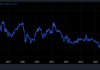

Gold prices fluctuated on Tuesday after a near $100/oz drop on Monday, as a ceasefire agreement between Israel and Lebanon reduced risk aversion in the market, but safe-haven demand remained amid ongoing Russia-Ukraine tensions.

Additionally, a pullback in the US dollar from its two-year high provided some support for gold.

At the close of New York trading, spot gold was up $6.40/oz from the previous session’s close, or 0.24%, to settle at $2,634/oz, according to Kitco exchange data.

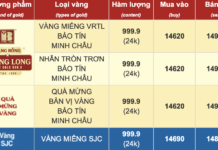

Just before 8 a.m. Vietnam time on Wednesday, spot gold in the Asian market was down $4.60/oz from the New York close, or 0.17%, trading at $2,629.40/oz. When converted at Vietcombank’s selling rate, this price is equivalent to VND 80.8 million/troy ounce, up VND 100,000/troy ounce from yesterday morning.

On Monday, gold prices fell 3.4% from a three-week high after news that Israel and Lebanon were close to reaching a ceasefire agreement. The nomination of Scott Bessent, a financial veteran with a stable personality, as Secretary of the Treasury by President-elect Donald Trump on Friday also reduced the need for gold as a risk hedge.

On Tuesday, more positive news emerged from the Middle East as Israel agreed to a ceasefire with Lebanon.

According to US President Joe Biden, the ceasefire between Israel and Hezbollah, a Lebanese armed group, is expected to take effect on Wednesday. Israeli Prime Minister Benjamin Netanyahu said he was ready to abide by the ceasefire and “respond forcefully to any violations” by Hezbollah.

“The ceasefire between Israel and Hezbollah only partially reduces the overall geopolitical risk in the world, but there is certainly some optimism here,” said Peter Grant, a senior strategist at Zaner Metals.

Grant added that investors remain anxious about the Russia-Ukraine war, and gold prices could continue to fluctuate in the short term within the $2,575-$2,750/oz range.

The decline in the US dollar has eased some of the recent pressure on gold prices. The Dollar Index, which measures the strength of the US dollar, fell to 106.8 points on Wednesday morning, down from a two-year high of 107.5 points last Friday, according to MarketWatch data.

However, the prospect of a slower pace of Fed rate cuts could continue to support the US dollar’s uptrend and put downward pressure on gold prices.

Minutes from the latest Federal Open Market Committee (FOMC) meeting, released on Tuesday, indicated that Fed officials expected to continue cutting rates in the future but at a “slow” pace.

Nevertheless, the probability of a rate cut at the December meeting has risen back to nearly 60%, after falling to zero the day before, according to CME exchange data.

In a report by Swiss bank UBS, analysts predicted that gold prices would continue to fluctuate in the short term “amid mixed signals on inflation, interest rates, geopolitics, and the upcoming US trade policy.”

However, the UBS analysts believed that gold still had room to grow in the long term. “We see further upside for gold, with a price target of $2,900/oz by the end of 2025. Gold remains a useful hedge against geopolitical risks and fiscal concerns,” the report stated.

The Sudden Drop: Gold Prices Plummet on November 25th Evening

This week’s early trading session (November 25) saw gold unexpectedly sold off despite a strong recovery the week before.