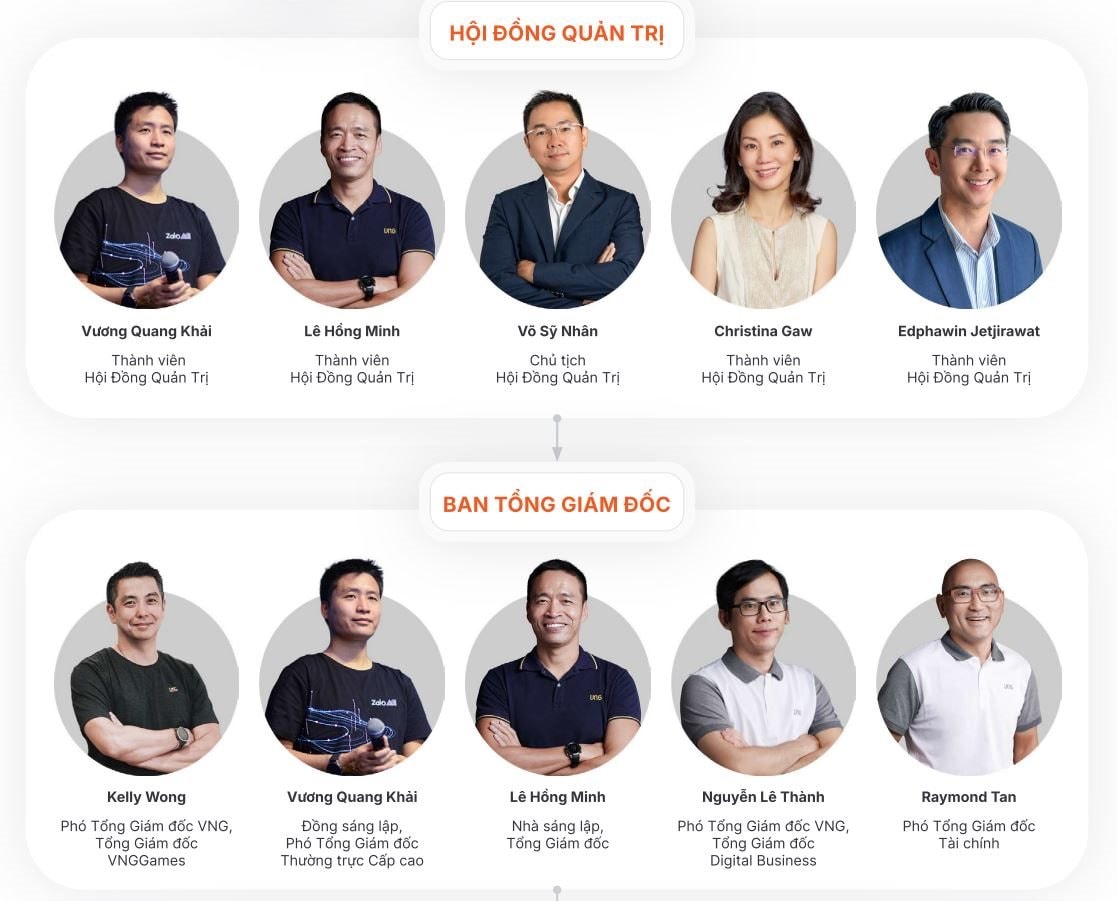

To comply with current regulations for public companies, VNG’s Board of Directors also voted to dismiss Le Hong Minh from the position of General Director. Le Hong Minh continues to oversee VNG’s overall operations as Chairman of the Board and legal representative.

Previously, Vo Sy Nhan was appointed as Chairman of VNG’s Board of Directors in December 2022. He is currently the CEO of Empire City and co-founder and CEO of GAW NP Capital.

In fact, Vo Sy Nhan officially assumed the role of Chairman of the Board from January 1, 2023, after Le Hong Minh was dismissed from the position of General Director. Thus, after nearly two years of stepping down, Minh has returned to the position of Chairman of VNG’s Board.

VNG, one of the leading technology companies in Vietnam, has also been the center of attention recently. This is especially true when considering the ownership structure and the recent moves made by major shareholders.

VNG’s leadership before Le Hong Minh stepped down as CEO and became Chairman of the Board. Source: VNG’s 2023 Annual Report

Who is really behind VNG?

