Illustrative image

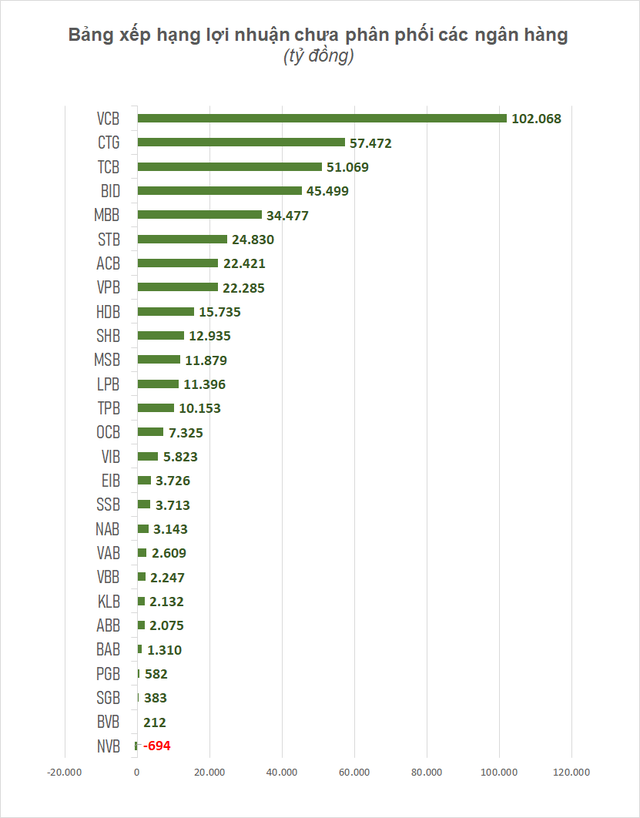

According to the consolidated financial report for the third quarter of 2024, the total undistributed profit of 27 banks on the stock market reached nearly VND 456,803 billion by the end of September, an increase of more than VND 99,245 billion, or 28%, compared to the end of 2023. Most banks recorded an increase in the scale of undistributed profits in the first nine months of 2024.

After deducting the profits belonging to subsidiary companies, the total amount that banks can use to pay dividends to shareholders by the end of September is estimated at over VND 400,000 billion.

Vietcombank currently has the largest undistributed profit fund in the system, with VND 102,068 billion as of September 30, 2024, an increase of VND 25,310 billion compared to the end of 2023, and accounting for nearly a quarter of the total undistributed profit of the 27 banks on the stock market.

Vietcombank also recorded the strongest increase in undistributed profits in the system, leading the industry in profits in the first nine months and not paying dividends in 2024.

In fact, after the issuance of nearly 857 million shares in August 2023 to pay the remaining dividends for 2019 and 2020, Vietcombank has not yet made any dividend payments in 2024, although it is implementing multiple plans to increase capital from undistributed profits in previous years.

In the context of capital increase plans awaiting approval from competent authorities, Vietcombank’s undistributed profit fund has continuously expanded over the years, but it is far behind large joint-stock commercial banks like VPBank and Techcombank in terms of charter capital.

On November 30, 2024, the National Assembly is expected to vote to approve the Resolution of the 8th Session of the 15th National Assembly, which includes a decision on the policy to additionally invest state capital in Vietcombank. If approved by the National Assembly, Vietcombank will be able to issue shares to pay dividends and increase its charter capital by VND 27,666 billion (including capital from the State and other shareholders), equivalent to a payment ratio of 49.5%. After the issuance, Vietcombank’s charter capital will reach VND 83,557 billion, ranking first in the banking system, while its undistributed profit fund will decrease.

VietinBank ranks second in terms of the scale of undistributed profits, with VND 57,472 billion, an increase of more than VND 15,100 billion compared to the end of 2023. Similar to Vietcombank, despite having one of the highest profits in the system, VietinBank faces challenges in profit distribution due to the need for multiple levels of approval.

The last time this “giant” paid dividends was in December 2023, with the source of payment being the remaining profit from 2020, which helped increase its charter capital to VND 53,700 billion.

At the recent annual general meeting of shareholders, Chairman Tran Minh Binh stated that VietinBank had received permission from the State Bank of Vietnam and the Ministry of Finance to retain the entire profit of 2022 (VND 11,678 billion) to increase capital by issuing dividends in shares. In addition, the bank plans to further increase its charter capital by VND 12,330 billion from the remaining profit of 2021 and the accumulated undistributed profit up to the end of 2016.

