On October 22, the provincial Department of Planning and Investment sent a document to the People’s Committee of the province regarding the handling of the Company’s dossier on requesting an increase in charter capital by converting the owner’s loan debt into capital contribution. The Department of Planning and Investment stated that the owner of Hoiana Nam Hoi An Company is Hoi An South Investments Pte. Ltd. (headquartered in Singapore). Hoiana Nam Hoi An Company has borrowed capital from Hoi An South Investments Pte. Ltd. Now, Hoiana Nam Hoi An Company proposes to increase its charter capital by converting the owner’s loan debt into capital contribution of the owner, amounting to 48.5 million USD on March 31, 2024, and 148 million USD on April 20, 2024.

To have a basis for handling the dossier on increasing charter capital by converting loan debt into capital contribution of the owner, the Department has sent a document requesting guidance from the Business Registration Management Bureau – Ministry of Planning and Investment. Accordingly, on August 28, the Bureau opined that: “The 2020 Enterprise Law does not regulate the owner’s conversion of the company’s loan debt into additional charter capital contribution.”

On September 9, Hoiana Nam Hoi An Company argued that the business registration agency could apply Point b, Clause 2, Article 34 of Circular No. 12/2022/TT-NHNN to resolve the proposal to increase capital. The Department of Planning and Investment held that the scope of adjustment of this Article does not regulate the increase of charter capital of an enterprise in the form of converting loan debt into capital contribution of the owner in a single-member limited liability company. As a foreign-invested enterprise, Hoiana Nam Hoi An Company is subject to the management of many specialized agencies and related laws. To ensure that the handling of the Company’s dossier on increasing charter capital complies with the relevant regulations (civil law, investment law, accounting law, financial law, foreign exchange law, etc.), the Department of Planning and Investment has sent a document to relevant agencies for their opinions on converting the loan debt into capital contribution of the owner to increase the charter capital of Hoiana Nam Hoi An Company in accordance with the specialized laws.

On October 28, Hoiana Nam Hoi An Company stated that at the beginning of April this year, the Company submitted a dossier on registering for an increase in charter capital through the conversion of the Company’s loan debt to the Department of Planning and Investment. After more than six months, this dossier has not been approved. The enterprise disagreed with the opinion of the Department of Planning and Investment that according to the provisions of Clause 1, Article 87 of the Law on Enterprises, a single-member limited liability company, like Hoiana Nam Hoi An Company, has only two forms of increasing charter capital, namely “the owner of the company contributes additional capital” or “mobilizing additional capital contribution from others,” and the conversion of loan debt into charter capital does not fall into these two forms.

Hoiana Nam Hoi An Company cited some other enterprises that have successfully registered to increase capital in the form of converting the loan debt of the parent company, all of which are single-member limited liability companies, such as Tuyen Quang Steel Joint Stock Company in 2023 and Hiep Phuoc Power Company Limited in 2019.

Hoiana Nam Hoi An Company also stated that on August 21, the Company submitted a dossier on changing the legal representative and supplementing business lines. However, as the increase in charter capital has not been completed, this change of legal representative has also been affected and not resolved. This situation, according to Hoiana Nam Hoi An Company, has created significant business and operational limitations for the Company. Because the previous legal representatives have terminated their labor contracts, and the Company needs to appoint new legal representatives to be able to sign the necessary documents.

To implement the Nam Hoi An Resort project, the Company borrowed 196.5 million USD through 13 direct loans from its owner, Hoi An South Investments Pte. Ltd., established in Singapore. To carry out its business plan, Hoiana Nam Hoi An Company and its parent company agreed to convert the entire debt of the 13 loans into capital contribution from the parent company and increase the corresponding capital of Hoiana Nam Hoi An Company.