According to publicly available data as of November 28, 2022, VNG and its investors have restructured their ownership, resulting in only three major shareholders remaining.

VNG Limited (49%); BigV Technology Joint Stock Company (24.4%); and Other Shareholders (26.6%), including founder Le Hong Minh, who owns 9.8% of VNG’s shares. Notably, the focus is on the two largest shareholders of VNG at that time, VNG Limited and BigV.

Regarding VNG Limited, this company was recently established on April 1, 2022, in the Cayman Islands, a well-known tax haven and a popular location for setting up holding companies. Concerning VNG Limited, observers have noted two noteworthy points.

First, the list of shareholders of VNG Limited includes 13 major shareholders, among them prominent names in global finance such as Tenacious Bulldog Holding Limited, Prosperous Prince Enterprises Limited, and Gamevest Pre. Ltd. As such, the major shareholders of VNG Limited are influential global “giants” in technology and finance, including Tencent, Mirae Asset, and GIC.

Second, there has been a shift in ownership proportions at VNG, as the major shareholders have collectively transferred their ownership to VNG Limited. This suggests that the major shareholders of VNG may not intend to divest but are instead consolidating their interests.

According to reports, the total number of shares held by VNG Limited and related parties amounts to 62.84%, with VNG Limited holding 49% and related parties, including Le Hong Minh and Vuong Quang Khai, holding 13.84%.

Observers have noted that the founders of VNG in Vietnam also have direct connections with VNG Limited and own a portion of the company, which could be part of a strategy to transfer ownership to an offshore company in the Cayman Islands. This move may aim to optimize ownership and provide flexibility in financial management, especially when the company has plans for international listing.

Regarding the second largest shareholder, BigV, in a related move, VNG Corporation’s shareholders also approved Big V’s purchase of treasury shares at a price lower than the original price (VND 177,881 per share). This also indicates that investors are restructuring their ownership rather than simply engaging in buy-and-sell transactions.

Overall, these developments suggest that VNG and its major investors are restructuring their ownership ratios rather than planning to divest. As a result, foreign investors such as Tencent, Mirae Asset, and GIC are currently collaborating with VNG’s founders, including Le Hong Minh, to transfer a significant portion of ownership to VNG Limited. This could be a strategy to centralize ownership and optimize asset management while providing flexibility for future development plans.

According to investors, this is a very normal activity, but there is still a need to find answers when deciding to invest in VNG. What motivates the Vietnamese founders to transfer their ownership overseas, and why do foreign investors consolidate their ownership in VNG Limited?

Some predictions suggest that VNG is planning to list VNG Limited in the US, and this listing process will be smoother through the SPAC model, which is very popular abroad.

