At the M&A Vietnam Forum 2024, organized by Đấu Tư newspaper, experts and business leaders shared an optimistic outlook on investment trends for the upcoming year.

According to Dealogic, global M&A deals announced as of September 25, 2024, reached $846.8 billion, a 14% increase from the previous year. Notably, Asia-Pacific witnessed a 54% surge, amounting to $273 billion, driven by several substantial transactions.

However, Southeast Asia experienced a subdued volume and value of transactions despite supportive monetary policies and lower interest rates. Global and regional challenges prompted investors and businesses to approach M&A activities with caution.

Money is flowing back into Vietnam, attracting “sharks” from Japan, South Korea, Singapore, and the US in 2025.

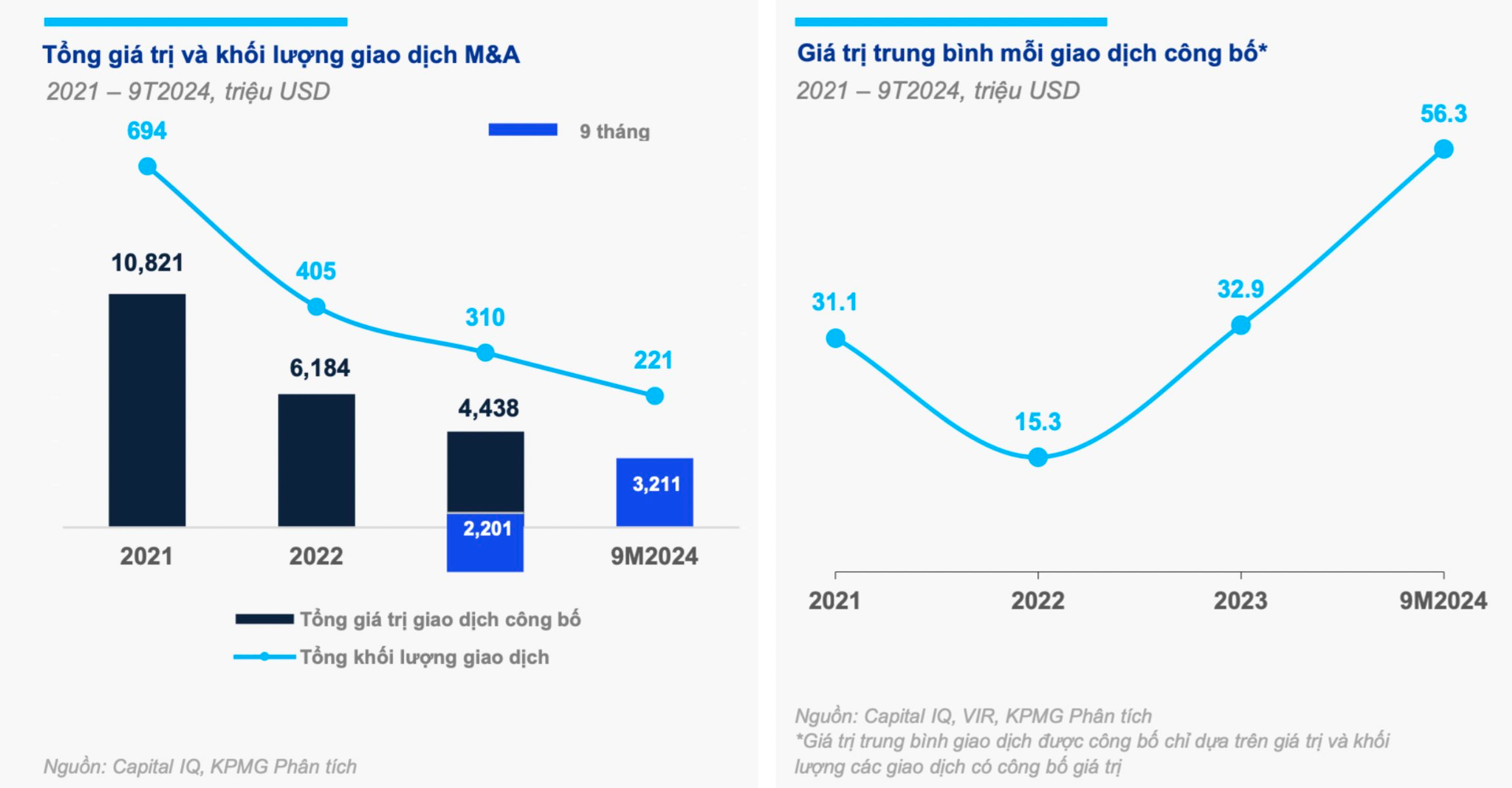

In contrast, Vietnam’s M&A market, as per KPMG’s analysis, demonstrated resilience with a total transaction value of $3.2 billion across over 220 deals, marking a 45.9% increase (contrasting the decline in Thailand, Indonesia, Malaysia, Singapore, and the Philippines).