On October 29, the People’s Committee of the province requested the Department of Planning and Investment to urgently obtain written opinions from the Department of Finance, the Department of Justice, the State Bank – Provincial Branch, the Provincial Tax Department, and related units on the dossier for registration of an increase in the charter capital of Hoiana Nam Hoi An Company. In case of difficulties, report to the People’s Committee of the province and clearly state the Department’s viewpoint on handling the dossier for registration of an increase in the charter capital of the above-mentioned Company and propose a solution.

|

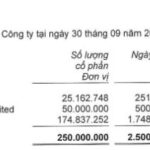

According to the author’s understanding, on November 6, Hoiana Nam Hoi An Company has changed its legal representative. Accordingly, the number of legal representatives of the enterprise was reduced from 5 to 4, including: Mr. Nguyen Vinh Tran (American citizen) – Director; Mr. Lok Man Wai (Chinese citizen) – Director; Mr. Jimmy, René, Yvan Lopez (French citizen) – Director; Mr. Steven Wolstenholme (American) – Chairman of the Board of Directors and General Director. The new list no longer includes Mr. Nelson Lobo Guimaraes (Portugal) – Director. The latest updated charter capital as of mid-November 2023 is more than 279 million USD, equivalent to nearly 6,389 billion VND, all of which is foreign capital. |

A corner of the completed project. The super project of Nam Hoi An Resort has a total area of 985ha located in Duy Xuyen and Thang Binh districts, Quang Nam province, invested by Hoiana Nam Hoi An Company, operating under the investment certificate granted by the People’s Committee of Quang Nam province since 2010. Total investment capital is 4 billion USD.

|

Project proposes to delay Phase 2 with an expected investment of 1 billion USD

Regarding Phase 2 of the project, following the guidance of the Foreign Investment Agency – Ministry of Planning and Investment on adjusting the progress of Phase 2 of the Nam Hoi An Resort project, at the beginning of November, Hoiana Nam Hoi An Company proposed to the People’s Committee of the province and the Department of Planning and Investment to guide the procedures for adjusting the investment progress of Phase 2 of the project with the force majeure events that the Company has mentioned.

On November 6, the People’s Committee of the province, the Office of the People’s Committee, requested the Department of Planning and Investment to take the prime responsibility, coordinate with relevant agencies, units, and localities to inspect and resolve or advise the People’s Committee of the province to resolve it according to its competence and regulations.

In addition, regarding the detailed planning of the Nam Hoi An Resort (Phase 1-B), at the beginning of November, the Chairman of the People’s Committee of the province, Le Van Dung, announced the conclusion at the meeting to discuss a number of related contents. Accordingly, the Department of Construction is responsible for guiding the Company to complete the dossier and related procedures; on the basis of synthesizing the opinions of the community, branches, units, and localities, the Appraisal Council.

The Department of Planning and Investment shall provide comments (in writing) on the proposal of the Department of Construction and be responsible for the contents related to the investment law for the progress, boundaries of the implementation stages, objectives, scale, and total investment capital of the Nam Hoi An Resort, thereby confirming whether the owner’s proposal to adjust the detailed planning of Phase 1-B belongs to the case where the investment approval must be adjusted according to the provisions of the investment law and sending it to the Department of Construction for synthesis, appraisal, and reporting to the competent authority for consideration.

In mid-October, at a meeting with the provincial leaders, Mr. Steven Wolstenholme, Chairman and General Director of Hoiana Nam Hoi An Company, said that Phase 1 of the project has a total investment of about 1.4 billion USD, and more than 2,500 local laborers have been employed by the Company. It is expected that Phase 2 will be expanded with an investment of approximately 1 billion USD and the recruitment of about 2,500 employees.

Owner of the 4-billion-dollar super project Nam Hoi An proposed to build more golf courses

How much money has the Hoiana – Vietnam’s largest casino – brought to LET Group?

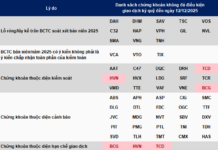

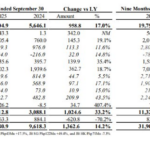

MB Securities to Issue Nearly 26 Million MBS Shares

Investors will subscribe for over 25.7 million MBS shares of MB Securities from November 20, 2024, to 3:00 PM on November 28, 2024.

Is Kafei Securities Upping its Capital Raising Game to 5,000 Billion VND?

The company Kafi is seeking shareholder approval for a new proposal. From November 18 to November 28, 2024, Kafi will be soliciting written feedback from its shareholders regarding a proposed alternative to the previously approved plan. This new proposal aims to present a revised strategy that better aligns with the company’s long-term vision and goals.

Unlocking the Power of PPPs: Harmonizing Interests and Sharing Risks for Mutual Success

It is believed by several National Assembly delegates that in order to unblock the “bottleneck” in infrastructure projects, especially in the field of transportation, it is necessary to devise harmonious solutions that balance the interests and risks of all involved parties when it comes to implementing investment projects through the public-private partnership (PPP) model.