Year on year, prices of primary apartments continue to climb

In Ho Chi Minh City, apartments priced at VND 1-2 billion are almost non-existent. Nowadays, apartments priced at VND 3 billion are also very rare.

Before 2018 , apartments priced between VND 1-1.5 billion were common, with projects such as Dat Gia, 4S Linh Dong, Moon Light, Lavita, 9View, Jamila, and the first phase of Muzuki.

From 2018 to 2020 , the VND 1 billion apartments disappeared, replaced by projects costing VND 2-2.5 billion, such as Safira, Vinhomes Urban, and the later phases of Muzuki.

From 2021 to 2023 , apartments below VND 2.5 billion became scarce, with smaller sizes and locations further from the city center. A new segment of apartments priced at VND 3 billion emerged, such as Vinhomes Q9 and Privia Khang Dien, but their numbers were limited.

In 2024 , new apartments are priced at VND 100 million per square meter and above. Notable examples include The OpusK and Masteri Grand View, with prices ranging from VND 6-8 billion. Meanwhile, apartments in the VND 3-4 billion range are gradually disappearing.

Looking at the current apartment market in Ho Chi Minh City gives a glimpse into the future of real estate in adjacent areas like Binh Duong and Dong Nai. In the next few years, the apartment market in these areas will follow a similar trajectory as Ho Chi Minh City’s current market. The steady year-on-year price increase has significantly changed the price landscape of projects and areas over the past years. This means that some projects priced at VND 1-2 billion in Dong Nai and Binh Duong at this point will become rare finds in the near future. The scarcity of affordable options due to the ever-increasing price levels has been evident in the real estate market over the years.

Buyers seize the opportunity to enter the market early

According to observations, apartments priced at VND 1-2 billion are now only found in Binh Duong, Long An, and Dong Nai, but their numbers are significantly lower compared to the 2018-2020 period. Long An and Dong Nai focus more on land, while Binh Duong mainly develops mid-range apartments.

From 2018 to 2020, Binh Duong had many apartments priced at around VND 1 billion, but the supply has decreased significantly, and prices have increased from VND 20-25 million per square meter (2018-2019) to VND 30-35 million (2021) and VND 40-50 million (2023-2024).

Currently, the supply of apartments priced at around VND 30 million per square meter or below in Binh Duong is quite modest. Some even predict that this price range is about to become a “rare find” in the area, as only a few projects have been launched recently, almost single-handedly driving the market demand.

Some affordable apartment projects have good liquidity due to the high market demand. Photo: HV

The decreasing number of affordable projects has prompted investors to seize the opportunity to enter the market early and increase their profits. For homebuyers, they take advantage of the period before prices rise significantly, along with attractive sales policies offered by developers, to make their purchases, saving tens to hundreds of millions of VND. This has stimulated liquidity in some projects.

For instance, the TT AVIO project, a joint venture between TT Capital and two Japanese giants, Cosmos Initia and Koterasu Group, recently sold out its first phase of 350 units on the morning of its market launch. With a price of VND 1.23 billion per unit – a rare price range in the area, along with breakthrough sales policies, the project quickly achieved an impressive absorption rate. The joint venture is now preparing to launch the second phase, expecting positive demand close to the Tet holiday, as it continues to offer competitive housing prices in the region.

In addition, the project’s quality construction and unique sales policies, prioritizing the interests of customers, are also highlights that attract buyers to this Japanese-standard apartment project. Specifically, instead of applying fixed payment schedules like many other developers, the Japanese joint venture allows customers to “negotiate payments” and adjust the payment schedule according to their financial capabilities. This policy not only helps buyers easily own an apartment but also optimizes their cash flow management during different contract stages. With superior advantages and support from reputable partners, the TT AVIO project is expected to continue its success in the second phase, providing an ideal home ownership opportunity right before the new year.

Similarly, Bcons, in collaboration with Tan Dong Hiep Corporation, has just launched the Tan Dong Hiep Residential Area project, comprising 2,650 units, attracting attention with a rumored price of VND 30 million per square meter. The project is expected to be sold in 2025 but has already garnered interest due to its rare price in Dĩ An, Binh Duong.

In the same area, Phu Dong SkyOne by Phu Dong Group also stands out with prices ranging from VND 1.6-1.8 billion per unit (75% of the basket), along with flexible policies: young people with an income of VND 20-25 million per month only need to pay VND 160 million to own an apartment, with a grace period for principal and interest support for 24 months. If they choose the non-bank slow payment option, buyers only need to pay VND 9 million per month to own an apartment. Notably, whether for living or renting, buyers can benefit from the developer’s commitment to lease the apartment for up to VND 8-10 million per month, up to VND 120 million in a year.

Thus, the number of affordable apartments in Binh Duong is decreasing, but new projects remain attractive due to their competitive prices compared to Ho Chi Minh City. Apartments priced below VND 2 billion per unit are expected to continue increasing due to land scarcity and rising input costs.

Mr. Le Quoc Kien, with his extensive experience in real estate investment and knowledge of the market’s development cycles, shared his insights: “Real estate prices are unlikely to decrease due to rising land, construction, and infrastructure costs. Specifically, for the apartment segment, prices may increase by 10% in the next three years as supply becomes scarcer.”

The Billion-Dollar Question: Unraveling the Mystery Behind Linh’s Company’s Unpaid Social Insurance Debt

National Meritorious Artist Quyền Linh provided a document from the Social Insurance Agency of Thu Duc City confirming that the company in which the actor has invested has completed insurance payments for 272 employees after a five-month delay.

The Capital’s Land Sales Surge: Hanoi Witnesses a 40% Spike in Land Listing in October, Surpassing House and Apartment Sales

According to Batdongsan.com.vn, the Hanoi market witnessed a significant surge in listing postings during October across most property types. The most notable increase was observed in project land listings, skyrocketing by 39% compared to the previous month. Following closely behind, detached houses and apartment listings also experienced substantial growth, with increments of 26% and 25%, respectively, compared to September.

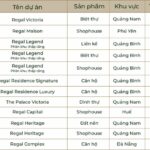

The Ultimate Coastal Escapes: Regal Group Unveils Its Upcoming Central Coast Projects for 2025

In the midst of the flourishing real estate market along the central coastal provinces of Vietnam, Regal Group is pioneering a new era of development with its transformative “backbone” projects along the coastline.

Mastering the Art of Flipping Properties Across Multiple Provinces

Southern localities are calling for an investigation into the causes of fluctuating real estate prices. They aim to understand and address the factors contributing to price volatility in different property sectors. This includes curbing the practice of quick resales, which has been prevalent in project areas and apartment complexes, leading to unusual price hikes.