In a recent letter to investors, the head of Finnish fund Pyn Elite Fund, Petri Deryng, expressed a positive outlook on bank stocks in the Vietnamese stock market. According to Mr. Deryng, this group has witnessed positive signals in 2024, with price increases ranging from 15% to 30%. However, looking at the broader picture over the last three years, many stocks in the industry have declined by 10% to 20%.

Nonetheless, the head of Pyn Elite Fund remains optimistic, stating that banks have maintained stable profit growth, albeit at a slower pace, while also expanding their business operations and accumulating significant equity.

“In our view, the banking sector continues to offer strong profit growth potential in the coming years,” Mr. Deryng said. “With a favorable macroeconomic environment, Vietnam’s GDP could achieve annual growth of 7%, providing a supportive foundation for the banking industry.”

Notably, he also revealed that the PYN Elite Fund recently realized profits from a bank stock, recording a gain of over 60% within just one year. The fund has also reallocated this capital by increasing its exposure to bank stocks, focusing on those with breakthrough profit growth potential in 2025.

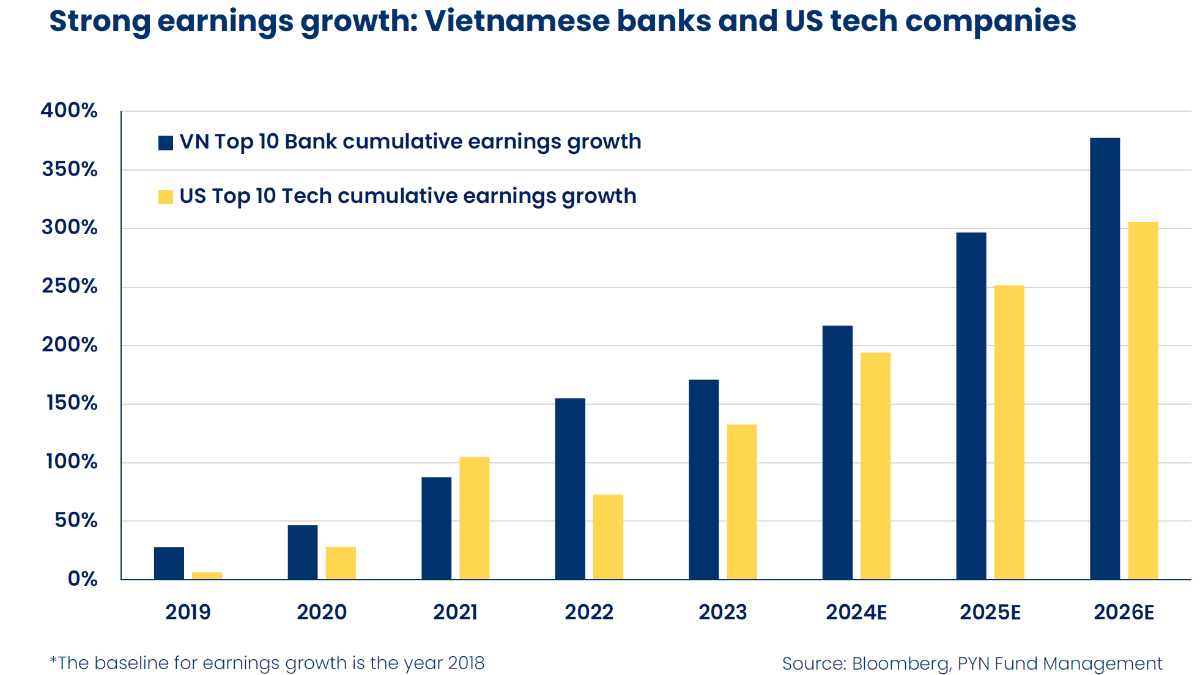

According to Mr. Deryng, Vietnamese banks possess impressive profit growth potential, even comparable to leading US tech companies. However, the stock price performance of banks over the past three years has contradicted their intrinsic growth. Therefore, this presents an ideal opportunity for a shift in capital allocation from high-valued tech stocks to undervalued Vietnamese bank stocks.

“I believe that Vietnamese bank stocks will become a highlight in long-term investment portfolios due to their stable growth potential and effectively managed risks,” affirmed Mr. Deryng.

In a previous letter, the Pyn Elite Fund boss also conveyed a positive outlook, noting the increasing number of positive signals within the country, thereby creating a solid foundation for the Vietnamese stock market. As most listed companies focus on domestic production and business activities, the potential import taxes that President Donald Trump might impose would directly impact foreign-invested enterprises (FDI) operating in Vietnam. However, these enterprises are not listed on the stock exchange.

Mr. Deryng forecasts that the profits of listed companies on the Vietnamese stock exchange could achieve growth rates of around 20% this year and maintain similar levels in 2025. The Vietnamese stock market remains reasonably valued, with a projected P/E ratio for 2025 of approximately 10 times, even after the recent sharp adjustments.

Currently, Pyn Elite Fund is one of the leading foreign funds in the Vietnamese stock market, with total assets under management exceeding 815 million EUR (22,000 billion VND) as of October-end. The financial group (banks and securities) dominates in both quantity and proportion. The fund’s investment performance for the first ten months of 2024 remains relatively favorable, achieving 18.54%.

Mobilizing Over 6,500 Workers and 2,200 Equipment, Most Transport Projects in the Mekong Delta Are Still Delayed by 4-15% for One Main Reason

The Mekong Delta region is currently undertaking nine significant national transportation projects, totaling an impressive investment of 106,000 billion VND. Of these ventures, eight are already under construction, with the My An – Cao Lanh Expressway project, funded by South Korean ODA, finalizing procedures and expected to commence in early 2025.