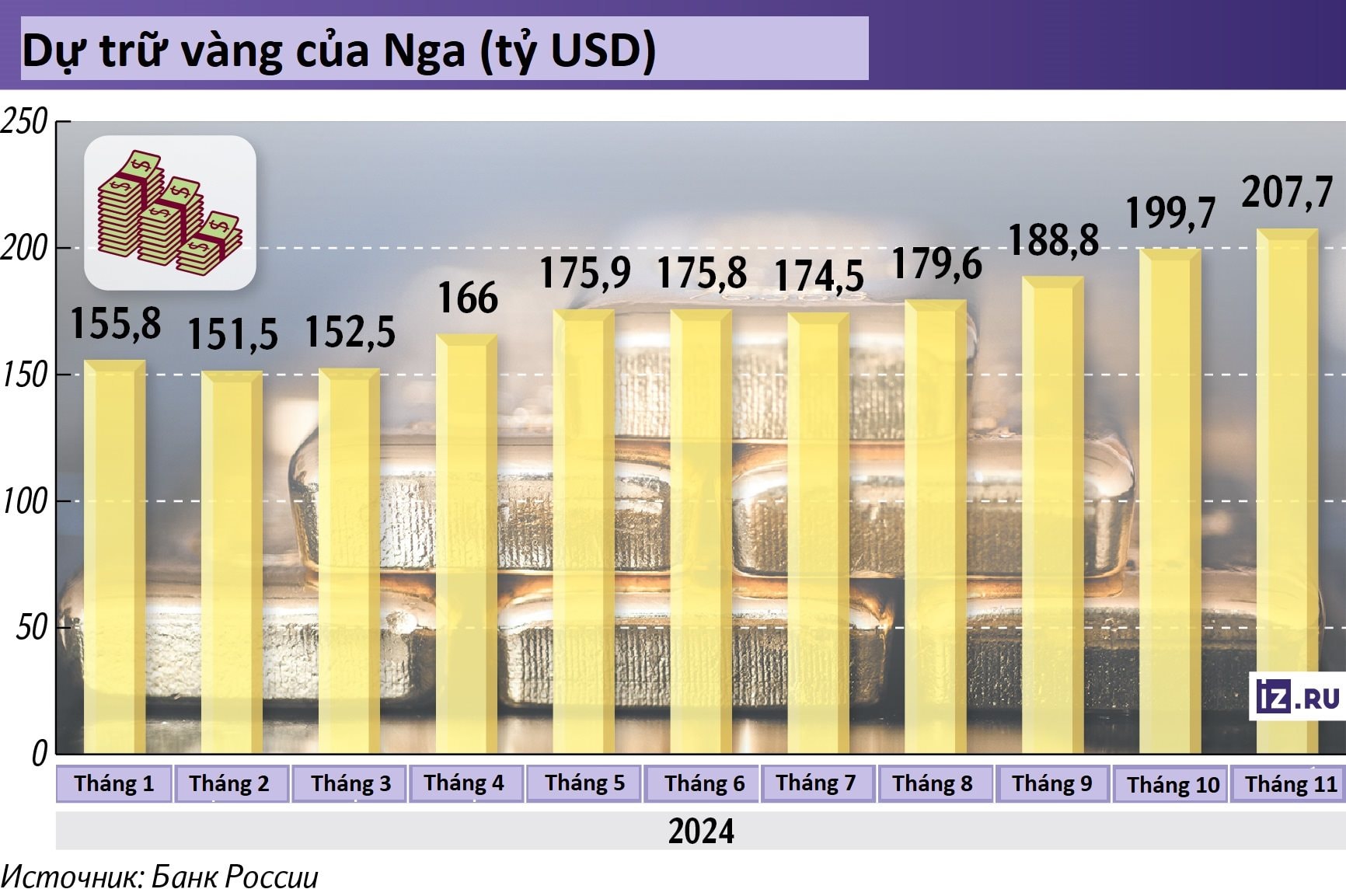

According to a report published by Izvestia, Russia has reached an impressive milestone in its gold reserves. According to the latest data from the Central Bank of Russia, the country’s gold reserves have surpassed the $200 billion mark, reaching a record high of $207 billion, a 33% increase in the first ten months of 2024. This is also the largest increase ever.

