|

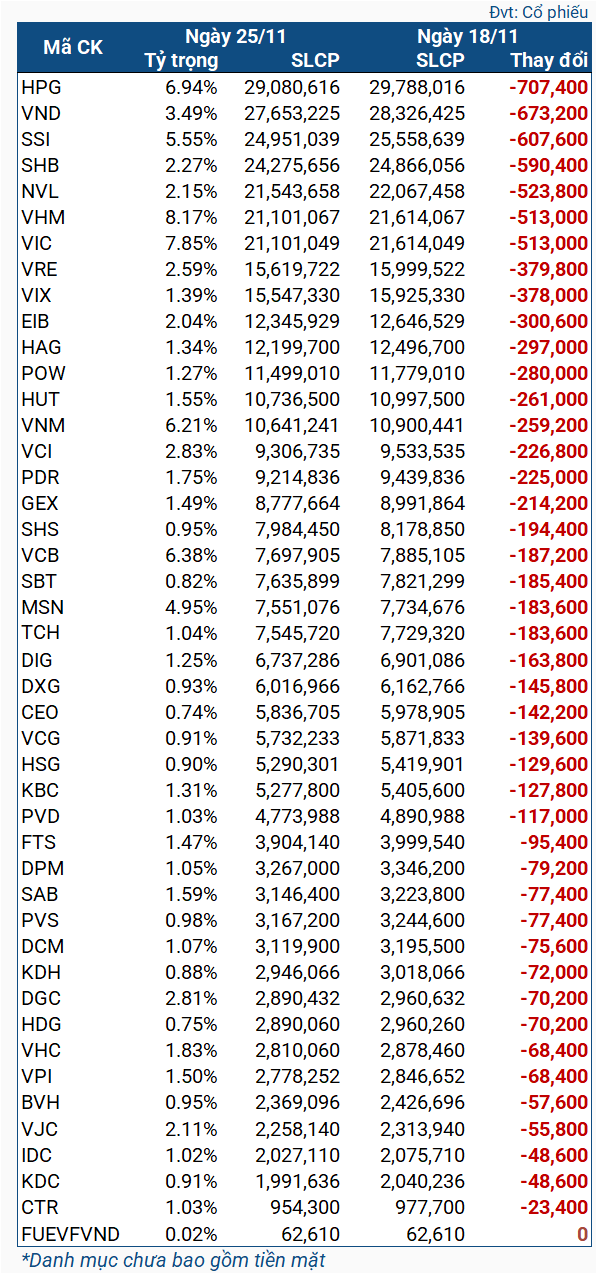

Stock Changes of VNM ETF for the Week of Nov 18-25

|

During this period, HPG witnessed the largest sell-off with more than 707,400 shares changing hands. Selling pressure was also concentrated on VND, SSI, and SHB, with trading volumes of around 600,000 shares. Additionally, NVL, along with two VinGroup stocks, VHM and VIC, also saw sell-offs of over 500,000 shares.

This marks the fifth consecutive week of net selling by VNM ETF, as foreign investors offloaded large volumes of stocks across 30 sessions, with multiple days of selling exceeding VND1,000 billion. However, starting from Nov 22, foreign investors resumed net buying (albeit with a modest value of a few dozen billion VND), and as of Nov 26, there have been three consecutive sessions of net buying. This suggests that the selling spree of VNM ETF is likely to subside in the coming week.

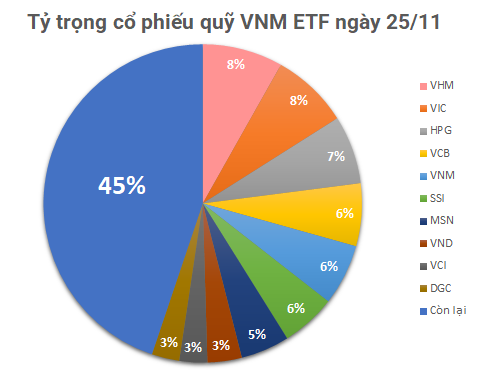

As of Nov 25, the net asset value of VNM ETF stood at nearly $433 million, slightly down from $434 million recorded on Nov 18. The entire portfolio comprises Vietnamese stocks, spread across 44 stock codes and one fund certificate. The top weights went to VHM (8.17%), VIC (7.85%), HPG (6.94%), VCB (6.38%), VNM (6.21%), and SSI (5.55%).

The Foreign Block: A 28-Session Sell-Off Streak and the Continued Unwinding of the Million-Dollar ETF

The week of November 11–18, 2024, marks yet another significant period of aggressive selling by the VanEck Vectors Vietnam ETF (VNM ETF). This is the fourth consecutive week of net selling by the fund, coinciding with a prolonged period of foreign investor selling spanning dozens of sessions.