VietBank to Issue New Shares for Dividend Payment

Vietnam Commercial Joint Stock Bank, known as VietBank (ticker: VBB), has announced that November 29 will be the record date for a 25% stock dividend.

VietBank plans to issue approximately 142.8 million new shares to distribute dividends to its shareholders. The issuance will be sourced from undistributed profits accumulated up to December 31, 2023. Following this issuance, the bank’s charter capital will increase by nearly VND 1,428 billion, reaching a total of VND 7,139 billion.

HDBank has also received approval from the State Bank of Vietnam to increase its charter capital by distributing stock dividends. HDBank is authorized to increase its charter capital by a maximum of VND 5,825 billion from undistributed post-tax profits, in accordance with the capital increase plan approved by the 2024 General Meeting of Shareholders.

After issuing a 20% stock dividend, HDBank’s charter capital will surpass VND 34,900 billion. This move solidifies HDBank’s position among banks with the largest charter capital in the system, ensuring its safety indicators and high operating efficiency.

At an extraordinary general meeting, LPBank shareholders approved a plan to increase its charter capital in 2024 by issuing stock dividends to existing shareholders at a rate of 16.8%. Following this issuance, LPBank’s charter capital is expected to reach a maximum of VND 29,873 billion, propelling the bank into the top 10 banks with the largest capital on the stock exchange.

Meanwhile, the Big 3 state-owned banks, including Vietcombank, VietinBank, and BIDV, are awaiting decisions from authorized agencies to distribute dividends as per their approved plans. None of these banks have paid dividends to shareholders so far this year.

On November 30, 2024, the National Assembly is expected to vote on a resolution at the 8th session of the 15th National Assembly, which includes a decision on: The policy of investing additional state capital in Vietcombank .

If approved by the National Assembly, Vietcombank will be able to issue shares to pay dividends, increasing its charter capital by VND 27,666 billion, equivalent to a payout ratio of 49.5%. Post-issuance, Vietcombank’s charter capital is projected to reach VND 83,557 billion, surpassing VPBank (VND 79,339 billion) and Techcombank (VND 70,450 billion) to become the largest in the banking system.

In addition to Vietcombank, the State Bank of Vietnam is collaborating with relevant ministries and sectors to submit to the competent authorities for approval of the policy of investing additional state capital in BIDV and VietinBank from the remaining profit after tax in previous years as prescribed.

At the 2024 Annual General Meeting of Shareholders, BIDV approved the issuance of nearly 1.2 billion new shares to pay 2022 dividends, equivalent to a payout ratio of 21% of the outstanding shares at the end of 2023. The issuance is expected to take place between 2024 and 2025.

For VietinBank, despite submitting its proposal quite some time ago, the process of increasing capital has been rather slow. The bank’s most recent dividend payment was in December 2023, utilizing profits remaining from 2020 to boost its charter capital to VND 53,700 billion.

At the recent shareholder meeting, Chairman Tran Minh Binh stated that VietinBank had received permission from the State Bank of Vietnam and the Ministry of Finance to retain all of its 2022 profits (VND 11,678 billion) for capital augmentation through stock dividends.

Additionally, the bank intends to increase its charter capital by VND 12,330 billion from profits remaining from 2021 and accumulated undistributed profits up to the end of 2016.

