Hoà Thọ Textile and Garment Corporation Announces Interim Dividend for 2024

The Hoà Thọ Textile and Garment Joint Stock Corporation (code: HTG) has just announced a resolution of the Board of Directors on the provisional payment of the second 2024 dividend in cash to shareholders, at a rate of 30%/share (1 share receives VND 3,000). The record date for shareholders will be December 25, and the payment will be made on January 23, 2025.

With more than 36 million shares outstanding, the company is estimated to spend approximately VND 108 billion on this dividend payment.

Including the first interim cash dividend of 10% at the end of July 2024, the total dividend ratio for 2024 of Hòa Thọ Textile and Garment reaches 40%.

It is known that this textile and garment enterprise has a tradition of paying high and consistent cash dividends to shareholders, ranging from over 20% to 40%. In 2023, Hòa Thọ Textile and Garment even paid a dividend for 2022 with a total ratio of up to 60%, of which 40% was in cash and 20% in shares.

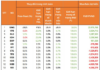

Regarding the business results for the third quarter of 2024,

Hòa Thọ Textile and Garment recorded net revenue of VND 1,498 billion, up 18% over the same period last year, and pre-tax profit of VND 93 billion, up 25%.

For the first nine months of the year, Hòa Thọ Textile and Garment’s revenue reached VND 3,772 billion and pre-tax profit was VND 236 billion, up 4.5% and 52%, respectively, compared to the same period in 2023. Thus, the company has achieved 84% of its revenue plan (VND 4,500 billion) and exceeded 6% of its profit target (VND 220 billion) for the whole year.

On the stock exchange, HTG shares closed the session on November 27 at VND 46,350/share, just 2% lower than the historical peak of VND 47,200/share on October 24.

Prospects for the Vietnamese Textile and Garment Industry

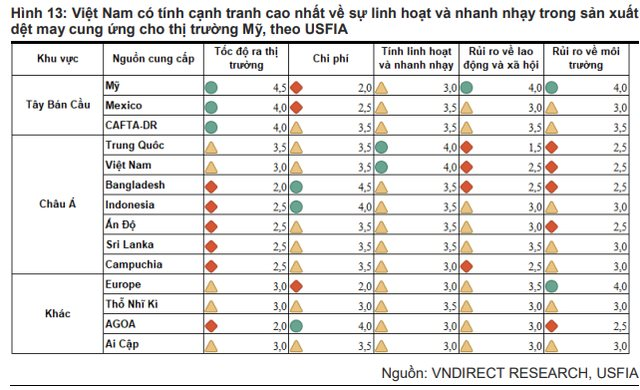

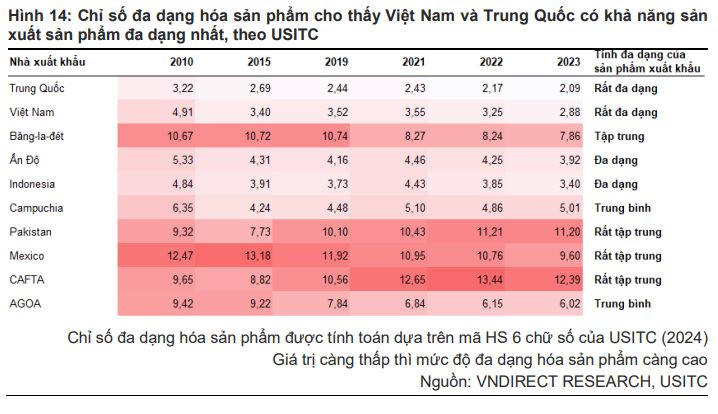

In a recent report, VNDirect Securities assessed that the Vietnamese textile and garment industry has many competitive advantages over the world. VNDirect stated that flexibility, agility, and product diversity are the greatest strengths of the Vietnamese textile and garment industry.

According to the latest survey by the United States Fashion Industry Association (USFIA), the Vietnamese textile and garment industry is the most competitive in terms of flexibility and agility in textile and garment supply, including meeting delivery deadlines, volume, and customized products according to customer requirements. Vietnam has a large port system and geographical and political stability advantages over Bangladesh.

Vietnam has lower shipping costs to the US than India, Indonesia, and Sri Lanka, but higher than Mexico. However, Vietnam outperforms Mexico thanks to cheaper labor and higher production skills.

