On November 26, 2024, the National Assembly passed the draft Law on Value Added Tax (VAT) amendment, officially making fertilizers VAT-liable at a rate of 5%, effective July 1, 2025.

Previously, according to Law 71/2014/QH13 on amendments to tax laws, which took effect on January 1, 2015, fertilizers were exempt from output VAT. However, the implementation of Law 71 revealed limitations as fertilizers were not subject to output VAT, but input materials were still subject to VAT rates ranging from 5% to 10%, resulting in domestic enterprises being unable to deduct input VAT and having to increase selling prices.

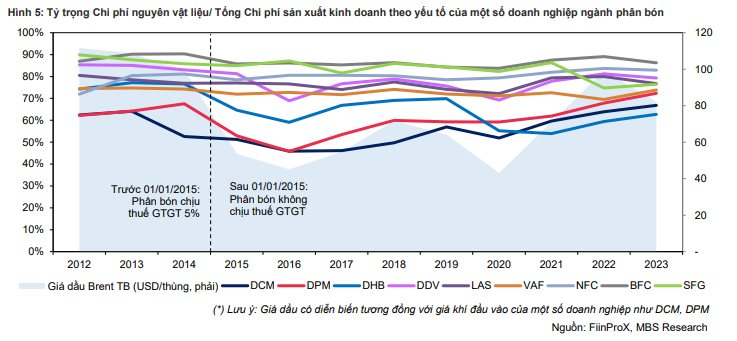

In a recent report, MBS Securities argued that applying VAT to fertilizers (at a rate of 5%) would allow enterprises to deduct input VAT, thereby supporting the profits of domestic fertilizer producers. Raw material costs typically account for a significant proportion of fertilizer companies’ total production and business costs, ranging from 50% to 80%. The input materials for fertilizer production are relatively diverse, and are subject to VAT rates ranging from 5% to 10%.

When fertilizers were not subject to output VAT, the VAT on input materials could not be deducted and had to be allocated to production and business costs, leading domestic producers to increase selling prices to reflect these costs and struggle to compete with imported fertilizers. Conversely, with fertilizers now subject to a 5% output VAT, input VAT will be refundable, and enterprises will benefit from reduced costs compared to previous years.

In theory, imposing VAT will increase fertilizer selling prices, but the supported profits will motivate domestic fertilizer producers to lower selling prices, thereby increasing competition with imported fertilizer products, which previously had a price advantage over domestically produced fertilizers. It is important to note that fertilizer importers are not significantly affected by this tax law change as both input and output VAT rates are 5%, resulting in no change in profits.

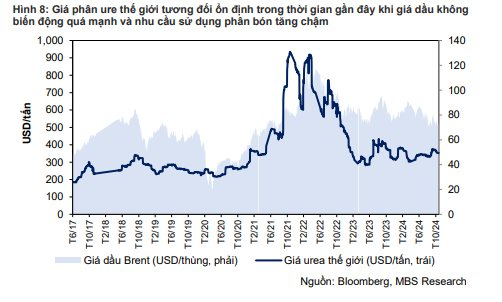

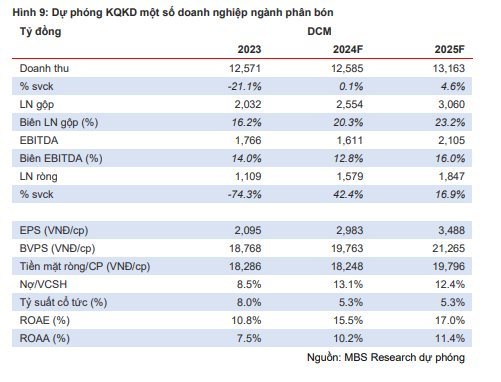

The analysis team believes that the new VAT law change could support the profit growth of some domestic fertilizer producers in 2025, amid stable fertilizer prices and capacity.

Accordingly, enterprises producing single fertilizers (urea, phosphate) and mainly DAP fertilizers such as DCM, DPM, DDV, and LAS will benefit from this change due to input VAT refunds, while NPK fertilizer producers will see minimal impact as their main input materials are single fertilizers, and the imposition of VAT on fertilizers has a negligible effect on their profits.

The Power of Nuclear Energy: Unlocking Vietnam’s Future with the Ninh Thuan Nuclear Power Project

On November 27, the government presented to the National Assembly a proposal to continue the investment policy for the Ninh Thuan nuclear power project. The government affirmed that the development of nuclear power must ensure the highest level of safety and minimize risks to people and the environment.

The Future of Trade: Lang Son’s Visionary 14-Lane Highway for Border Trade

With the collective efforts of the entire political system, Lang Son is envisioned to become one of the growth poles and economic centers of the midland and mountainous regions of Northern Vietnam by 2030.

“Japanese Giant Acquires 49% Stake in a Vietnamese Pesticide Manufacturer”

This Japanese conglomerate has joined forces with the BRG Group to embark on an ambitious $4.2 billion investment project, aiming to develop a smart city in the northern part of Hanoi.