Illustrative image

After more than 3 months of stagnation, SeABank has just increased deposit interest rates for terms ranging from 1 to 12 months.

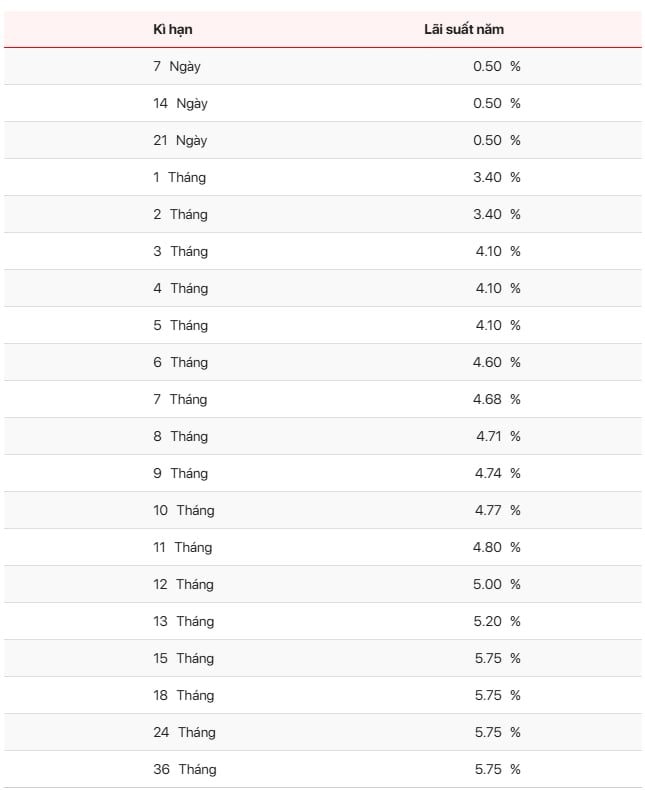

According to the term deposit interest rates with interest payable at maturity, the interest rate for 1-2 month terms has increased by 0.45% p.a., reaching 3.4% p.a. For terms of 3 to 5 months, the increase is even more significant at 0.65% p.a., resulting in a rate of 4.1% p.a.

For terms ranging from 6 to 11 months, the interest rates have all been adjusted upward by 0.75% p.a. Specifically, the 6-month term now stands at 4.5% p.a., 7 months at 4.6% p.a., 8 months at 4.65% p.a., 9 months at 4.7% p.a., 10 months at 4.75% p.a., and 11 months at 4.8% p.a.

Additionally, the 12-month term interest rate has also increased by 0.5% p.a., reaching 5% p.a. Meanwhile, interest rates for longer terms, such as 15 months (5.25% p.a.) and 18-36 months (5.45% p.a.), remain unchanged.

SeABank’s latest term deposit interest rates with interest payable at maturity

SeABank is the 14th bank to raise deposit interest rates since the beginning of the month, joining the ranks of BaoViet Bank, HDBank, GPBank, LPBank, Nam A Bank, IVB, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank, and VietBank. Notably, MB, Agribank, and VIB have increased their interest rates twice since the start of the month.

Following a period of stagnation, a series of banks, including major players like Agribank, Techcombank, and MB, have recently raised their savings interest rates.

These developments come during the peak credit growth period at the end of the year, and there are signs of tightening liquidity in the banking system. According to the State Bank of Vietnam (SBV), credit growth as of October 31 has increased by 10.08% compared to the end of 2023. In the same period last year, credit growth was only 7.4%.

On another note, the continuous listing of USD exchange rates at commercial banks, even reaching the ceiling for more than a month, has prompted the SBV to simultaneously employ tools such as bills and foreign currency sales to stabilize the market. While these interventions are expected to curb the sharp rise in exchange rates, they may also impact the VND liquidity of the banking system.

In a recent report, MBS stated that the high interbank interest rates signal a liquidity shortage. According to MBS, the issuance of bills by the SBV and the withdrawal of over $4.5 billion by the State Treasury from three major banks in the third quarter of 2024 were factors that increased liquidity pressure.

“Despite the SBV’s strong interventions through OMO injections, the overnight interest rate remains above 5%, indicating significant pressure in the system,” MBS assessed.

MBS believes that this development is a contributing factor in banks’ decisions to adjust their deposit interest rates upward to attract new capital and ensure liquidity. MB’s analysts forecast a slight increase of 0.2 percentage points in deposit interest rates by the end of this year.

Enhancing SeABank’s Supervisory Board: Strengthening Oversight and Fostering Sustainable Growth for the Bank

On November 15, 2024, the Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) held an Extraordinary General Meeting (EGM) to elect two additional members to its Supervisory Board (SB) for the 2023 – 2028 term, bringing the total number of SB members to five. The election aimed to enhance the capabilities and effectiveness of SeABank’s SB and to align with international best practices in corporate governance.

The Trillion-Dollar Bank: BIDV’s Monthly Loan Disbursements Surpass the Combined Total of 15 Other Banks

With a staggering monthly increase of VND 19.5 trillion in outstanding loans, this bank is on track to hit the VND 2 quadrillion mark by the end of the year. This unprecedented scale of lending portfolio solidifies its position as the leading lender in Vietnam, a remarkable feat that underscores its financial prowess and dominance in the industry.

A Bank Slashes Savings Rates Today, 22/11

NCB Bank has announced an update to its savings account interest rates, effective from 22nd November 2024.