Government Inspectorate Points Out Irregularities in Equitization and Land Management at ACV

On November 13, 2024, the Government Inspectorate issued Inspection Conclusion No. 419/KL-TTCP on the restructuring of state-owned enterprises (reorganization, equitization, and capital withdrawal), the conversion of land use purposes from production and business land of state-owned enterprises and equitized enterprises to commercial land and housing development during the 2011-2021 period at the Ministry of Transport (MoT).

According to the inspection conclusion, ACV was not subject to equitization (according to Decision No. 14/2011/QD-TTg dated March 4, 2011, and Decision No. 37/2014/QD-TTg dated June 18, 2014, of the Prime Minister) as 21/22 airports managed by ACV are used for dual-use (civil and military aviation) purposes.

The equitization was initiated by the MoT, and during the implementation process, it encountered numerous difficulties and obstacles, especially in handling assets inside and outside the airport area, land, and policies, which affected aviation security and safety. In reality, the equitization of ACV also did not achieve the expected results as per the approved equitization plan.

Additionally, the MoT approved the enterprise value for ACV’s equitization without completing the legal dossiers for 29 land-based facilities, obtaining provincial People’s Committee approval for land use plans, and clearly handling the ownership of fixed assets in the airport area managed by the Aviation Authority and the enterprise’s land use rights.

Furthermore, the determination of business advantages was not in accordance with regulations, resulting in a shortfall of 581 million VND that should have been paid to the state budget.

“The above-mentioned shortcomings are the responsibility of the Ministry of Transport, the Equitization Steering Committee, ACV, and the enterprise valuation consulting unit,” the inspection conclusion stated.

ACV was also slow in finalizing settlement, revaluing the state capital portion, and preparing financial statements when transforming into a joint-stock company, violating the provisions of Circular No. 127/2014/TT-BTC and Decree No. 59/2011/ND-CP. ACV also violated regulations related to land management and use during the equitization process.

Specifically, the Corporation has not completed legal procedures for land for 20 land-based facilities (outside the airport area) with an area of approximately 35,124m2. ACV was also held responsible for the conversion of land for commercial and residential purposes at the project located at 108-112B-114 Hong Ha Street, Tan Binh District, Ho Chi Minh City. Here, Sasco (a company with a large stake held by ACV) collaborated with a real estate enterprise to construct and sell apartments without obtaining a land use right certificate.

“Thus, the project to build a commercial and high-end apartment complex has not completed the procedures for changing the land use purpose and determining the land price, nor has it paid for the land use right. It has collaborated with a joint venture to invest in construction and sell apartments to the people, and the people have moved in, which is not in compliance with the proper investment procedures. The responsibility for the above-mentioned shortcomings lies with the Ministry of Transport, the People’s Committee of Ho Chi Minh City, Nova Sasco Company Limited, Sasco, and ACV,” the inspection conclusion stated clearly.

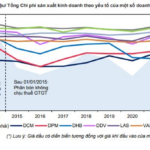

Vietnam Airports Corporation (code: ACV) has just announced its Q3/2024 financial statement, with revenue reaching VND 5,655 billion, up 6% over the same period. Gross profit reached VND 3,631 billion, up 9.2%, bringing the gross profit margin to 64.2%.

However, pre-tax profit decreased by 15.7% to VND 2,878 billion, and profit after tax belonging to the parent company’s owners also decreased by 18.3%, reaching only VND 1,977 billion. Thus, ACV ended its seven-quarter streak of profit growth.

In this quarter, ACV’s financial revenue decreased sharply by 70% to VND 294 billion, while financial expenses soared from VND 20 billion to VND 809 billion due to a foreign exchange loss of nearly VND 800 billion.

ACV’s significant foreign exchange loss in this quarter is not entirely unexpected. Previously, Dragon Vietnam Securities (VDSC) had raised concerns about ACV’s profitability due to the strong appreciation of the Yen.

ACV currently has long-term debt of approximately JPY 63.5 billion from ODA capital sources, so the appreciation of the Yen will have a negative impact on the company’s profitability. This is also ACV’s dilemma in the current context, as if the exchange rate continues to rise in the remaining months of 2024, the company will be pushed into a foreign exchange loss situation for the entire year of 2024.

As of September 30, ACV’s total assets reached VND 73,258 billion, an increase of nearly VND 6,000 billion compared to the beginning of the year. Of this, the company holds more than VND 27,241 billion in cash and cash equivalents, accounting for 37% of total assets. Long-term unfinished assets reached VND 14,880 billion, mostly invested in airport projects, including VND 9,500 billion for Phase 1 of Long Thanh Airport and VND 3,700 billion for Tan Son Nhat T3 Terminal.

In addition, ACV’s short-term receivables are at VND 13,782 billion, of which VND 8,846 billion is bad debt from airlines such as Bamboo Airways, Vietjet, and Vietnam Airlines.

In the Q3/2024 financial statement, ACV has financial investments in enterprises such as Tan Son Nhat Airport Ground Services JSC (VND 1,585 billion), Saigon Ground Services JSC (VND 486.8 billion), Southern Airports Aircraft Maintenance Service Co., Ltd. (VND 15.3 billion), Southern Airports Commercial Joint Stock Company (VND 7.5 billion), Southern Airports Transportation Joint Stock Company (VND 14.8 billion), and Hanoi Ground Services JSC (VND 30 billion).

Unlocking the Potential: Strategic Investors Exit Early, Leaving Cienco 8 in the Capable Hands of the Phuc Loc Group, Led by Business Tycoon Luong Minh Tuong

The Inspectorate pointed out a series of violations during the equitization process at Cienco 8, including the formulation of vague criteria for selecting strategic investors, which led to early divestment by the investor. As a result, Cienco 8 quietly fell into the hands of the Phuc Loc Group, owned by tycoon Luong Minh Tuong.

The Province with Three Times More Sea than Land is Getting an Industrial Zone Worth Over 2,200 Billion VND

This project, spanning an impressive 194.36 hectares, is the brainchild of a well-renowned enterprise in Thai Binh province.

The New 5% VAT on Fertilizers: MBS Unveils Businesses Set to Benefit

MBS Securities believes that applying a value-added tax to fertilizers (at a rate of 5%) will enable businesses to claim input VAT deductions, thereby supporting the profitability of domestic fertilizer producers.