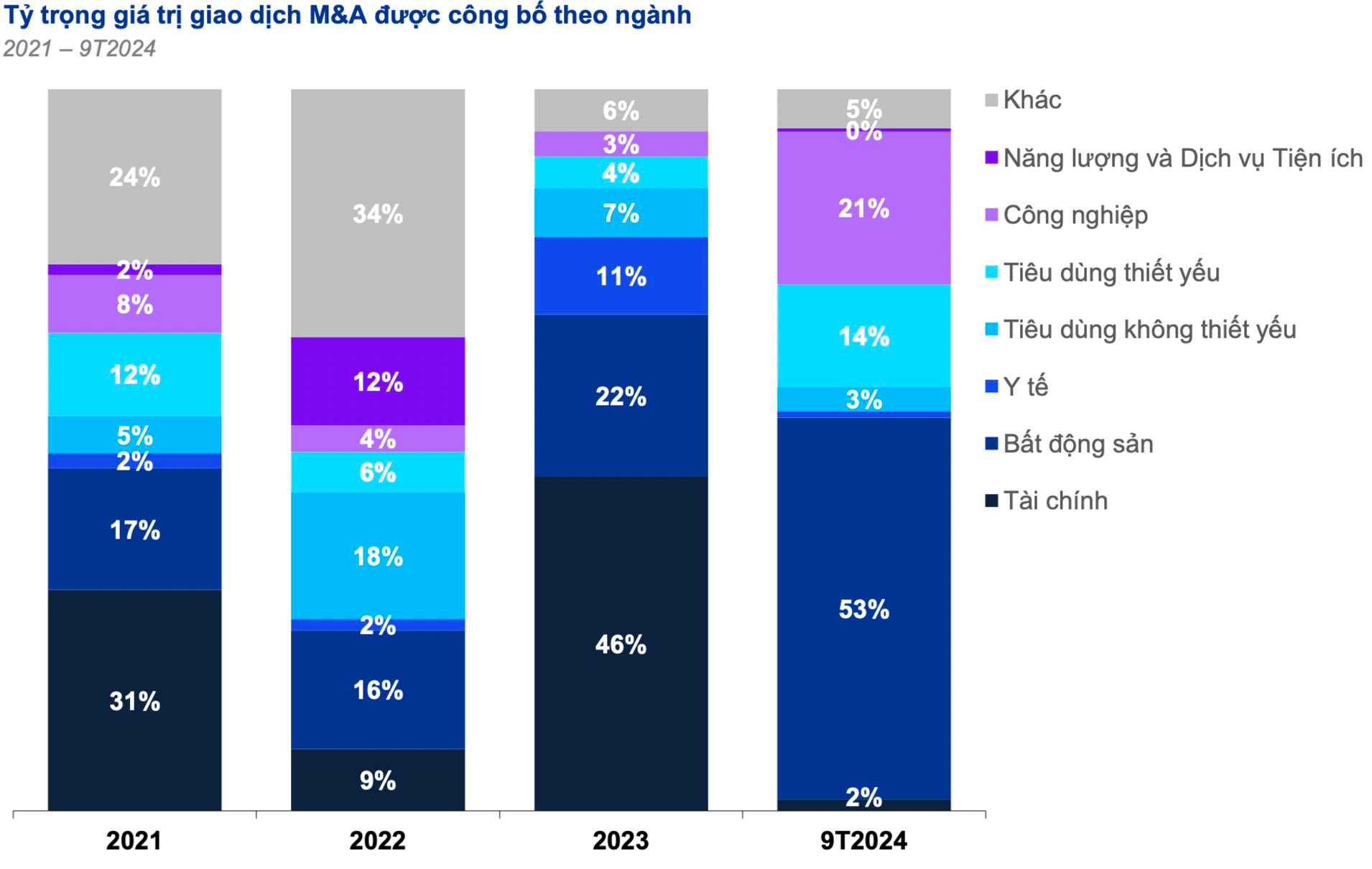

The average deal value stood at $56.3 million, with the largest transaction reaching $982 million. Notably, 88% of the deal value originated from real estate, essential consumer goods, and industrial sectors. Despite prevailing challenges, Vietnam’s fundamental strengths for long-term growth remain intact.