Such an equivalent was only observed in 2016, but at a much lower value ($64.5 billion). The gold reserve volume of the Russian Federation has remained almost unchanged since the beginning of the year, equivalent to 2,335 tons.

Nikolay Dudchenko, an analyst at Finam, stated that this reserve increase directly reflects the surge in gold prices. As of the beginning of November, gold prices had increased by 4% compared to the previous month, reaching $2,744 per ounce.

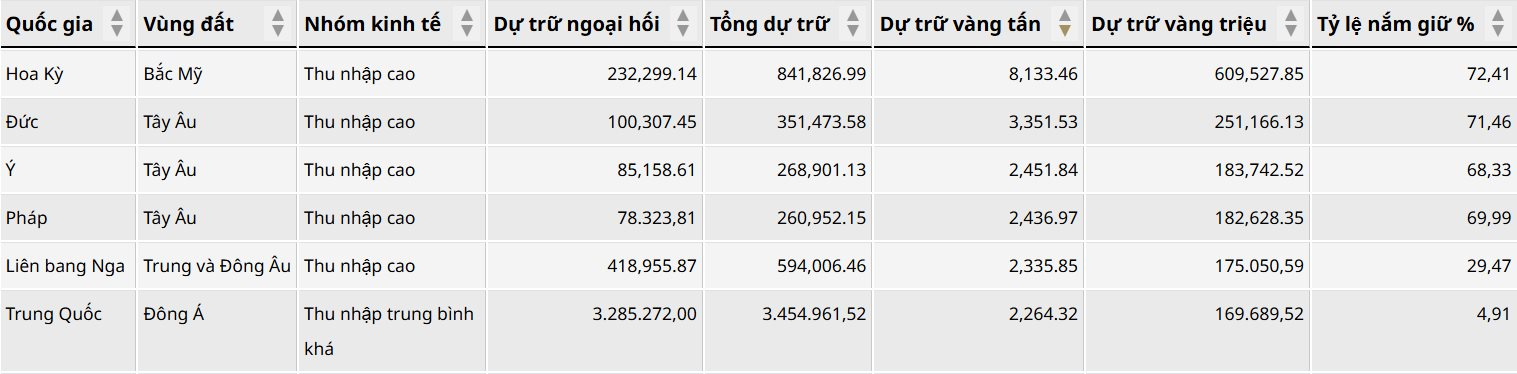

With this new record, Russia is now ranked 5th in the world in gold reserves, only behind the US, Germany, Italy, and France, and ahead of China, according to the World Gold Council’s (WGC) assessment in the second quarter of this year.

According to independent expert Andrey Barkhota, in the context of geopolitical tensions and increasing sanctions pressure, gold has become a favored reserve asset for the “White Birch Country.” He assessed that the price of this metal does not fluctuate as rapidly as the value of a currency, and the resilience of this asset to sanctions is generally significantly higher. Especially, as one of the world’s largest gold producers, Russia has the advantage of self-sufficiency in gold supply.

Source: WGC

Vladimir Chernov, an analyst at Freedom Finance Global, believes that the Russian government changed its approach to forming gold and foreign exchange reserves in 2022 after Russia’s monetary assets in USD and euros were frozen. This precious metal became the top priority.

Additionally, since the end of February 2022, the Central Bank of Russia has continued to buy gold on the domestic market, according to expert Chernov. For example, one of the world’s largest mining companies, Polyus Gold, has sold almost all of the precious metal it produces to the domestic market of the Russian Federation, mainly to the Central Bank of Russia.

Overall, gold prices have increased by 29% since the beginning of the year, according to TradingView data. Ilya Fyodorov, the chief economist at BCS World of Investments, points out that the recent surge in gold prices is mainly due to geopolitical tensions.

Furthermore, Dmitry Skryabin, an analyst at Alfa-Capital, mentions that the trend of gold accumulation is not only observed in Russia but also in many other central banks, especially in China, India, and Turkey.

Moreover, tensions in the Middle East are considered one of the main factors driving gold prices higher. According to Skryabin’s forecast, gold could reach a new record high of $3,000 per ounce by 2025.

References: TASS, iz.ru

The Golden Opportunity: Rising Prices and a Shining Future

The price of gold on the global market, as observed on the Kitco exchange this 27th of October, stood at $2,747 per ounce, marking a notable increase of $7.84 from the previous day’s rates.