I. MARKET ANALYSIS OF THE STOCK MARKET FOR NOVEMBER 28, 2024

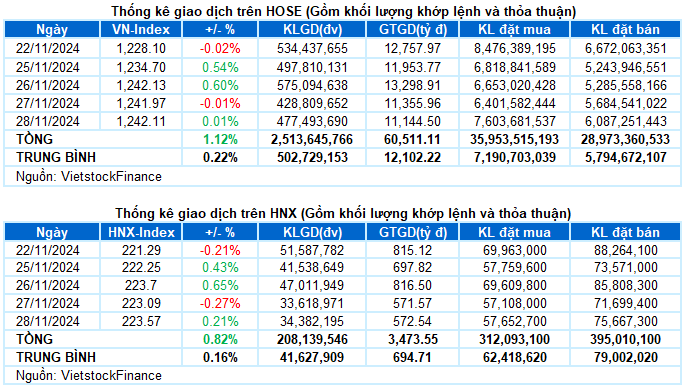

– The main indices edged slightly higher in the trading session on November 28. The VN-Index closed just above the reference level at 1,242.11 points, while the HNX-Index ended at 223.57 points, a 0.21% increase from the previous session.

– Matching volume on the HOSE reached nearly 415 million units, a 13.3% increase compared to the previous session. Meanwhile, matching volume on the HNX rose 2.3% to over 31 million units.

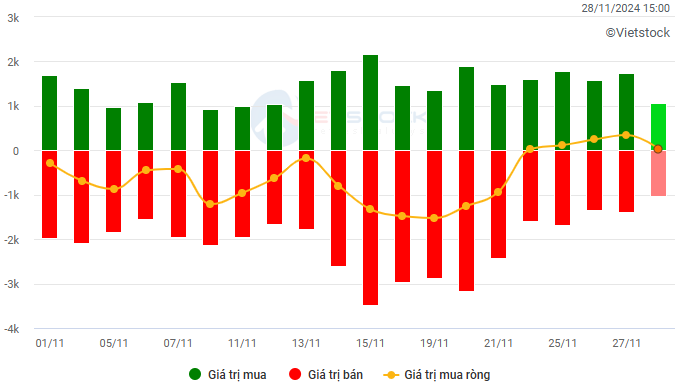

– Foreign investors net bought on the HOSE and HNX with a value of over VND37 billion and VND1.6 billion, respectively.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

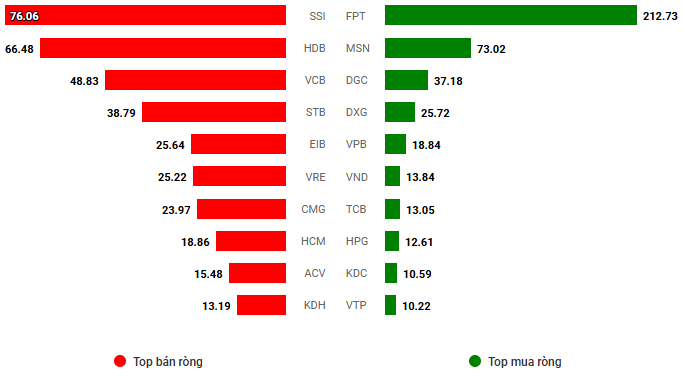

Net trading value by stock. Unit: VND billion

– The market opened on a positive note on November 28, led by large-cap stocks, and the VN-Index quickly gained more than 8 points, approaching the 1,250-point threshold after the first hour of trading. However, selling pressure intensified, narrowing the gains, and the index rose only 2 points by the end of the morning session. Buyers did not make a significant comeback in the afternoon, and the market oscillated around the reference level until closing at 1,242.11 points, up 0.14 points from the previous day.

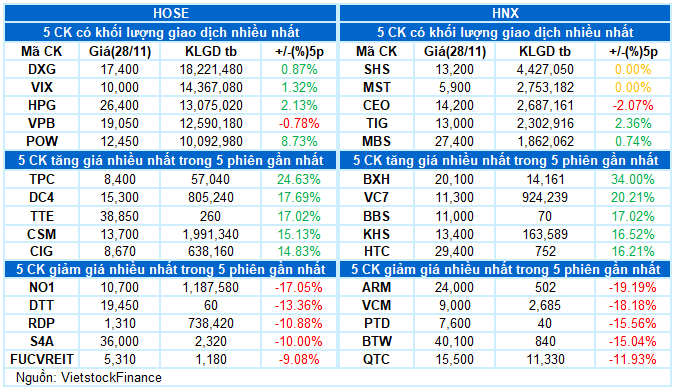

– In terms of impact, CTG, VIB, and PLX were the most positive contributors to the overall index, adding less than 1 point. On the other hand, VHM exerted the most significant negative influence, dragging the index down by nearly 0.8 points, while the remaining stocks had a negligible impact.

– The VN30-Index edged up 0.04% to 1,301.52 points. The market breadth was relatively balanced, with 12 gainers, 15 losers, and 3 unchanged stocks. Among them, PLX and VIB topped the gainers’ list with increases of more than 2%. Conversely, VHM and SAB witnessed notable declines of over 1%. The remaining stocks in the basket witnessed only slight fluctuations around the reference level.

Regarding sector performance, telecommunications led the market with a substantial gain of over 4%, mainly driven by the uptrend of leading stocks in the industry, including VGI (+5.26%), VNZ (+2.13%), FOX (+0.85%), and CTR (+0.77%).