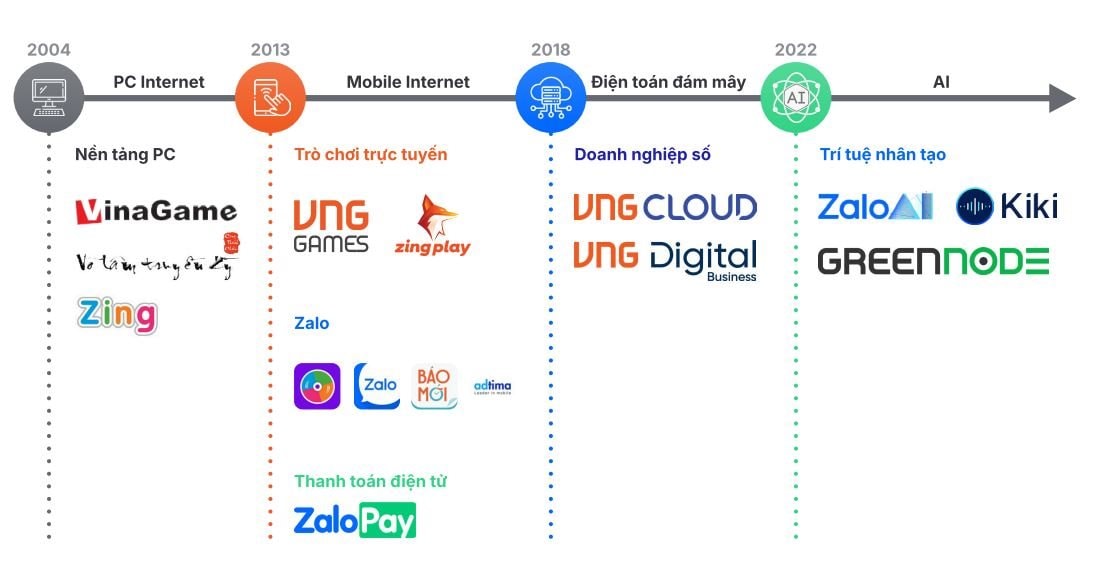

VNG’s business segments. Source: VNG’s disclosures

US listing filings show that VNG Limited holds 49% direct stake and 21.3% indirect stake in VNG

In 2023, filings submitted to the US Securities and Exchange Commission (SEC) revealed that VNG Limited held a 49% direct stake and a 21.3% indirect stake in VNG Corporation through BigV Technology Company. Thus, VNG Limited held more than 70% of the shares in VNG Corporation at that time.

Specifically, at VNG Limited, Le Hong Minh, Founder and CEO of VNG, owned 12.27% of the capital, and Vuong Quang Khai, Vice Chairman and Executive Deputy General Director, held 4.99% of the capital.

In addition, large corporations such as Tencent, Ant Group (China), and two investment funds from Singapore, GIC and Seletar Investments, also hold voting rights in VNG Limited.

Specifically, the circulating shares of VNG Limited are divided into two types: Class A common stock and Class B common stock. Each Class A share entitles the holder to one vote, while each Class B share carries ten votes. Class A shares cannot be converted into Class B shares and vice versa.

These two types of shares are issued to two separate groups of shareholders: foreign shareholders and the management of VNG Limited. The two founding shareholders, Le Hong Minh and Vuong Quang Khai, respectively own 12.6 million and 1.68 million Class B shares, corresponding to 45% and 6% of the voting rights in VNG Limited. Thus, the founding group holds all the Class B shares and controls 51% of the votes.

Tencent, the tech giant, holds over 65 million Class A shares, representing 23.2% of the voting rights. Tencent’s ownership includes 43 million shares of Tenacious Bulldog Holdings Limited, 14.5 million shares of Prosperous Prince Enterprises Limited, and over 7.5 million shares to be issued if VNG Limited completes its IPO.

Tenacious Bulldog and Prosperous Prince Enterprises are two legal entities controlled by Tencent and are headquartered in the British Virgin Islands. They previously appeared in VNG’s list of major shareholders in 2018.

According to filings with the SEC, VNG Limited stated that both companies are controlled by Tencent Holdings.

Other foreign shareholders of VNG Limited include GIC, which through Gamvest Pte, holds 15.2 million Class A shares, or 5.4% of the voting rights, and Ant Group, which through Ant International Technologies, owns 7.77 million Class A shares, or 2.8% of the voting rights. Temasek Holdings, through Seletar Invesments, holds 9.4 million Class A shares, equivalent to 3.4% of the voting rights. Gamvest Pte and Ant Group were previously owned by Jack Ma.

Based on this structure, it is evident that apart from the founding group of Le Hong Minh and Vuong Quang Khai, Tencent is the only foreign shareholder with the largest voting rights in VNG Limited, which controls VNG Corporation.

Filings with the SEC indicate that Tencent not only holds voting rights in VNG Limited but also demonstrates a close business relationship between the two companies.

In reality, VNG is the publisher of online games in Vietnam and the Southeast Asian market, with titles such as PUBG Mobile, Vo Lam Truyen Ky, and League of Legends. Most of these popular games published by VNG are developed by Tencent Games.

As a result, the game publishing segment contributed 80% and 92% of VNG’s revenue in 2020, 2021, and 2022, respectively. Notably, games developed by Tencent and Kingsoft contributed 30.6%, 40.7%, and 29.4% to VNG’s total revenue during these years.

Conversely, VNG has also spent a significant amount on royalties to game developers, amounting to VND 1,214.9 billion, VND 1,818.4 billion, and VND 1,520.4 billion in 2020, 2021, and 2022, respectively.