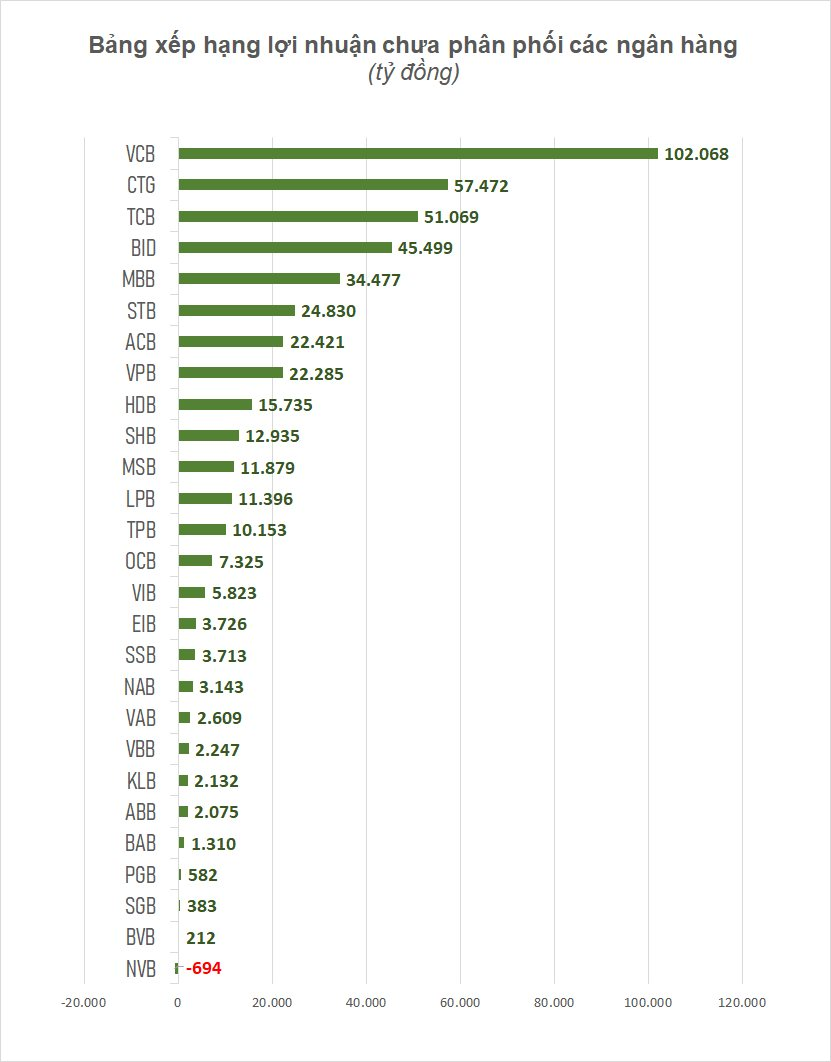

Accumulated Undistributed Profits of 27 Listed Banks as of Q3 2024

According to the consolidated financial statements for Q3 2024, the total undistributed profits of 27 banks on the stock market amounted to nearly VND 456,803 billion as of the end of September, an increase of over VND 99,245 billion, or 28%, compared to the end of 2023.

After deducting profits belonging to subsidiaries, the estimated amount available for dividend distribution to shareholders as of the end of September exceeded VND 400,000 billion.

“Vietbank’s Endeavor for Capital Increase: A Commitment to Sustainable Growth”

The State Securities Commission (SSC) has confirmed receiving the necessary documents for Vietbank’s (VBB on UPCoM) stock dividend issuance, aiming to boost its charter capital by VND 1,428 billion. With this capital increase, Vietbank’s charter capital will rise to VND 7,139 billion. This crucial step of finalizing the procedures with the SSC empowers Vietbank to strengthen its financial capabilities and lay the groundwork for expanding its nationwide network.

Mrs. Dang Thi Hoang Yen Returns to the TTC Agri Board

“Mrs. Huynh Bich Ngoc, wife of Mr. Dang Van Thanh, has rejoined the Board of Directors of TTC AgriS as a member. This announcement comes after she stepped down from her position as Chairman of the Board in July 2024. With her extensive experience and knowledge, Mrs. Ngoc is expected to contribute significantly to the company’s strategic direction and growth.”

Vietbank Proudly Opens New Branch in Bac Ninh

On September 26, the Vietnam Thrift Bank, more commonly known as Vietbank, inaugurated its 120th transaction office: Vietbank Bac Ninh Branch in Bac Ninh city, Bac Ninh province.