Following closely were the healthcare, energy, and industrial sectors, all recording increases of more than 1%. While buyers were not overwhelmingly dominant across the board, several stocks in these sectors attracted exceptional demand, notably DBD, which hit the daily limit-up, IMP (+3.82%), DHT (+9.54%), VDP (+2.29%); BSR (+1.55%), PSB (+1.82%); ACV (+2.47%), VTP (+3.04%), MVN (+1.62%), and PHP (+2.65%).

The remaining sectors exhibited a somewhat mixed performance. The real estate sector lagged, weighed down by losses in several large-cap stocks such as VHM (-1.91%), VRE (-0.55%), NVL (-0.89%), KBC (-0.71%), and HDG (-1.03%). Nevertheless, some stocks in the sector managed to stay in positive territory, including NLG (+1.06%), SIP (+1.82%), QCG (+1.99%), SGR (+1.07%), and NHA (+2.3%), among others.

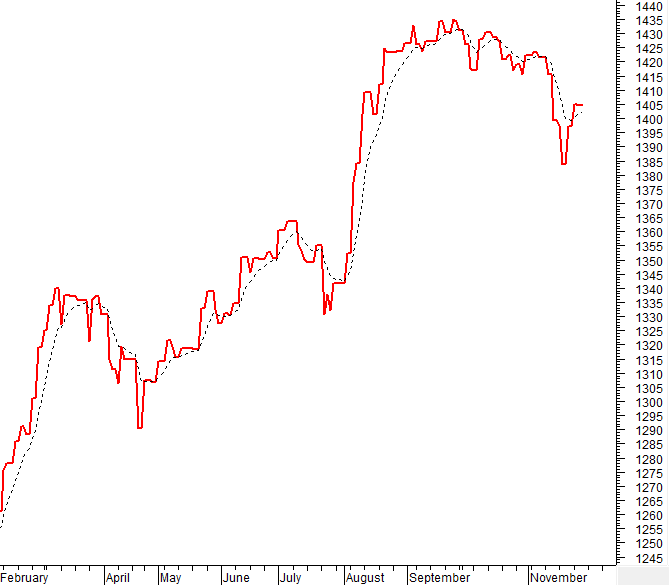

VN-Index posted a slight gain while remaining above the Middle Bollinger Band. If, in the upcoming sessions, the index continues to trade above this level with matching volume surpassing the 20-day average, the uptrend will be reinforced. Currently, the MACD indicator has issued a buy signal after crossing above the Signal Line. Moreover, the Stochastic Oscillator also suggests a similar signal. If this trend persists in the following sessions, the short-term outlook will turn optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Sustaining Above the Middle Bollinger Band

VN-Index edged higher while staying above the Middle Bollinger Band. If, in the upcoming sessions, the index continues to trade above this level with matching volume surpassing the 20-day average, the uptrend will be reinforced.

At present, the MACD indicator has issued a buy signal after crossing above the Signal Line. Moreover, the Stochastic Oscillator also suggests a similar signal. Should this trend be maintained in the following sessions, the short-term outlook will turn optimistic.

HNX-Index – Stochastic Oscillator and MACD Maintain Buy Signals

HNX-Index advanced amid matching volume below the 20-day average, indicating investors’ cautious sentiment.

The Stochastic Oscillator continues to ascend after exiting the oversold zone. Additionally, the MACD indicator has turned positive again, crossing above the Signal Line. If this status quo is maintained, the short-term optimistic outlook will prevail.

Analysis of Money Flow

Movement of Smart Money: The Negative Volume Index of the VN-Index surpassed the EMA 20-day line. If this status quo is maintained in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors continued net buying on November 28, 2024. If this trend persists in the upcoming sessions, the market sentiment will improve.

III. MARKET STATISTICS FOR NOVEMBER 28, 2024

Economic and Market Strategy Division, Vietstock Consulting

The Heat is On: Foreign Investors Turn to Selling

The VN-Index continued its upward trajectory throughout the morning session, but the gains are gradually diminishing. Trading volume on the HoSE remained similar to yesterday’s morning session, and large-cap stocks showed resilience, maintaining their stability.

Stock Market Blog: Are Bottom-Fishing Stocks a Thing of the Past?

The upward momentum significantly stalled in today’s session, yet the market managed to maintain a delicate balance between supply and demand. The volatility was relatively subdued, with narrow fluctuations in both indices and individual stocks. Notably, the combined trading volume of the two exchanges once again dipped below the 10 trillion dong threshold, indicating that investors are holding onto their stocks rather than engaging in short-term trading.

“Stocks Rise Amidst Doubt: How Can Investors Sift Through the Sand to Find Potential Winners?”

For an investment strategy in a “bullish-yet-cautious” market, VPBankS experts emphasize the importance of assessing one’s risk appetite. This crucial first step guides the creation of a portfolio with varying industry weightings, a key factor in navigating such market conditions.

The Market Beat: Foreigners Keep Buying, but VN-Index Stagnates

The market closed with slight losses, as the VN-Index dipped by 0.16 points (-0.01%) to finish at 1,241.97, while the HNX-Index shed 0.61 points (-0.27%), closing at 223.09. The market breadth tilted towards decliners, with 366 tickers in the red against 307 gainers. Additionally, within the VN30 basket, decliners outnumbered advancers with 14 tickers ending in the red, 9 in the green, and 7 unchanged.