The market saw an initial reaction to the psychological support level of 1200 points last week, with relatively positive results. However, liquidity has left experts uncertain about the possibility of a major bottom formation around this level.

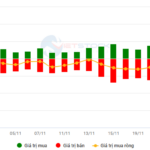

The VN-Index had three consecutive declining sessions at the beginning of the week, continuously dipping towards the 1200-point level. On November 20, the index even breached this level, falling to a low of 1197.99 points before recovering strongly. For the rest of the week, the market witnessed positive trading sessions and maintained a balanced state despite the increasing short-term selling pressure.

Experts assessed that the recovery range at the end of the week was positive, but they did not expect the market to recover in a V-shape similar to the bottom formations in April and August. The reason is that the current downtrend of the VN-Index has dropped below the 200-day moving average (MA200), and the market has not experienced a “wash-out” phase with high liquidity. Although the recovery range at the end of the week was quite strong in terms of points, it lacked strong liquidity. After the recovery, the market faced short-term supply around resistance levels. Therefore, experts believe that the market is likely to form a “small bottom” and may need to retest the 1200-point level again.

In line with the short-term uncertainty, experts have not significantly increased their investments but have maintained a moderate level. If the retreat to test the 1200-point level does not face significant selling pressure, it will be a positive signal, and they may consider increasing investment.

Nguyen Hoang – VnEconomy

In the first three trading sessions of the week, the market continuously tested the 1200-point support level and even briefly broke through it before recovering. Last week, you were waiting for further trading developments to confirm the “wash-out” state. Liquidity during the test of the 1200-point level was not high, except for the session on November 20. What are your thoughts on this bottom test?

I am somewhat cautious and not inclined to believe that the market can form a significant bottom around the 1200-point level or recover in a V-shape. Currently, I only expect the market to be in a short-term recovery due to oversold conditions.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

The market received support at the 1200-point level with low liquidity, which I believe indicates investors’ hesitation as they approach a strong support level. However, technically, the VN-Index has broken below the MA200 in the upward trend on the weekly chart, so a “wash-out” situation may occur if there are “black swan” events in the market.

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

Although liquidity has not shown significant changes, the recovery reaction around the 1200-point level somewhat reflects the proactive bottom-fishing mentality and the presence of waiting capital. At the very least, with the current developments, the short-term recovery can alleviate the dominant selling trend, as reflected in the two latest gaining sessions where the phenomenon of panic selling has diminished.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The market did not experience a “wash-out” phase that would push sentiment into a state of panic. Instead, it fell with gradually decreasing selling pressure, and when the VN-Index approached the 1200-point level, bottom-fishing demand reappeared. The upward momentum was generally positive, mainly due to the large fluctuations recently, but buying power did not show signs of improvement as volume remained low.

I assess this signal as not being positive, and it tends to support the possibility that this is just a short-term recovery after a prolonged downtrend lasting more than a month. If, next week, the market continues to recover with weak buying power, the index may turn back when approaching the resistance around the 1240-point level or the 1250-1260-point range.

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, the strong support level of 1200 points could be the deepest bottom of the market in the recent period. On the monthly chart, the strong resistance is likely only in the 119x-1200-point range – the accumulation range of the market is probably the 1225-1230-1240-point range in the coming period.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

The stock market last week witnessed interesting developments as it continuously tested the 1200-point support level. On November 20, the index officially broke below 1200 points but quickly rebounded with relatively positive liquidity compared to previous sessions. The trading volume last week was not high and showed a decreasing trend from the peak of 1300 points. Essentially, I assess this as one of the positive signs for the end of the downtrend, but it does not mean that the market will immediately increase or “sideway” for a period.

Looking at the trading value throughout 2024, the lending ratio of securities companies has not yet peaked, and the average buying price of investors is also not significantly different, leading to low buying and selling pressure. The lending ratio has not yet peaked at the high prices of the market, so when it falls to the 1200-point level, we do not see a panic selling-off from investors or margin-called accounts. Therefore, a “wash-out” has not actually occurred at this point, and if it does, it will likely appear at lower price levels.

Nguyen Hoang – VnEconomy

The recovery was quite rapid towards the end of the week, with the VN-Index rising 23 points, which is quite strong. Looking back at the two bottom formations in April and August, when the market rebounded with a large range, it formed a V-shape. Will this happen again? Has the market really bottomed out yet?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

I notice that the market at this level seems to be referenced a lot to the two previous bottom formations in April and August when the RSI entered the oversold zone, and expectations are that this time, it will also have similar developments to maintain the 1180-1300-point sideway channel. However, in my opinion, it is necessary to pay attention to the overall context. This time, the market has lost the MA200, and at the same time, the upward momentum of the DXY has not shown signs of weakening, increasing the risk of exchange rates, which weighs heavily on investor sentiment. In addition, there is still the concern about bad debt in the banking group.

Therefore, I am somewhat cautious and not inclined to believe that the market can form a significant bottom around the 1200-point level or recover in a V-shape. Currently, I only expect the market to be in a short-term recovery due to oversold conditions.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

The VN-Index has rebounded after many previous turbulent sessions, rising from a low of 1,198 points on November 20 to 1,228 points at the close of November 22. The 1,200-point level is a psychological and strong support level for the market in 2024. If we look at the picture for the whole year, the domestic macro economy has not had many fluctuations, so the market lacks a breakthrough and “sideways” in the 1,200-1,300-point range. This leads to a lack of significant differences in the average buying price of investors. The selling side is willing to sell when the market rises by a few percentage points, and the buying side is also ready to buy when the market falls.

I assess this as one of the positive signs for the end of the downtrend, but it does not mean that the market will immediately increase or “sideway” for a period.

