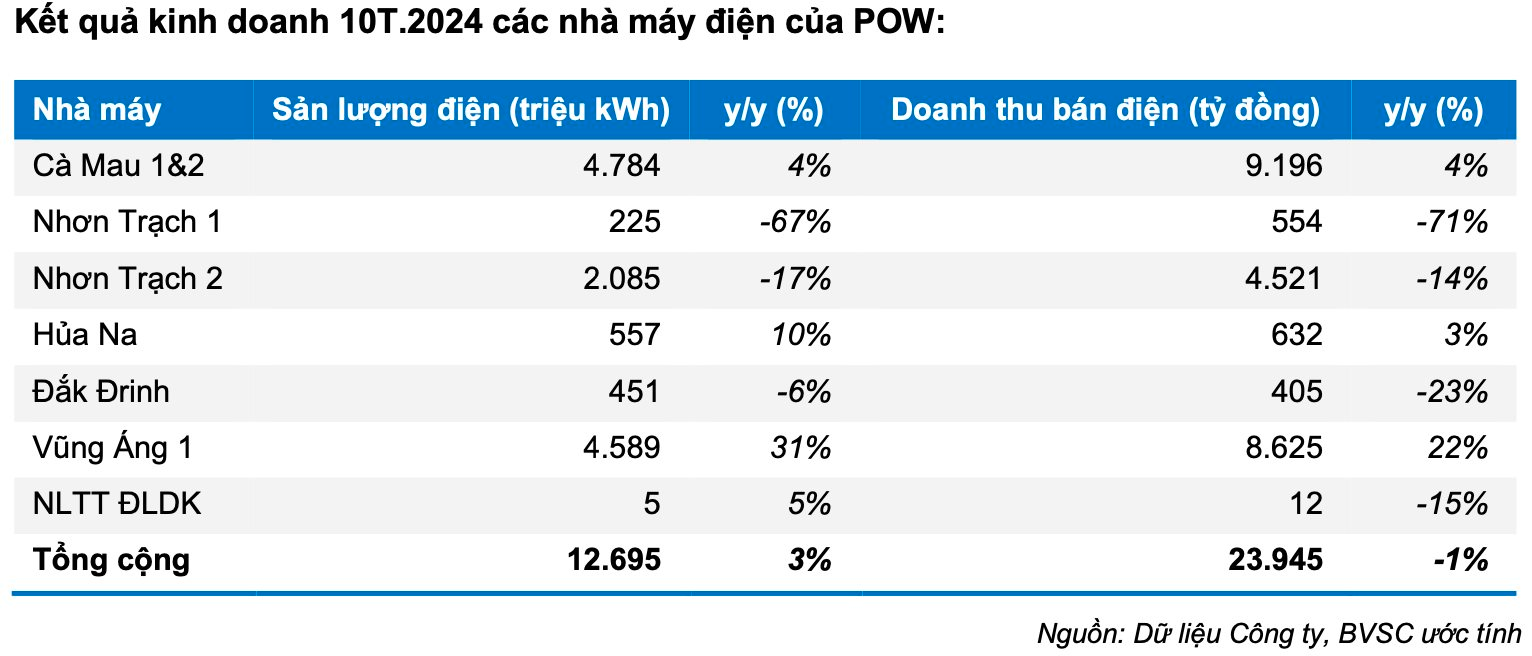

According to preliminary announcements from Vietnam Petroleum Power Corporation – JSC (PV Power, stock code: POW), the enterprise recorded consolidated revenue and net profit after tax of VND 24,672 billion (up 1% over the same period) and VND 1,218 billion (up 20%) respectively, in the first ten months of the year. This surpasses 48% of the profit plan assigned by the Annual General Meeting of Shareholders. The Company’s total electricity output reached 12,695 million kWh (+3% y/y), mainly contributed by Vung Ang 1 and Ca Mau thermal power plants, compensating for the severe output decline from the Nhon Trach gas-fired power cluster.

