Illustrative Image

Wheat is one of the world’s essential staple crops, and in Vietnam, the country’s wheat supply relies predominantly on imports. According to preliminary statistics from the General Department of Customs, in October 2024, Vietnam imported 482,000 tons of wheat, valued at over $128 million, a decrease of 42.8% in volume and 43.4% in value compared to the previous month.

Cumulatively, in the first ten months of the year, the country’s wheat imports surpassed 5.01 million tons, equivalent to over $1.37 billion, marking a 35% increase in volume and a 7.1% rise in value compared to the same period in 2023.

The average import price stood at $274 per ton, a significant drop of 20.6% from the previous year.

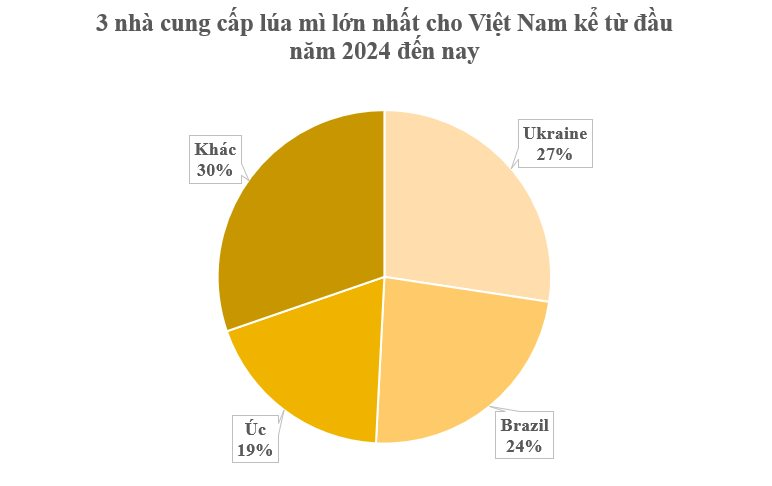

Notably, Ukraine emerged as Vietnam’s largest wheat supplier during this period, exporting over 1.37 million tons, valued at more than $351 million. This reflects a remarkable 879% surge in volume and an 800% increase in value compared to the corresponding period in 2023, surpassing traditional key providers such as Brazil, Australia, the US, and Canada. The average import price from Ukraine was $254 per ton, a slight decrease of 8.1% from the previous year’s first ten months.

In October alone, Ukraine provided Vietnam with over 248,000 tons of wheat, totaling more than $63 million in value, representing a substantial increase of 329.4% in volume and 304.2% in value compared to October 2023.

Ukraine is a significant wheat and corn producer globally. Before the conflict with Russia in 2022, Ukraine exported approximately six million tons of grain per month through its Black Sea ports. According to Ukraine’s Ministry of Agriculture, farmers had completed around 92% of the winter wheat planting plan as of October 28. However, due to prolonged drought conditions from summer to early autumn, farmers were compelled to sow wheat on parched land, hindering crop development and threatening yields. This situation has severely impacted Ukraine’s wheat production outlook for the coming year.

Aside from Ukraine, Brazil was the second-largest supplier, providing 1.17 million tons, worth over $293.14 million, a substantial increase of 348.9% in volume and 205.9% in value compared to the same period last year. The average price stood at $249.6 per ton, a 32% decrease from the first ten months of 2023.

Australia, the third-largest supplier, exported over 948,000 tons, valued at nearly $292 million, a significant drop of 63.2% in volume and 66.8% in value. The average import price was $308.5 per ton, a 9.8% decline from the previous year.

According to the Livestock Association, wheat is primarily used in mixed animal feed production. As Vietnam does not produce wheat domestically, its supply depends entirely on imports. This year’s wheat import prices have plummeted by almost 22% compared to last year, prompting enterprises to seize the opportunity of lower prices, especially from Ukraine, to increase their imports.

The global wheat market is vast, with an annual production of approximately 770 million tons and a value exceeding $200 billion. The leading exporting countries include Russia, the US, Canada, and Ukraine. With this import volume, Vietnam ranks among the top ten wheat importers worldwide.

The USDA forecasts global wheat consumption for 2024/25 to increase by 4.1 million tons to a record high of 804 million tons. This growth is mainly attributed to higher feed usage and other purposes in the EU, Kazakhstan, and Ukraine, along with increased demand for wheat as food, seed, and industrial use (FSI) in Nigeria and Algeria.

The Feed Import Industry: A $2.65 Billion Dollar Deficit

As per the Ministry of Agriculture and Rural Development, between January and August 2024, exports of animal feed and raw materials reached $0.67 billion. However, imports of the same group during this period stood at a much higher $3.32 billion. This trade deficit of $2.65 billion highlights a significant gap in the industry.