According to statistics from 13 representative bond funds in the market for the first nine months of 2024, excluding the MBAM Bond Fund, a newly established fund in May 2024, total income and revenue reached nearly VND 787 billion, with net profit after tax amounting to nearly VND 696 billion. This reflects a decrease of 66% and 68%, respectively, compared to the same period last year. The business results of the funds showed mixed performances, with seven funds experiencing profit declines and five funds achieving profit increases.

As of the end of September 2024, the total investment portfolio of the funds increased by 238%, surpassing VND 16,600 billion. Bank deposits and cash equivalents witnessed the most significant growth, surging by 517% to over VND 7,400 billion. Bond investments also increased by 156%, reaching more than VND 8,700 billion. Consequently, the funds’ portfolios underwent substantial shifts, with the proportion of bond investments decreasing from over 69% at the beginning of the year to nearly 53% by the end of September. In contrast, the proportion of bank deposits and cash equivalents increased from nearly 25% to almost 45% during the same period.

The TCBF Bond Fund, managed by Techcom Securities Investment Fund Management JSC, boasted the largest net asset value (NAV) among the funds, amounting to over VND 11,212 billion, reflecting a remarkable 345% increase since the beginning of the year. Within its portfolio, the value of bonds surpassed VND 5,600 billion, tripling from the start of the year, while bank deposits and cash equivalents reached nearly VND 5,500 billion, an eleven-fold increase. The NAV/ccq stood at VND 19,811, representing an increase of over 11%. TCBF also attracted the highest number of investors, with 31,545 investors holding fund certificates.

Only a few funds boasted NAVs in the thousands of billions, including the VFF Bond Fund, with a NAV of nearly VND 1,636 billion, a 120% increase, and the DCBF Bond Fund, with a NAV of nearly VND 1,486 billion, a 229% surge.

The bond funds primarily invested in corporate bonds, but their portfolios are undergoing significant adjustments. Notably, six funds reduced the proportion of bond investments, opting instead to allocate more resources to bank deposits, certificates of deposit, equities, and other assets.

Despite its leadership in terms of investment scale and substantial absolute increases across all major investment categories, TCBF witnessed a decrease in the proportion of bond investments from 75.3% to 49.7%. Simultaneously, the fund significantly increased its allocation to bank deposits and cash equivalents, which rose from 19.9% to 48.2%.

Additionally, five funds, including VNDCF, BVBF, TCFF, VLBF, and VTBF, did not have bond investments as the largest component of their portfolios. Instead, they focused on other asset classes, such as bank deposits, equities, and money market instruments.

TCBF’s profit for the nine-month period decreased by 75% compared to the previous year, amounting to nearly VND 516 billion. This decline was attributed to a significant reduction in unrealized investment revaluation gains and bond interest income, which are crucial revenue streams for the fund. Nevertheless, in absolute terms, TCBF’s profit remained the highest among all the funds.

In terms of profit growth, VNDCF took the lead with a 296% increase, reaching over VND 3.6 billion. This impressive growth was driven by substantial increases in dividend income and interest received.

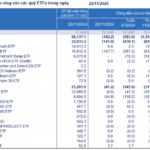

The table below provides additional insights into the performance of the bond funds during the first half of 2024:

|

Huy Khai

Design: Tuan Tran

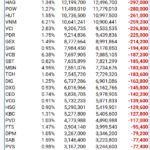

The Great ETF Exodus: A Triple Retreat

Vietnam-focused equity ETFs witnessed outflows of over VND 583 billion last week, marking a significant surge in withdrawal activity with triple the amount compared to the previous week’s outflows.

When Will the $100 Million ETF Stop Selling?

The period from November 18-25 marked yet another week of net selling for the VanEck Vectors Vietnam ETF (VNM ETF), as the fund offloaded Vietnamese stocks for the fifth consecutive week amidst robust foreign net selling. However, with foreign investors showing signs of returning to the market, is the fund’s selling spree finally coming to an end?

The Art of Investing in Private Corporate Bonds: Insights from the Ministry of Finance’s Deputy Minister

“The latest draft of the Securities Law amendment, as per Deputy Finance Minister Nguyen Duc Chi, introduces a significant change by allowing individual investors to partake in all types of private corporate bond investments. This move is aimed at enhancing the quality of bonds in the market, with a particular focus on the utilization of credit ratings as a tool to achieve this goal.”