In its latest report, Bao Viet Securities Company (BVSC) attributes the positive profit growth of POW primarily to financial gains. This year, POW disbursed nearly VND 10,000 billion for the construction of NT3 and NT4 projects while also borrowing USD-denominated loans. The depreciation of the USD/VND exchange rate allowed the company to record unrealized foreign exchange gains. However, if the USD/VND exchange rate rises again, it could negatively impact POW’s Q4 business results.

Notably, BVSC states that the total insured amount for the incident at Vung Ang 1 exceeds VND 1,000 billion. In the first nine months, POW received approximately over VND 600 billion. The remaining amount is expected to be received from now until the beginning of Q1/2025 and will be officially recognized in the company’s financial statements. This was a significant factor in POW’s robust business performance in 2024.

Additionally, electric vehicle charging stations are a new business segment for POW. Charging station No. 6 on Huynh Thuc Khang Street (comprising two charging columns) officially commenced operations on November 1, 2024. Initial assessments indicate good station utilization due to its favorable location, high vehicle demand, and density in the area. POW will continue to monitor the business efficiency of this new project. Recently, POW signed a cooperation agreement with Vingroup to develop charging stations, entrusting V-Green with the task of achieving 1,000 charging points nationwide by 2035. The charging infrastructure developed and operated by V-Green will be exclusively dedicated to VinFast vehicles.