Nguyen Thi Thao Nhu

With a balanced buying and selling state like the present, it is understandable to expect the market to bounce back similarly to April and August. However, the interesting thing about the stock market is that even if you are walking on a clear, cloudless summer day, you can still get wet even if you are carrying an umbrella. Even though there is a not-so-low probability that the market will continue to rise, investors should still be cautious because “history” is still just “history,” as its name suggests.

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

With the current developments, I believe that the VN-Index has likely formed a small bottom around the 1200-point level. However, as the short-term downtrend is dominant, the bounce back will likely struggle to create a large range and may face the risk of reversing at the upper resistance levels due to the potential latent high-price supply. In this case, the deeper support level at 1180 points is expected to provide better support for the index.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

The market retested the 1200-point level with much lower liquidity than the two previous bottom formations in April and August. Although the VN-Index rose significantly, selling pressure did not appear, especially in the session on November 21, when the market gained 11.79 points but with lower liquidity than the average of the previous 10 sessions. Currently, the VN-Index has filled the “gap” that formed during the decline on November 15. In my opinion, there will be a struggle around this level, and we need to monitor the price action next week to determine if the market has successfully formed a bottom.

Le Duc Khanh – Director of Analysis, VPS Securities

I believe that the market will form a bottom in the shape of a V or a double bottom in the last two weeks of November. Although the market may struggle to recover strongly, a few individual stocks are performing better than the overall market.

Nguyen Hoang – VnEconomy

The market is about to enter the last month of the year. December is usually a positive period for the market as the accumulation of stocks for the year-end financial reporting season becomes more active, especially after a relatively strong decline. What stocks/sectors do you prioritize?

December is usually a positive short-term period for stocks/sectors with good business results for the year. 2024 is also expected to be a year of improved profit growth for businesses compared to 2022 and 2023.

Nguyen Viet Quang

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

In the November 2024 Strategic Report of Rong Viet Securities Company, we believe that the stock market is at an attractive discount level, supported by positive Q3 business results, continued positive prospects in the coming quarters, and interest rates in the economy, which will be supported as major central banks continue the trend of normalizing monetary policies.

However, there are short-term headwinds to note, such as (1) geopolitical conflicts that can trigger short-term risk-averse sentiment among investors, and (2) the potential initial strengthening of the US dollar if the Trump administration wins. Therefore, investors should prepare for the scenario of taking advantage of market dips to build long-term positions, especially in the banking, real estate, technology, industrial, and financial services sectors. In other words, we encourage investors to ensure positions for the opportunity of market re-rating but maintain buying power to cope with potential headwinds mentioned above.

In the run-up to the new earnings season, potential investment ideas that investors can consider for their portfolios include:

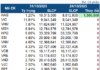

i) Maintain a recommendation to increase the allocation to the banking sector as the opportunity for re-rating remains ahead. Our preferred banking stocks include: ACB, VCB, BID, CTG, VIB, and VPB.

ii) A new recommendation for steel stocks, including GDA and HPG, with a growth story in terms of production volume and expectations for a recovery in prices.

iii) The real estate sector is also under our consideration as the prospects for Q4 2024 and the first half of 2025 are positive. Within this theme, we choose KDH, a financially healthy company with attractive valuations as one of the few remaining land fund developers in Ho Chi Minh City.

iv) Trump’s victory will increase the likelihood of imposing very high taxes on Chinese exports to the US, leading to the need to shift production to countries like Vietnam. We expect this factor to support the acceleration of sales for industrial real estate companies. In this regard, we choose KBC, LHG, SIP, and NTC.

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

Based on business results so far this year, in addition to prioritizing the selection of enterprises with strong and stable profit growth, sectors related to the import-export field, such as textiles, seafood, ports, and maritime transport, are expected to benefit greatly from the trend of supply chain shifts and the new US trade policy.

In addition, in terms of valuation, banking stocks are still relatively cheap compared to the market, and this adjustment phase may open up potential investment opportunities for both short-term and long-term positions.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

December is usually a positive short-term period for stocks/sectors with good business results for the year. 2024 is also expected to be a year of improved profit growth for businesses compared to 2022 and 2023. My priorities for the upcoming earnings season are in the technology, industrial real estate, and textile sectors.

I expect there will be a retest of the 1200-point level after this technical rebound.

Nghiem Sy Tien

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

After the sharp decline, the market has returned to the 1200-point level, offering some good opportunities to find quality stocks

Technical Analysis for the Session Closing November 27th: Deciphering the Diverging Forces Governing the Market

The VN-Index and HNX-Index both witnessed declines, alongside a significant dip in trading liquidity during the morning session. This indicates that investors are exercising caution in their transactions.

The Power of Persuasive Words: Crafting a Compelling Headline

“Sustaining the Uptrend: A Comprehensive Guide to Navigating the Volatile Market”

The VN-Index continued its upward trajectory, surging above the Middle Band of the Bollinger Bands. If, in the upcoming sessions, the index sustains its position above this threshold, coupled with trading volumes surpassing the 20-day average, the upward momentum will be reinforced. Moreover, the MACD indicator has flashed a buy signal, crossing above the signal line, boding well for the short-term outlook.

The Art of Investing: Strategies for the Ultra-Wealthy

The ultra-wealthy population in Vietnam is witnessing a rapid surge, accompanied by a diversifying range of investment needs. Elevation Talks, a unique investment event series, is the brainchild of BIDV and Dragon Capital. This collaborative initiative serves as an intellectual hub, fostering connections and providing a platform for in-depth market insights and effective investment strategies. Modeled after the renowned investment clubs worldwide, Elevation Talks offers a space for like-minded individuals to engage, exchange ideas, and explore lucrative opportunities.