In addition, Vietnam is also leading in flexible and diverse production capabilities, thanks to investments in advanced machinery and skilled labor, according to the USITC. Compared to Bangladesh, Vietnam is capable of providing high-value and diverse products such as vests, winter coats, and swimwear, while Bangladesh mainly produces basic t-shirts in bulk.

The second advantage is the strong digital transformation. According to FPT Digital, the readiness for digital transformation of Vietnamese textile and garment enterprises is still low, although we participate strongly in the global textile and garment supply chain. According to Mr. Nguyen The Phuong, a consultant at FPT Digital, up to 90% of Vietnamese textile and garment enterprises are outside the digital transformation trend. The biggest challenge is the investment capital, implementation, and maintenance of digital solutions due to high costs and short-term productivity gains that are not yet apparent.

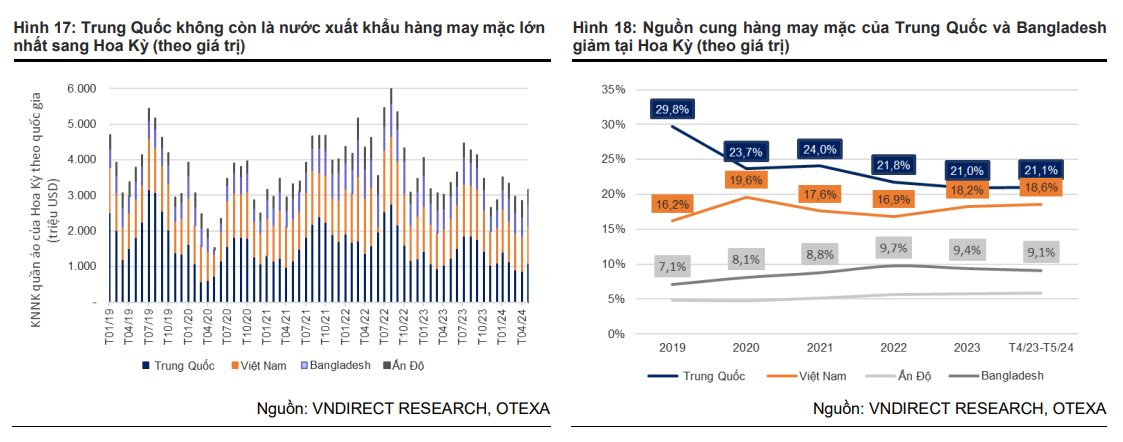

The third advantage is VNDirect’s expectation that it can attract more customers from the shift in supply sources out of China. American fashion companies are planning to accelerate the “reduction of dependence on China,” according to USFIA. According to the latest USFIA survey, 80% of respondents plan to reduce their apparel sourcing from China over the next two years.

Vietnam, Bangladesh, and India are the most popular alternative destinations for survey participants. These countries generally have large-scale production capacity and long-standing experience in the textile and garment industry. VNDirect expects the Vietnamese textile and garment industry to benefit not only from this trend but also from our strengths as mentioned above.

BIDV Wins 3 International Awards for Customer Experience

With an unwavering dedication to innovation and delivering superior customer experiences, the Bank for Investment and Development of Vietnam (BIDV) has been recognized with three prestigious international awards. The bank was honored with the Platinum Award for “Excellence in Customer Experience” by the Contact Centre Association of Asia–Pacific (CC-APAC). In addition, BIDV also garnered two Gold Awards from the Contact Centre Association of Singapore (CCAS) in the categories of “Best Customer Experience” and “Best Social Media Service Contact Centre.” These accolades serve as a testament to BIDV’s commitment to raising the bar in customer satisfaction and digital innovation.

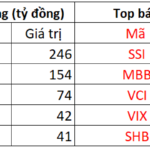

The Big Banks’ Big Payout: Unlocking $400 Trillion for Dividends—Vietcombank Leads the Pack, but LPBank is the One to Watch

As of the end of the third quarter, the three state-owned commercial banks, Vietcombank, VietinBank, and BIDV, boasted a staggering combined after-tax profit of over 200,000 billion VND, accounting for nearly 45% of the total undistributed profits of the 27 banks listed on the stock exchange.

The Top 5 Tech Strategies for Financial Institutions in 2025: A Comprehensive Guide.

In the midst of the ongoing digital revolution, financial institutions are relentlessly seeking advanced technology solutions to enhance their competitive edge and meet the ever-increasing expectations of their customers. From improving user experiences to optimizing operational processes, technology has become the key determinant of success.