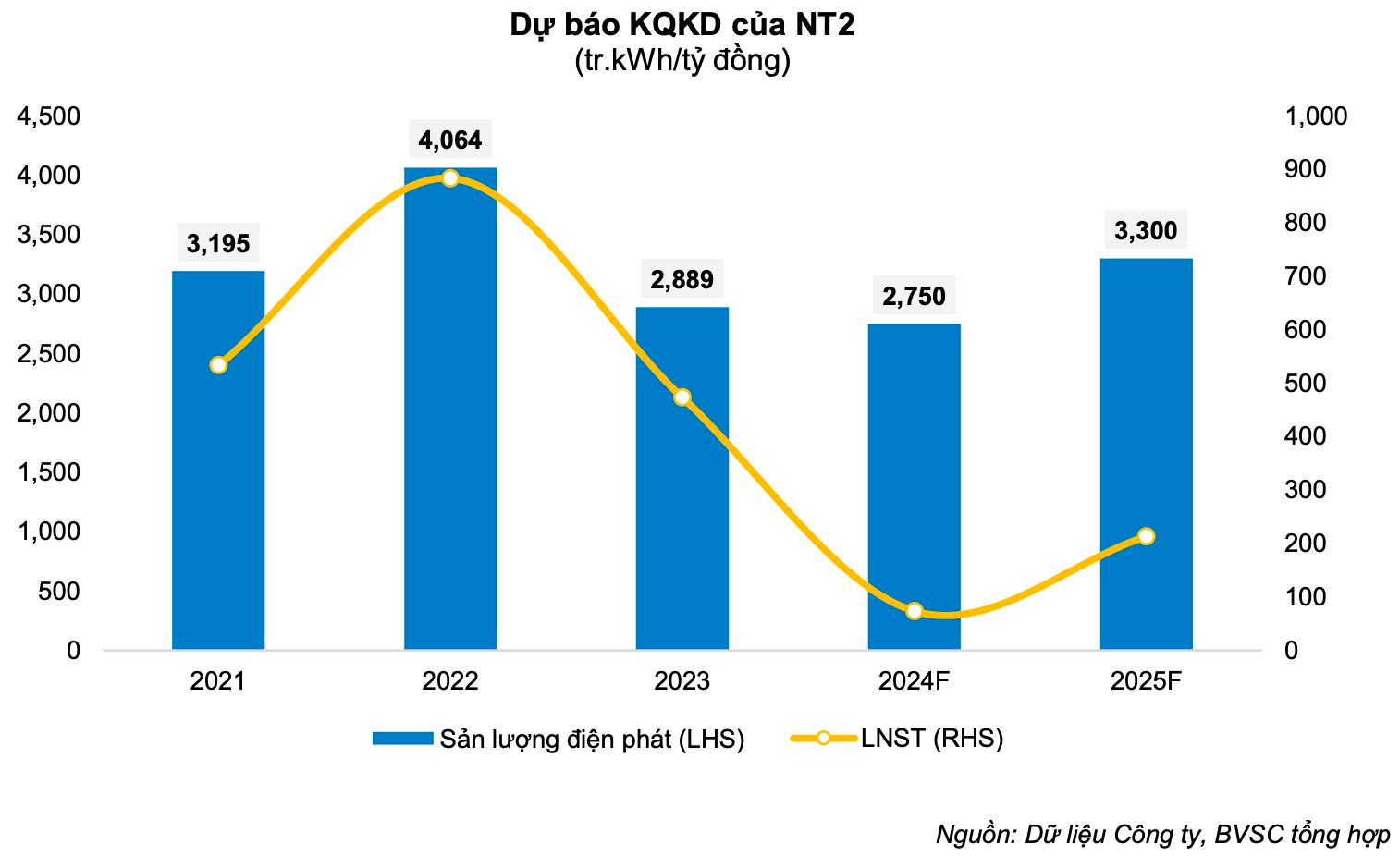

NT2 is expected to be mobilized with high output in 2025, while NT3 and NT4 projects are anticipated to incur losses in the first 3-4 years.

Returning to the core business, among the gas-fired power plants in the Southeast region, only Nhon Trach 2 (NT2) has a contractual obligation to consume gas from GAS for a volume of 784 million Sm3 of gas/year (equivalent to an electricity output of nearly 4 billion kWh). Having a gas consumption contract with GAS ensures NT2’s fuel autonomy and access to more reasonable costs compared to imported LNG.

Furthermore, according to information shared by POW, the Ministry of Industry and Trade is chairing a meeting on formulating the 2025 power supply plan. The proposed approach is to not operate the Phu My 3 and Phu My 2.2 power plants. BVSC believes this presents a favorable condition for NT2, enabling POW to be mobilized with higher output, and the business results are expected to recover in the coming years. BVSC forecasts NT2’s electricity output for 2024-2025 to reach 2,750 million kWh (-5% year-on-year) and 3,300 million kWh (+20%), respectively.

Regarding other power plants, according to the operation plan, NT1 in 2025 will generate electricity using LNG and based on the dispatch requirements of the National Load Dispatch Center (NLDC). Currently, NT1 is only dispatched when the system’s demand is high, and it is assigned a very low Qc (stable output) because it is located at the end of the gas pipeline from Nam Con Son to Ho Chi Minh City, resulting in high transportation costs and less attractiveness compared to the Phu My gas-fired power plants.

At the Ca Mau 1 and Ca Mau 2 power plants, POW is focusing on negotiations with the field operator and supplier to regulate the gas source from PM3 according to the operation plan assigned by the NLDC to POW in 2025. The preliminary plan is to dispatch the Ca Mau thermal power plants at a high capacity factor to ensure the efficiency of the Vietnamese gas volume received in 2025. This will be an advantage for POW in 2025. The projected electricity output for the two plants in 2024-2025 is 5,541 million kWh (+5%) and 5,929 million kWh (+7%), respectively.