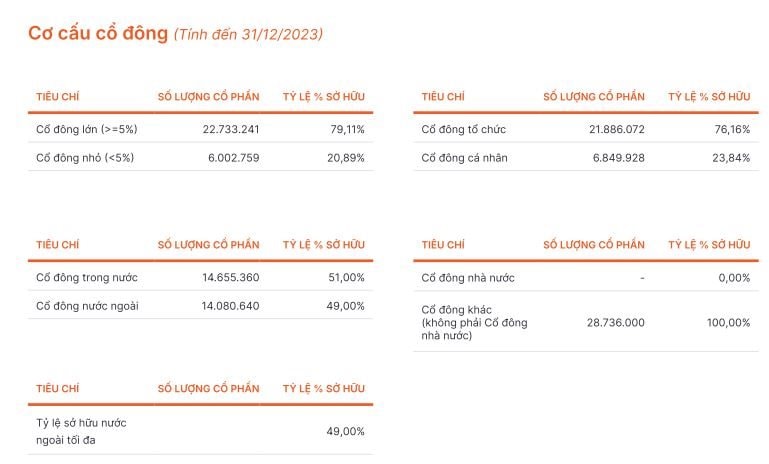

Shareholder structure disclosed by VNG as of the end of 2023.

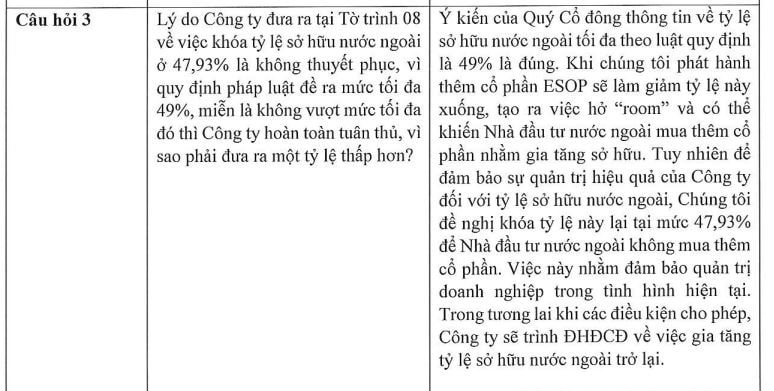

At the 2024 Annual General Meeting of Shareholders held on June 21, 2024, VNG’s shareholders raised the question of why the company locked the foreign ownership ratio at 47.93%, which was unconvincing, as the law sets the maximum limit at 49%. They questioned why the company would set a lower ratio.

Source: VNG

In response to this question, VNG’s leadership explained that the maximum foreign ownership ratio stipulated by law is indeed 49%. However, when the company issues more ESOP shares, it will reduce this ratio, creating room for foreign investors to purchase additional shares to increase their ownership. To ensure effective corporate governance regarding foreign ownership, VNG’s management proposed to lock the ratio at 47.93% to prevent foreign investors from buying more shares.

According to VNG’s management, this measure aims to ensure corporate governance in the current situation and in the future when conditions permit, they will propose to the General Meeting of Shareholders to increase the foreign ownership ratio again.

VNG’s business performance in the first nine months

According to the financial statements published by the company, in the first nine months of 2024, VNG recorded accumulated revenue of nearly VND 7,000 billion, and net profit from business activities after adjustments reached VND 202 billion. However, the company still incurred a net loss of over VND 505 billion, although it was only a third of the loss in the same period last year. Tax contributions in the first nine months amounted to VND 700 billion.

