Eximbank’s shareholders have recently proposed notable changes to the bank’s management. Specifically, a group of shareholders holding over 5% of Eximbank’s capital has called for the dismissal of Mr. Nguyen Ho Nam and Ms. Luong Thi Cam Tu from their positions as members of the Board of Directors.

This proposal is based on the shareholders’ interpretation of the bank’s governance reports, which indicate that Ms. Tu had missed four board meetings and failed to authorize another member to represent her. Additionally, she only attended 17 out of 21 meetings, amounting to an attendance rate of 81%. Furthermore, Ms. Tu also missed 23 out of 243 board decisions made through written opinions, resulting in a participation rate of 91%.

The shareholders also referenced the semi-annual governance report for the first half of 2024, which showed that Ms. Tu missed one out of 109 shareholder decisions made through written opinions, resulting in a 99.08% participation rate. They concluded that Ms. Tu had not fully attended the board meetings and participated in written opinion-based board decisions.

Regarding Mr. Nam, the semi-annual report revealed that he had missed two out of 38 board decisions made through written opinions in the past two months, resulting in a 94.74% attendance rate. Mr. Nam has served as a member of Eximbank’s Board of Directors since April 26, 2024. The shareholders concluded that he, too, had not fully participated in the written opinion-based board decisions.

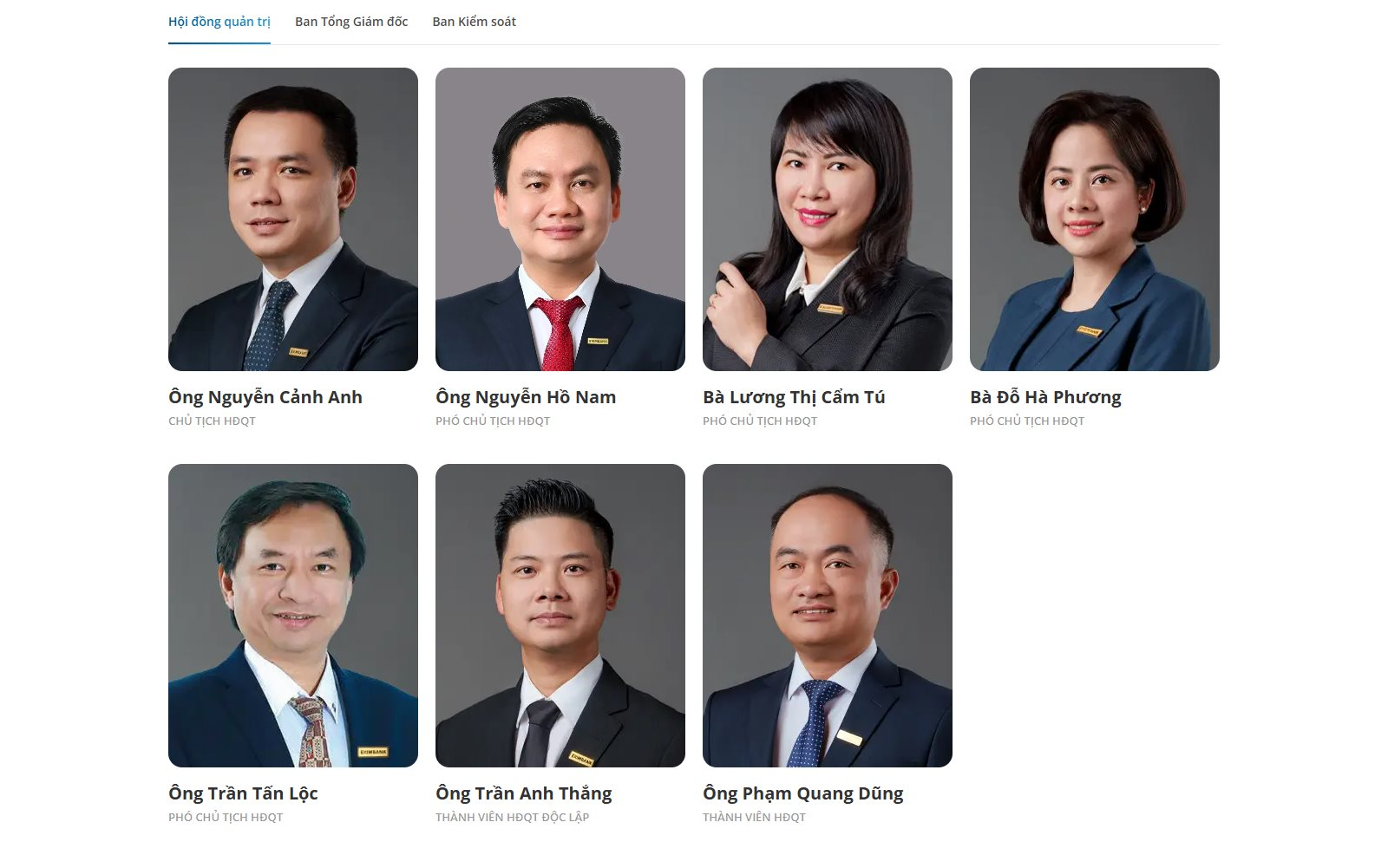

Eximbank’s Board of Directors currently comprises seven members, including Mr. Nguyen Canh Anh as the Chairman. Mr. Nguyen Ho Nam, Ms. Luong Thi Cam Tu, Ms. Do Ha Phuong, and Mr. Tran Tan Loc serve as Vice Chairpersons, with Mr. Pham Quang Dung and Mr. Tran Anh Thang as the remaining members, including an independent director.

The current members of Eximbank’s Board of Directors

Prior to this proposal, another group of shareholders holding over 5% of Eximbank had also called for the dismissal of Mr. Ngo Tony from his position as a member of the bank’s Supervisory Board. They alleged that Mr. Tony had abused his position and violated the bank’s charter and the Supervisory Board’s regulations, significantly impacting the shareholders’ interests.

At the upcoming General Meeting, Eximbank will discuss several important agenda items. These include a proposal to change the location of the bank’s head office from Ho Chi Minh City to a new address in Hanoi and the termination of the plan to construct a new head office at 07 Le Thi Hong Gam Street, Nguyen Thai Binh Ward, District 1, Ho Chi Minh City.

Eximbank’s Pre-Extraordinary General Meeting in Hanoi: A Successful Capital Increase to VND 18.7 Trillion

This information was released ahead of the bank’s upcoming Extraordinary General Meeting (EGM) in Hanoi, scheduled for November 28th.

The Race to Raise Deposit Rates: Why Banks Are Competing to Offer Higher Returns

As we approach the year-end, there has been a significant surge in demand for capital, especially medium and long-term funds. In response, banks have engaged in a fierce competition to raise deposit interest rates, with the highest rate reaching an impressive 6.4% per annum for terms of 18 months and beyond.

“Eximbank Shareholders Revolt: A Call to Action Against the Discharge of the Chief Controller.”

A group of major shareholders in Eximbank have raised concerns over the removal of Mr. Ngo Tony from his position as Chief Controller. They believe that the decision to terminate his role was made in violation of legal procedures and have voiced their opposition to this move.

“Eximbank Launches Exclusive Credit Package for Import-Export Businesses”

Eximbank has just launched an exceptional credit promotion program tailored for import-export businesses, featuring an attractive interest rate starting from 3.7% per year and a range of service fee waivers. This program is specially designed for SMEs and customers who have not previously had a credit relationship with Eximbank.