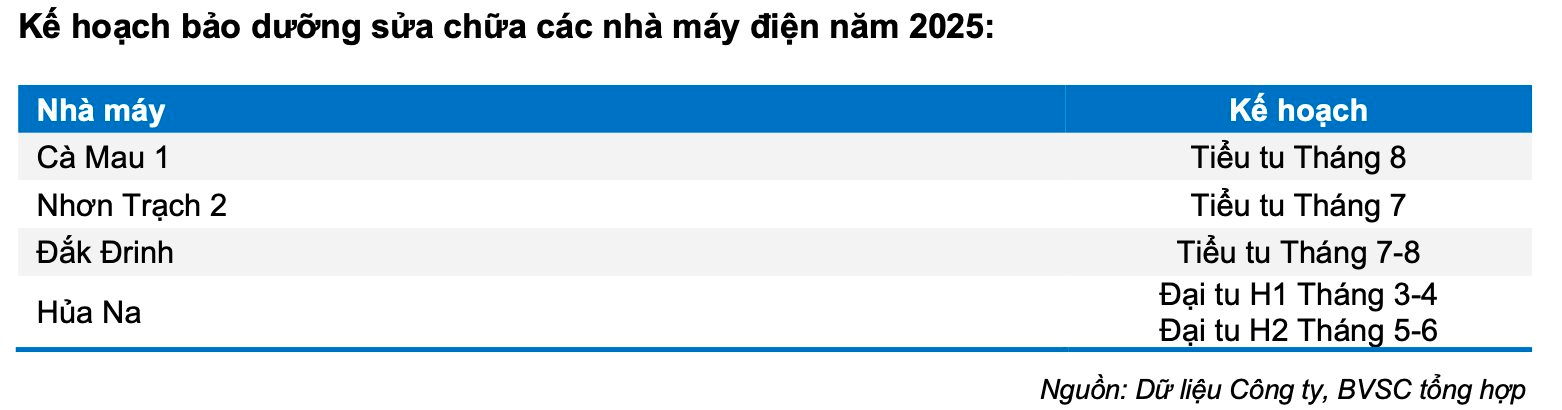

Also, according to POW’s latest Analyst Meeting, as of the end of October 2024, the overall progress of the EPC package is estimated at 94%. As per the schedule, NT3 will start trial operations from the end of December 2024 and officially come into commercial operation in June 2025. NT4 is expected to be commercially operational in September next year. BVSC believes that POW will complete the commercial operation of the two plants, NT3 and NT4, as per the current plan. However, in the short term, over the first 3-4 years, the project is expected to incur losses due to significant depreciation and interest expenses in the initial years; electricity output remains low for the next 1-2 years, and the plants are mainly dispatched during power shortage periods rather than baseload operation. Additionally, there is the loss from exchange rate differences as the project borrows more than VND 17,000 billion in USD-denominated loans.

In the medium and long term, the project is expected to contribute positively and be the main growth driver for the company’s overall business results.