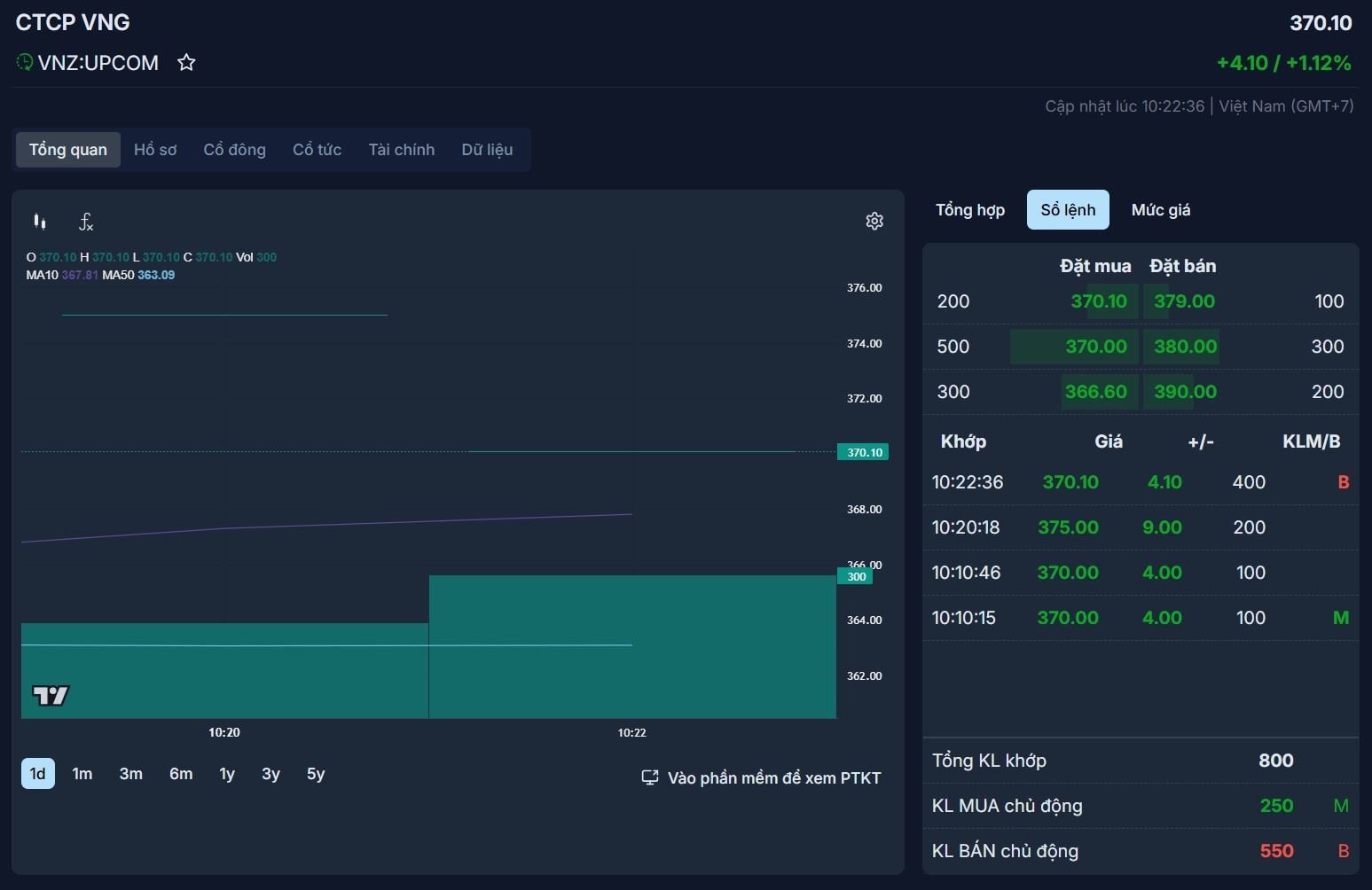

Source: Fireant

In the stock market, as of 10:22 am on November 26, VNZ shares were almost illiquid, with only 800 shares traded, despite a slight increase in market price to VND 370,100 per share.

Up to now, although it has fallen by 46% from its peak at the beginning of the year, VNZ still maintains its position as the “king of market price” on all three exchanges.

The Power of Persuasion: How Lê Hồng Minh’s Leadership at VNG Sent Stocks Soaring

“Tech unicorn” VNG confirmed that Le Hong Minh remains the CEO and legal representative of the company. In other news, VNZ stock soared for the second consecutive session, with the tech stock surging nearly 30%.

The Great Bank Branch Shutdown: Over 100 SCB Offices Close Their Doors; VNG Appoints New Leader

This week’s notable news includes SCB bank’s decision to close multiple branches, VNG appointing a new CEO, a surge in grocery shopping as people prepared for an incoming storm, the recovery of 2.4 trillion dong mistakenly given as benefits to veterans, and a temporary suspension of pension payments in provinces affected by Storm No. 3.

Is VNG Taking a Bold Step or a Gamble with its Ambitious Ventures?

VNG has unveiled its three new growth strategies: AI, Go Global, and Platform. The company has ambitious plans to become a pioneer and leader in Vietnam and the region, with a particular focus on AI. As the world undergoes an AI revolution, is this goal within reach?