If approved and implemented, VietinBank’s charter capital will increase to over VND 77,700 billion, and its undistributed profit fund will decrease significantly compared to the present.

Techcombank ranks third in terms of undistributed profits, with VND 51,069 billion as of September 30, 2024, an increase of just over VND 2,000 billion compared to the end of 2023.

Techcombank is the second most profitable bank in the system and leads the group of private banks. In addition, the bank has continuously retained all profits since its listing on the stock exchange and only started paying cash dividends from 2024. This has allowed Techcombank’s “profit warehouse” to grow significantly in previous years.

In 2024, the bank made a significant change in its dividend payment policy. Accordingly, after ten years of accumulating profits for reinvestment in business activities and not paying dividends, Techcombank implemented a plan to pay cash dividends to shareholders at a rate of 15%. At the same time, the bank also paid dividends in shares at a rate of 100%, increasing its charter capital to the second highest in the system.

As the bank with the strongest growth in undistributed profits among the Big 3, BIDV currently has nearly VND 45,500 billion available for dividend payments. Similar to Vietcombank and VietinBank, BIDV also faces challenges in capital increase due to the need for multiple approval steps.

The last time BIDV paid dividends was in December 2023, with the payment source being the remaining profit after tax and the establishment of funds for 2021. At the 2024 Annual General Meeting of Shareholders, BIDV approved the issuance of nearly 1.2 billion shares to pay dividends for 2022, equivalent to a ratio of 21% of the shares in circulation at the end of 2023. The issuance is expected to take place in 2024-2025.

If approved by the competent authorities, BIDV will be allowed to use a portion of its undistributed profit warehouse to pay dividends and increase capital.

As of the end of the third quarter, MB’s undistributed profit reached VND 34,477 billion, an increase of 35% compared to VND 25,560 billion at the end of 2023. In 2024, MB paid cash dividends at a rate of 5% and stock dividends at a rate of 15%. However, thanks to positive business results, with after-tax profit in the first nine months reaching over VND 16,000 billion, MB’s “profit warehouse” continued to expand.

In addition to the banks mentioned above, the TOP10 banks with the largest undistributed profits on the stock market also include familiar names such as Sacombank (VND 24,830 billion), ACB (VND 22,421 billion), VPBank (VND 22,285 billion), and HDBank (VND 15,735 billion).

On the other hand, the banks with the lowest undistributed profits in the system are currently SaigonBank (VND 383 billion) and BVBank (VND 212 billion). Meanwhile, NCB has accumulated losses of over VND 694 billion.

In terms of the growth rate of undistributed profits, LPBank (+135%), Eximbank (88%), and SHB (+61%) are the banks with the fastest growth in the first nine months. In contrast, BVBank (-63%), PGBank (-61%), and Saigonbank (-38%) are the banks that experienced the most significant decreases in undistributed profits.

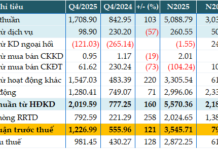

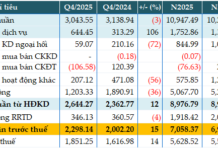

The Bank with the ‘Huge’ Interest Rates from Insurance Sales Revealed

Several banks have reported an increase in revenue from insurance service fees. Notably, KienlongBank’s insurance revenue in the third quarter reached nearly VND 40 billion, a significant surge of almost 73% compared to the same period last year.

The Thai-Owned Vietnamese Packaging Company to Spend $50 Million on Factory Relocation from Vietnam’s First Industrial Park

SVI is renowned for being one of the top five packaging suppliers in the Southern region, catering to prominent brands such as Unilever, Pepsico, Nestle, and Vinacafe. With a strong reputation for delivering high-quality packaging solutions, SVI has established itself as a trusted partner for industry leaders, ensuring their products are presented with excellence.

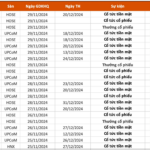

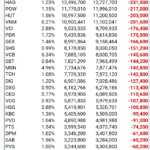

The Foreign Block: A 28-Session Sell-Off Streak and the Continued Unwinding of the Million-Dollar ETF

The week of November 11–18, 2024, marks yet another significant period of aggressive selling by the VanEck Vectors Vietnam ETF (VNM ETF). This is the fourth consecutive week of net selling by the fund, coinciding with a prolonged period of foreign investor selling spanning dozens of sessions.