2024 profit may nearly double

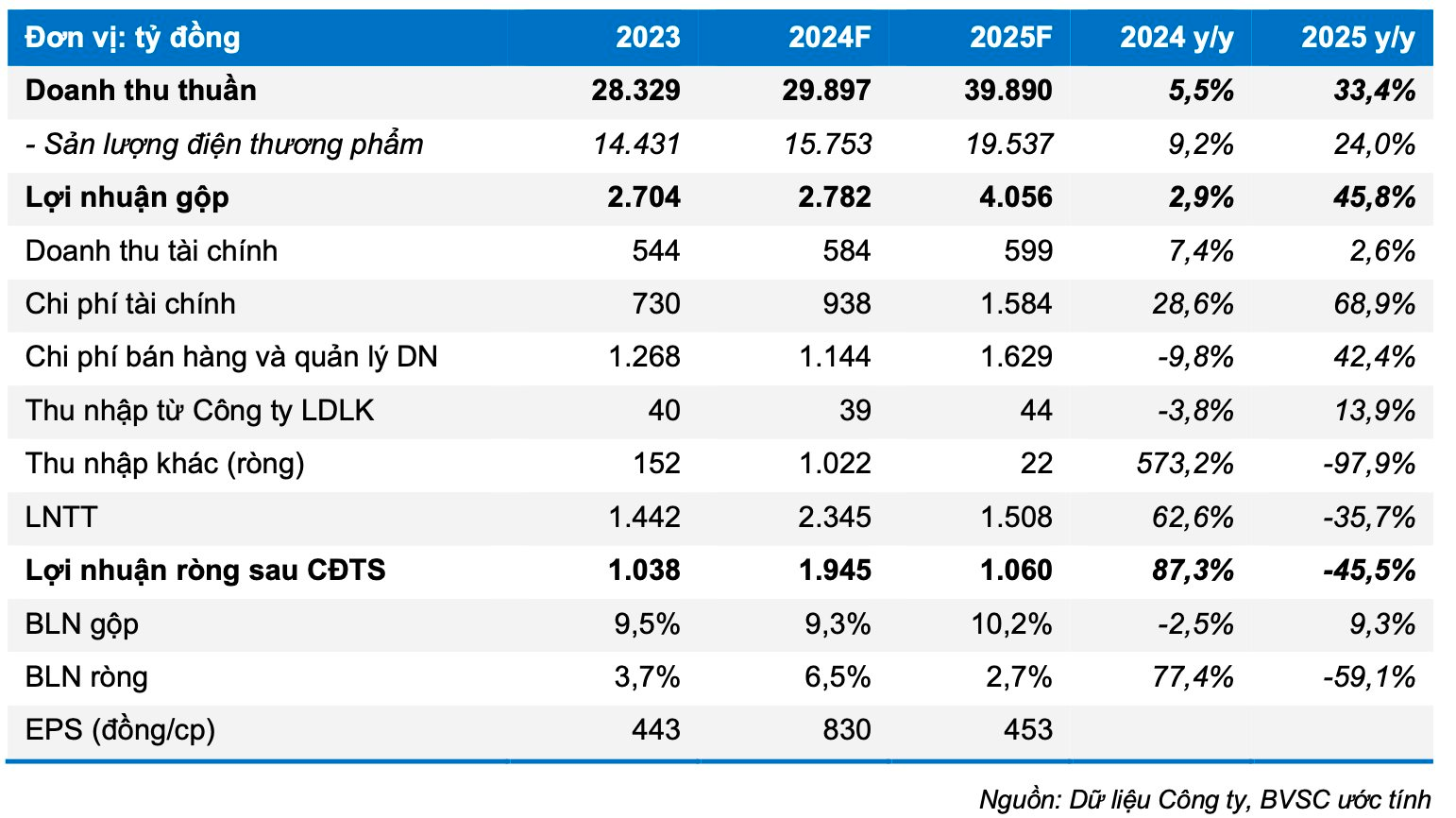

Projecting the 2024 business results, BVSC anticipates a strong performance for POW, with revenue of VND 29,897 billion (+6%) and post-tax profit after minority interests of VND 1,945 billion (+87%). The main driver is the insurance compensation of VND 1,000 billion for the incident at the Vung Ang 1 power plant. Excluding this one-off gain, core profit after tax is expected at VND 1,145 billion (+10%) thanks to positive results from Vung Ang 1, Ca Mau, and Hua Na, offsetting the decline from the two Nhon Trach power plants. Electricity output is projected at 15,753 million kWh.

For 2025, BVSC forecasts revenue of VND 39,890 billion (+33%) and post-tax profit after minority interests of VND 1,060 billion (-45%). The decline in profit is due to a 24% increase in electricity output, and while NT3 and NT4 will be commercially operational as planned, POW will not receive any other compensation. Excluding the one-off gain, core profit in 2025 may decrease by 7% as NT3 and NT4 are expected to incur losses due to financial pressure and high depreciation expenses.

BVSC assesses POW as one of the leading power generation companies in Vietnam. From now until 2030, the outlook for electricity consumption growth is projected at 7–9%. POW, as the country’s fifth-largest power generator, along with upcoming projects such as NT3, NT4, and the longer-term LNG Quang Ninh project, will be a supportive factor for the company’s profitability in the medium and long term.

The Province with Three Times More Sea than Land is Getting an Industrial Zone Worth Over 2,200 Billion VND

This project, spanning an impressive 194.36 hectares, is the brainchild of a well-renowned enterprise in Thai Binh province.

The New 5% VAT on Fertilizers: MBS Unveils Businesses Set to Benefit

MBS Securities believes that applying a value-added tax to fertilizers (at a rate of 5%) will enable businesses to claim input VAT deductions, thereby supporting the profitability of domestic fertilizer producers.