The unit noted that Ho Chi Minh City’s rental property market in Q3 and October 2024 witnessed notable shifts in rental rates and supply-demand dynamics.

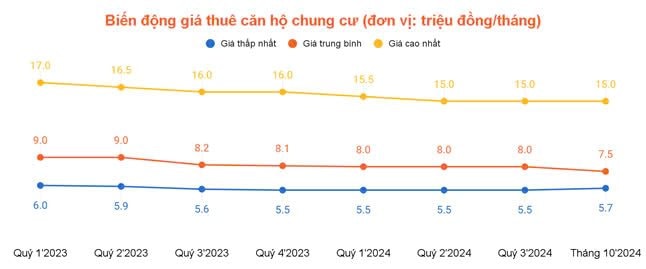

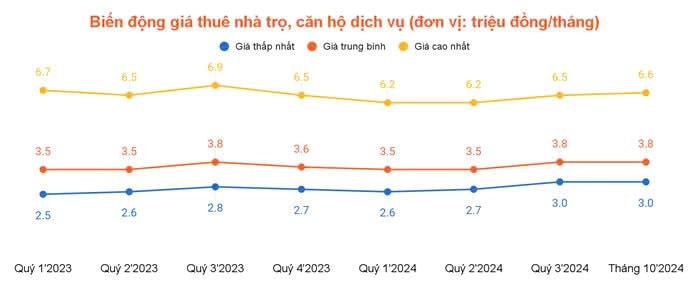

From July to October 2024, apartment and house rental prices remained relatively stable compared to the beginning of the year and were lower than the same period in 2023. In contrast, the lower-priced segment of room rentals and serviced apartments saw price increases in Q3 2024.

Apartment rental prices: The lowest rate was VND 5.5 million/month in the first three quarters, then increased to VND 5.7 million/month in October 2024. The average rate decreased from VND 8 million/month to VND 7.5 million/month in October, lower than the previous year. The highest rate also slightly decreased from VND 16 million /month (Q3 2023) to VND 15 million/month this year.

House rental prices: There was an increase in the lowest and average prices. Specifically, the lowest price increased from VND 7.5 million/month in Q1 to VND 8 million/month from Q2 and remained stable until October. The average price reached VND 12 million/month throughout the three quarters, unchanged from the previous year. Meanwhile, the highest price fluctuated from VND 18 million/month in Q1, increased to VND 20 million/month in Q2, then decreased to VND 18.9 million/month in Q3, and slightly increased to VND 19 million/month in October.

Room rental/serviced apartment prices: There was a tendency to increase again in Q3, coinciding with the start of the school year for students. Notably, the lowest rental price reached VND 3 million/month, the highest in the past two years.

The high rental prices have created difficulties for certain groups, such as students, as they compete to find accommodations near their schools within limited budgets. Compared to the average price of VND 2.5 – 2.7 million/month in the first months of the year, this increase ranges from 10% to 20%, exceeding the affordability of some, forcing them to look for places further away or settle for subpar living conditions.

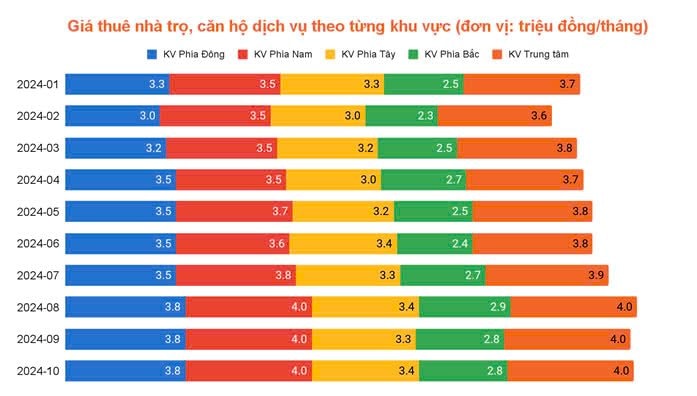

According to Cho Tot, room and serviced apartment rental prices increased in most areas of the city, with the highest prices concentrated in the central and southern regions.

In the southern region, prices increased from VND 3.5 million/month in the first half of the year to VND 4 million/month in Q3 and remained at that level until October 2024.

Notably, District 7 witnessed a strong recovery in the demand-supply ratio in Q3 after a continuous decline from February to June. The demand-supply ratio surged, especially in August, with a 59.0% increase compared to the previous month, before slightly decreasing in October. Supply remained stable throughout Q3. This area showed the most significant growth in rental demand during the quarter.

In the central area, prices also increased from VND 3.8 million/month to VND 4 million/month in Q3 and October 2024, surpassing the VND 3.7 million of the previous year.

In the northern part of Ho Chi Minh City, prices slightly increased from VND 2.7 million/month in the first half of the year to VND 2.9 million/month in Q3, then stabilized until October.

In the eastern part of the city, prices rose from VND 3.5 million/month in the first half to VND 3.8 million/month in Q3 and remained stable until October 2024.

In the western region, prices ranged from VND 3.8 – 4 million/month in Q3 and October 2024, exceeding the VND 3.3 million of Q3 2023.

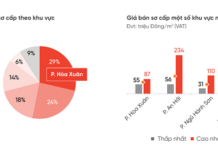

Room rental/serviced apartment prices by district in the central area: Room rentals in the central area of Ho Chi Minh City, including districts such as District 1, District 3, Binh Thanh District, District 10, Phu Nhuan District, District 5, District 4, District 11, Go Vap District, and Binh Tan District, exhibited variations in prices and supply across these districts.

District 1 took the lead with the highest average price of VND 5.2 million/month, followed by District 3 with VND 4.7 million/month, while Binh Tan District recorded the lowest price of VND 2.9 million/month. Binh Thanh and Go Vap Districts accounted for over 50% of the total number of listings, making them the largest suppliers.

Ho Chi Minh City’s rental property market in Q3 and October 2024 displayed a clear differentiation between key areas. According to Cho Tot, rental demand was high in District 7 and Thu Duc City, while the central area, such as Binh Thanh District, maintained a balanced state. District 12 stood out with a significant increase in supply, but demand has yet to catch up. Conversely, District 6 experienced a decrease in supply, but it did not significantly impact the demand for rentals in that area.