Mr. Nguyen Van Dinh – Vice President of the Vietnam Real Estate Association

At the forum on “Sustainable Development of the Real Estate Market and Certification of Livable Projects 2024”, Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, shared that the economy is showing positive signs of growth, and the real estate market is thriving.

Mr. Dinh added that the real estate market has seen positive results with the introduction of new supply and approximately 40,000 new products. The government’s and local authorities’ efforts to reform and remove obstacles have had a positive impact on the market.

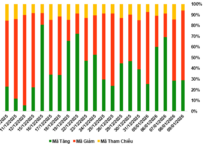

The supply-demand balance is being adjusted as the increase in supply eases the pressure on demand, leading to a more appropriate adjustment in real estate prices.

However, Mr. Dinh also expressed some concerns. The announcement of land prices and new planning by local authorities can directly affect real estate prices. There is a risk that land prices in some areas will be pushed up due to the high compensation and site clearance costs currently being experienced in Hanoi and Ho Chi Minh City, which may lead to increased investment costs and a sudden spike in product prices.

“Therefore, we predict that real estate prices are unlikely to decrease and are showing signs of increasing. Paradoxically, while improved supply should theoretically lead to lower prices, we are seeing the opposite. If prices do not become more competitive, transactions will slow down, which is a worrying prospect,” shared Mr. Dinh.

The pent-up demand and limited new supply have resulted in good absorption despite the price increase. If real estate prices do not adjust downwards to a more reasonable level and if capital continues to flow into the real estate sector, we believe the market will slow down and weaken, potentially leading to a state of oversupply.

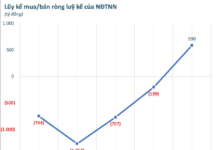

According to Mr. Nguyen Van Dinh’s assessment, the industrial real estate segment remains hot with a significant increase in new projects, attracting large FDI inflows, and maintaining a stable growth rate in the occupancy rate of operational industrial parks.

The commercial office and retail real estate segments continue to develop with great potential in the long term due to the growing demand for both scale and quality.

However, the tourism and resort real estate market faces challenges, especially in terms of legal issues. Despite the existence of relevant laws, there has been little improvement. If this segment could be enhanced, it would attract more investors and contribute to the overall development of the real estate market.

Based on the positive results observed, we predict that if factors such as legal policies, finance, and public investment continue to improve, the market is likely to heat up further in the next phase with the implementation of new legal frameworks and the continued development of projects by investors.

The slight growth in some segments could lead to a strong recovery if supportive factors such as policies, infrastructure, and finance are addressed. However, if the rise in real estate prices is not intervened early on, it will have adverse effects on the market and society.

Mr. Dinh expressed: “To address this situation, the government needs to promptly implement support measures to unblock commercial housing projects for affordable and social housing, and introduce recovery policies for the resort real estate market. In parallel, the involvement and collaboration of all stakeholders are crucial, including state management agencies, social professional organizations, real estate businesses, and real estate brokers.”

The Soaring Property Prices in Ho Chi Minh City: Are Satellite Towns Feeling the Heat?

As the year drew to a close, an intriguing development emerged in the real estate markets of Dong Nai and Long An, provinces neighboring Ho Chi Minh City. The introduction of luxurious townhouses and mansions, priced from 10 to nearly 20 billion VND per unit, captured the attention of prospective homebuyers and investors alike.

The Southern Surge: As Ho Chi Minh City’s Real Estate Market Bounces Back

As we move into the final quarter of 2024, Ho Chi Minh City’s real estate market has experienced a notable recovery in terms of interest, supply, and selling prices. This positive trajectory has caught the attention of investors and property businesses from the north, who are now eyeing opportunities in the southern market.

The Race to Build HCMC’s Metro Line 2: Unveiling the $2 Billion Project

The Ho Chi Minh City administration has made a strategic decision to utilize its own budget to construct the highly-anticipated Metro Line 2, connecting Ben Thanh and Tham Luong. This marks a shift from the previous plan of relying on ODA loans, showcasing the city’s commitment to taking charge of its infrastructure development.