left-pad the text to make it more readable.

The ongoing uptrend is causing some discomfort for investors who have yet to buy. Many are waiting for a pullback to get a better entry point, with the VNI index’s 1240-point threshold being closely watched.

The recovery dynamics bear resemblance to the previous two bottom formations, characterized by sharp and continuous upward moves with only intraday corrections. This “abandonment” recovery style leaves cautious investors behind as they passively place buy orders.

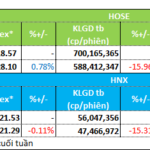

This dynamic explains why the market is rising with relatively low liquidity, not due to a lack of funds but because buy orders are not being filled. The total volume of daily buy orders remains significant, but this latent demand is not translating into actual trading volume.

There are two advantages to this type of advance. Firstly, it creates a sense of growing impatience among investors. When skepticism sets in, there are countless reasons to doubt the sustainability of the uptrend, leading to expectations of a price reversal and a better buying opportunity. When this doesn’t happen, intraday dips encounter improved demand sooner.

Secondly, the rapid price increase sets a more distant reference point for the bottom. The larger the gap between the current price and the bottom, the lower the likelihood of revisiting that low. For instance, with the VNI index, many would have hoped for a retracement to test the 1200-point level or even a drop to 1180 points last week. But with the index now at 1242 points, the prospect of returning to 1200 points becomes increasingly slim.

The 1240-point threshold now comes into play from a psychological perspective. This technical support level, which was decisively breached two weeks ago, has now turned into resistance according to theory. Many investors will be anticipating a strong selling wave in this zone, leading to a price pullback. While today’s buying momentum showed signs of slowing down, selling pressure has not intensified, nor has there been any notable price suppression. It remains to be seen if selling volume will increase in the coming sessions, but the composure displayed by investors suggests that short-term trading is not the dominant strategy. Each day’s uptrend is accompanied by intraday corrections, but the downward volume remains modest, and prices are well-supported.

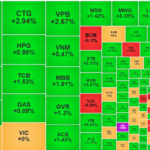

However, this does not imply that all stocks will behave similarly. Some stocks that have rallied strongly or become overheated in recent days will likely encounter substantial profit-taking. The rotation of capital will become more apparent. If you hold such stocks, short-term trading opportunities exist. Conversely, most stocks have not witnessed significant gains during this recovery, offering limited trading prospects and only allowing for optimal cost averaging. Since the magnitude of the advance and the inflow of capital vary across stocks, even if the VNI index reacts to the 1240-point level, the oscillations in individual stocks will differ.

The stance remains that the market is in a favorable state. If a shakeout occurred during the “wash-out” week without causing concern, the current situation is even more relaxed. Should volatility arise around the 1240-point level, portfolio restructuring or small-scale trading to lower costs can be considered.

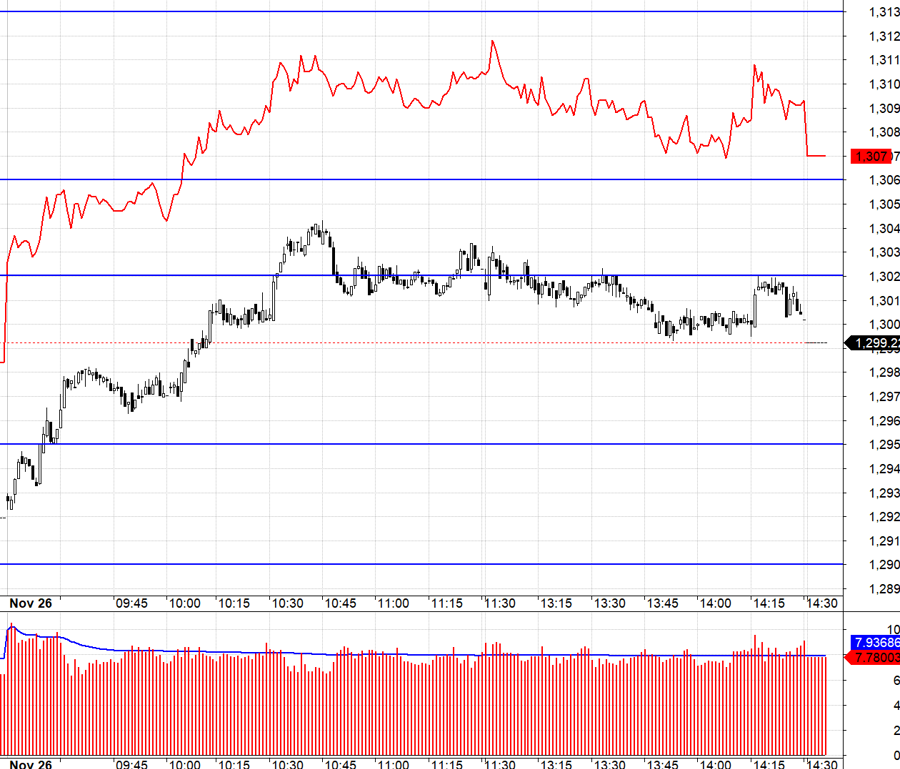

Today’s performance in the derivatives market was frustrating. The F1 basis was excessively wide, with an average spread of over 8 points during the initial uptrend, making it impractical to go long due to the uncertainty around when selling pressure might increase. For the remainder of the day, the VN30 index hovered closely around 1302.xx, creating a favorable environment for short positions, and any decline would likely target the 1295.xx level. While the risk-reward ratio and stop-loss parameters were favorable, the mild downward movement in the index and the stable basis resulted in subpar outcomes.

The market currently finds itself in a fragile balance between supply and demand. The buying momentum that pushed prices up until this afternoon has noticeably waned, and the small-scale selling has kept prices stable. If selling pressure intensifies or there is concerted selling of large-cap stocks in the coming sessions, it could trigger a more substantial release of short-term holdings. The strategy involves trading stocks and dynamically employing long and short positions in derivatives.

The VN30 index closed today at 1299.22. Tomorrow’s resistance levels are 1302, 1307, 1313, 1317, and 1325. Support levels are 1295, 1290, 1283, 1278, 1271, and 1265.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The assessments and investment perspectives are solely those of the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment perspectives.

Is a V-Shaped Recovery in the Cards for the Market Post-Deep Pullback?

The afternoon session witnessed a surge in trading activities, with momentum picking up towards the end. The depletion of selling pressure from the morning session triggered a rapid upward swing in prices. As buying momentum improved, sellers became imbalanced, leading to a dominant wave of rising prices across the board. The HoSE trading volume soared by 130% in the afternoon session compared to the morning.

The Liquidity Crunch: Capital Flow Conundrum for Real Estate Players

After a week of recovery, fueled by bottom-fishing funds, the market’s liquidity took a turn for the worse. Many groups witnessed a decline in their trading volumes. Amidst this downturn, real estate emerged as a sector with a distinct divergence in fund flows.