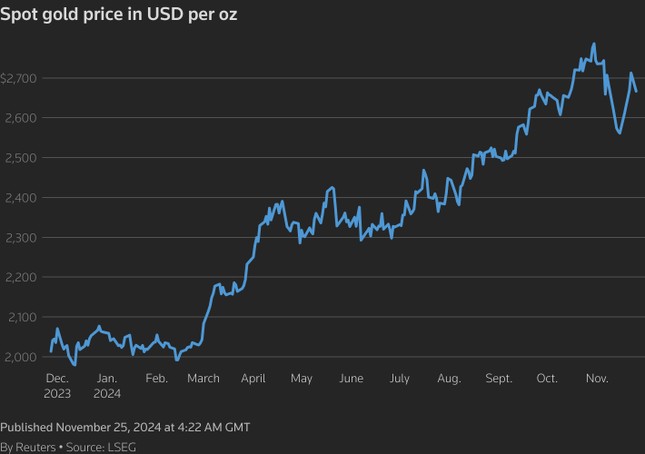

Gold prices slipped on November 25 as some traders looked to cash in on recent gains, while a less dovish outlook from the US Federal Reserve weighed on the precious metal. Spot gold fell 1.52% to $2,671.29 per ounce, while US gold futures dropped 1.5% to $2,672.90. Matt Simpson, a senior analyst at City Index, attributed the decline to profit-taking, as gold had reached a high of $2,718 earlier.

The Fed’s rate-setting meeting the previous week had a significant impact on the market. According to CME’s Fedwatch tool, the probability of a 25-basis-point rate cut in December fell to 51% from 62% the week before. Higher interest rates tend to diminish the appeal of non-yielding assets like gold.

Diverging views among Fed policymakers added to the complexity. While some expressed concern about the stagnant inflation progress, prompting a cautious approach to rate cuts, others emphasized the need for further reductions. Yeap Jun Rong, a market strategist at IG, suggested that a less dovish policy signal from the Fed and potential inflation surprises could lead to a hold in rates in December, putting downward pressure on gold prices.

Gold prices took a hit.

In equity markets, the broadest MSCI index of Asia-Pacific shares outside Japan rose 1.6%, and S&P 500 futures gained 0.5%, nearing a record high. The previous day, the S&P 500 cash index (.SPX) had climbed 0.3%.

The US dollar weakened against major currencies, falling 0.7% against the yen and 0.6% against the euro, as traders bought US Treasuries, pushing the benchmark 10-year yield down seven basis points to a two-year low of 4.341%. Societe Generale strategist Stephen Spratt commented on the market’s relief that Bessent, considered a ‘safe’ pick for US Treasury Secretary, was in the running for the position.

Japan’s Nikkei (.N225) and South Korea’s Kospi (.KS11) indices rose 1.6% and 1.5%, respectively. The Australian market (.AXJO) also climbed 0.7% to a record high. However, Chinese stocks faced headwinds due to the looming threat of Trump’s tariffs. Hong Kong’s Hang Seng (.HSI) edged up 0.2%, while China’s blue-chip CSI300 (.CSI300) dipped 0.2%.

The Japanese yen, sensitive to US yields, recently traded at 153.76 yen per dollar. The euro changed hands at $1.0477, recovering from a two-year low. The British pound rose 0.5% to $1.2592, rebounding from a weak performance the previous Friday, where it hit its lowest since early May at $1.2475.

Bitcoin inched up to $97,511, approaching the previous week’s record high of $99,830, boosted by expectations of a more crypto-friendly stance under Trump. Bitcoin’s value surged by approximately 45% following Trump’s decisive victory over Kamala Harris in the presidential race.

In the oil market, Brent crude futures rose 0.2% to $75.30 a barrel, while US West Texas Intermediate crude traded at $71.38 per barrel, up 0.2%. Geopolitical tensions between Western powers and rising concerns over supply disruptions kept oil prices near two-week highs.

The Golden Rush: Gold Prices Soar Past $2,700/oz Despite a Strong US Dollar

This week, the global gold price surged by VND 4.4 million per tael, recovering most of the loss from the previous two weeks’ decline of over VND 5 million per tael.

The Golden Rush: Gold Prices Surge Past $2,700 per Ounce on November 22nd Evening

Gold has been on a consistent upward trajectory in recent sessions, as market risk appetite has shifted.