The trading session on November 27, 2024, ended with the VN-Index down 0.01%, closing at 1,241.97 points, with a matched trading value of 9,236.5 billion VND, a decrease of 17.7%, accounting for 81.5% of the total trading value.

In terms of industries, liquidity declined across the board, notably in Real Estate, Securities, Banking, Food, Construction, and Steel. In contrast, it increased in Information Technology and Chemicals. Regarding price movements, Banking, Construction, Retail, Information Technology, and Warehousing added points, while the remaining sectors decreased compared to the previous session.

Foreign investors bought a net of 343.8 billion VND, and their net buying value in matched transactions was 275.1 billion VND.

The main sectors where foreign investors net bought on the matched transactions were Information Technology, Food and Beverage. The top stocks that foreign investors net bought were FPT, MSN, VNM, POW, BID, FUEVFVND, TCB, VPB, CTG, and MWG.

On the sell side, foreign investors net sold Chemicals stocks in matched transactions. The top stocks that foreign investors net sold were FRT, DCM, SSI, DGC, NLG, VRE, VCB, DPM, and CTR.

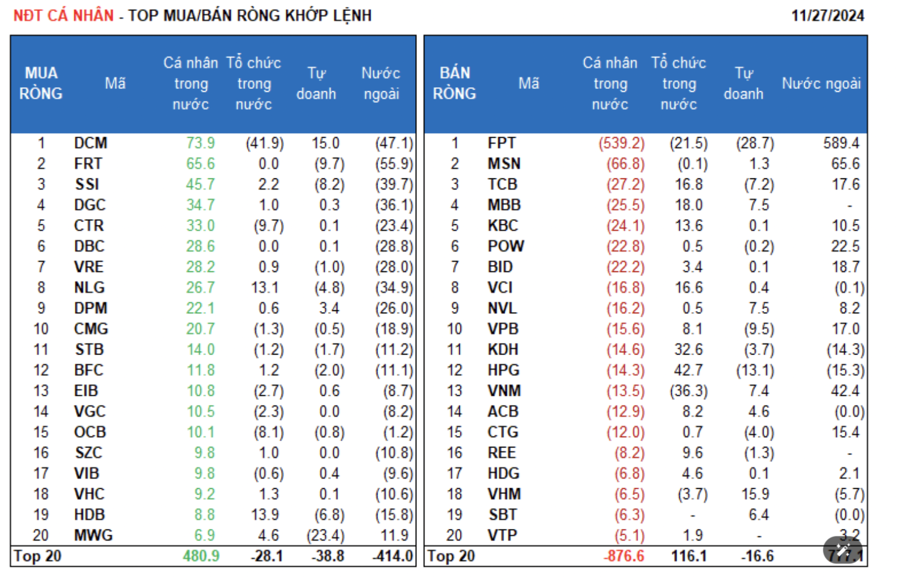

Individual investors net sold 320.3 billion VND, including 349.1 billion VND in net selling value in matched transactions.

In terms of matched transactions, they net bought 9/18 sectors, mainly in the Chemicals industry. The top stocks that individual investors net bought were DCM, FRT, SSI, DGC, CTR, DBC, VRE, NLG, DPM, and CMG.

On the sell side, they net sold 9/18 sectors, mainly in the Information Technology and Banking sectors. The top stocks that individual investors net sold were FPT, MSN, TCB, MBB, KBC, POW, VCI, NVL, and VPB.

Proprietary trading accounted for a net sell of 145.8 billion VND, and their net selling value in matched transactions was 62.9 billion VND.

In terms of matched transactions, proprietary trading net bought 8/18 sectors. The main net buying sectors were Food and Beverage and Real Estate. The top stocks that proprietary trading net bought were VHM, DCM, MBB, NVL, VNM, SBT, DXG, ACB, FUEVFVND, and HAG. The top net selling sector was Retail. The top net sold stocks were FPT, MWG, HPG, VCB, FRT, VPB, SSI, TCB, HDB, and GVR.

Domestic institutional investors net bought 126.9 billion VND, and their net buying value in matched transactions was 136.9 billion VND.

In terms of matched transactions, domestic institutions net sold 8/18 sectors, with the highest value in the Chemicals sector. The top net sold stocks were DCM, VNM, FPT, FUEVFVND, CTR, OCB, PTB, HAH, DRC, and VHM. The highest net buying sector was Banking. The top net bought stocks were HPG, VCB, KDH, MBB, TCB, VCI, HDB, KBC, NLG, and PNJ.

Today’s negotiated transactions reached 2,641.1 billion VND, up 3.8% from the previous session, contributing 20.6% of the total trading value.

Notable transactions today were in FPT stock, with more than 2.5 million units, equivalent to 353.6 billion VND, changing hands between individual investors. In addition, individual investors continued to trade in the Banking sector (EIB, SHB, LPB, TCB, MSB) and large-cap stocks (VIC, MSN, HPG, MWG).

The money flow allocation ratio increased in Chemicals, Agricultural & Seafood, Retail, Software, Water Transport, and Electricity Production & Distribution, while it decreased in Real Estate, Banking, Securities, Construction, Steel, Food, Oil & Gas, Textiles, and Aviation.

In terms of matched transactions, the money flow allocation ratio increased in the large-cap VN30 stocks, while it decreased in the mid-cap VNMID and small-cap VNSML stocks.

The Great ETF Exodus: A Triple Retreat

Vietnam-focused equity ETFs witnessed outflows of over VND 583 billion last week, marking a significant surge in withdrawal activity with triple the amount compared to the previous week’s outflows.

The Market Beat: Rising Pressure Wipes Out VN-Index’s Early Gains

The market remained under pressure during the afternoon session, with indices retreating from reference levels. At the close on November 28, the gains were modest, with the VN-Index edging up 0.14 points to 1,242.11, the HNX-Index climbing 0.47 points to 223.57, and the UPCoM-Index advancing 0.38 points to 92.35.

Superior Liquidity – The Core Attraction of Right Property

The real estate market is showing positive signs in the final months of 2024. While a cautious mindset still prevails among investors, there is a sense that the tide may be turning. With capital flows yet to fully recover, the industry is poised for a potential rebound, offering a window of opportunity for those bold enough to seize it.

The Foreign Block: Investing Inflows and the Liquidity Conundrum

Liquidity in the afternoon session unexpectedly dropped by 22% compared to the morning session, despite the overall breadth remaining favorable. The upward momentum showed signs of weakening. This development reflects the caution among buyers as the market enters a resistance zone, where stronger profit-taking may occur.