2025 is expected to bring positive shifts, with previously postponed deals likely to resurface. Foreign investors, primarily from Japan, South Korea, Singapore, and the US, who once led M&A activities in Vietnam, are anticipated to return.

Mr. Seck Yee Chung, Executive Lawyer at Baker McKenzie, shared his insights: “Vietnam holds development potential, and 2024 has witnessed improved FDI attraction compared to the previous year. Vietnam can aim for a higher GDP growth rate of 6-7%. FDI is largely driven by supply chains. From my experience with M&A, 2023 was a pause, and 2024 marks a comeback.”

Mr. Đinh Thế Anh, Executive Member and Head of Corporate Finance Advisory at KPMG Vietnam, emphasized the return of buyers to the market, including individual buyers, financial buyers, and PE and venture capital funds, signifying a resurgence of money flowing into Vietnam.

Capital-raising activities have gained momentum. While strategic investors from Japan and South Korea were relatively quiet last year, they are now re-entering the market, especially South Korean investors who have strong faith in Vietnam’s business landscape.

2024 witnessed a trend of domestic companies acquiring each other rather than foreign investors buying local firms, influenced by protective policies and high-interest rates that discouraged capital outflow.

Domestic investors energize the M&A market in 2024, led by VinGroup, Masan, and Becamex…

The double-digit growth in Vietnam’s M&A market during the first nine months of 2024 was primarily driven by significant domestic transactions, notably four deals involving Vingroup and Masan Group worth $1.9 billion, accounting for 58% of the total market value. The average deal size for disclosed transactions increased significantly to $56.3 million as large deals dominated the market.

Overall, the top ten deals contributed approximately $2.8 billion, equivalent to 87% of the total disclosed transaction value. Compared to the previous three years, the average value of disclosed deals surged to $56.3 million per transaction in the first nine months of 2024, with large deals capturing the market (values of many smaller deals are often not publicized)

The year’s largest transaction, valued at $982 million, involved a group of Vietnamese-based companies acquiring 55% of SDI Development Investment and Trading Company, an indirect 41.5% shareholder of Vincom Retail.

The real estate sector witnessed the second-largest deal, with Becamex IDC selling a residential project in Binh Duong to Sycamore Limited, a CapitaLand Group subsidiary from Singapore, for $553 million.

In the consumer sector, a notable deal involved Bain Capital of the US investing $255 million in Masan Group through a private placement. Additionally, Masan Group also acquired shares worth $200 million in VinCommerce from SK South-East Asia Investment.

In the industrial sector, VinFast Auto Ltd. signed an agreement to purchase VinES Energy Solutions Joint Stock Company from Mr. Phạm Nhật Vượng for $440 million.

M&A transactions in the $40-112 million range also took place in the industrial and information technology sectors.

Vietnam’s upward trajectory is further bolstered by a low base in 2023 and several substantial transactions from domestic investors, indicating that local enterprises are adjusting their business strategies and optimizing their focus on key areas amidst ongoing business challenges.

The Rising Demand for Residential Properties Among Professionals in Binh Duong: Drivers and Forecasts

“The robust growth of industrial parks and foreign investment in Binh Duong has led to a sharp rise in housing demand from professionals. “

The Industrial Zone Tycoon’s Shares Surprise: Samsung, Amkor, Foxconn, and More Pledge Over $5 Billion to Bac Ninh

This enterprise currently owns 6,611 hectares of industrial land, accounting for 5.1% of the country’s total industrial land area. A significant player in the market, their vast land ownership presents a unique opportunity to shape the industrial landscape and cater to a diverse range of businesses.

Sure, I can assist you with that.

# The Country’s Top Revenue-Generating District to Become a Bustling Port City, Embracing its Three River Frontages.

With an impressive portfolio of over 440 foreign-invested projects, this district boasts a total investment capital of more than 11 billion USD.