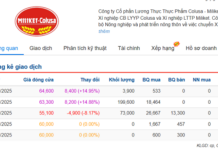

Vinhomes Joint Stock Company (stock code: VHM) has just announced the report on the results of the buyback. Accordingly, the company bought back nearly 247 million of its own shares during the period from October 23 to November 21. The average purchase price was VND 42,444 per share, corresponding to a transaction value of up to VND 10,500 billion – the largest in the history of Vietnam’s stock market.

After the transaction, the number of voting shares of Vinhomes decreased from over 4.35 billion units to nearly 4.11 billion units. The company’s charter capital also decreased from VND 43,544 billion to over VND 41,000 billion.

Regarding the purpose of the buyback, Vinhomes stated that the market price of VHM was lower than the company’s actual value. The buyback of shares ensures the interests of the company and its shareholders. The enterprise affirmed that the share buyback plan would be financed by available cash and operating cash flow, thanks to revenue from the sale of some projects.

However, during the time Vinhomes traded to buy treasury stocks, foreign investors net sold these shares heavily and only had a single light buying session. The total net selling volume reached nearly 91 million shares, with a net selling value of about VND 3,800 billion. This trend has shown signs of reversal as foreign investors have returned to light buying in recent sessions.

VHM has bought back nearly 247 million shares from October 23 to November 21.

In the market, VHM shares saw a strong increase after revealing the treasury stock purchase plan, thereby climbing to a one-year high before fluctuating during the transaction. At the beginning of the trading session on November 27, the market price was VND 42,400 per share. Vinhomes’ market capitalization reached approximately VND 185,000 billion.

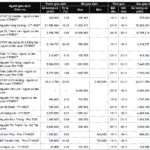

In the third quarter of this year, VHM recorded net revenue of VND 33,323 billion, up nearly 2% over the same period last year. Financial revenue was three times higher than the same period with nearly VND 5,498 billion, financial expenses recorded more than VND 1,555 billion, up 63% over the same period last year. After deducting various expenses, Vinhomes reported a third-quarter after-tax profit of over VND 8,980 billion.

In the first nine months of the year, Vinhomes recorded a consolidated net revenue of VND 69,910 billion and a consolidated net revenue converted (including revenue from Vinhomes’ activities and joint venture contracts) of VND 90,923 billion. The company’s consolidated after-tax profit reached VND 20,600 billion.

As of September 30, Vinhomes had total assets of VND 524,684 billion (up 18% from the beginning of the year) and equity of VND 215,966 billion (up 18.3% from December 31, 2023). In the third quarter, Vinhomes continued to launch new subdivisions in major projects as the real estate market recovered.

The New Vinhomes: Unlocking Growth with a Strategic 67% Stake Acquisition

Our company has successfully purchased 247 million treasury shares, an impressive 67% of the registered 370 million.

The Market Beat: Rising Pressure Wipes Out VN-Index’s Early Gains

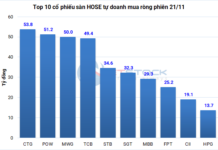

The market remained under pressure during the afternoon session, with indices retreating from reference levels. At the close on November 28, the gains were modest, with the VN-Index edging up 0.14 points to 1,242.11, the HNX-Index climbing 0.47 points to 223.57, and the UPCoM-Index advancing 0.38 points to 92.35.

The Market Climbs Higher Amid Uncertainty: Foreign Investors Ease Off Selling Spree

The T+ profit-taking volume remained but did not put much pressure on the first trading session of the week. The slow upward trend, with low liquidity and gradually improving breadth, reflected a doubtful sentiment, yet there was still money flow willing to push the prices higher.

The Market Beat, November 18th: A Tug of War Persists, VN-Index Stuck in the Red

The market closed with the VN-Index down 1.45 points (-0.12%) to 1,217.12, while the HNX-Index climbed 0.26 points (+0.12%) to 221.79. The market breadth tilted in favor of gainers with 368 advancing stocks against 340 declining ones. Meanwhile, the VN30-Index presented a relatively balanced picture, with 14 decliners, 12 advancers, and 4 unchanged stocks.