The VN-Index ended November 2024 at 1,250.46, a decrease of 14.02 points or 1.11% from October. The average trading value per session fell to an 18-month low of 12,202 billion VND, considering only matched orders.

The average trading value across the three exchanges reached 15,785 billion VND in November. For matched orders only, the average trading value was 13,481 billion VND, a 12.7% decrease from the October average and a 30% decrease from the yearly average.

On a monthly basis, cash flow proportions decreased in Banking, Securities, Steel, Food, Retail, and Oil & Gas, while increasing in Real Estate, Information Technology, Chemicals, Construction, Agriculture & Fisheries, Textiles, and Aviation.

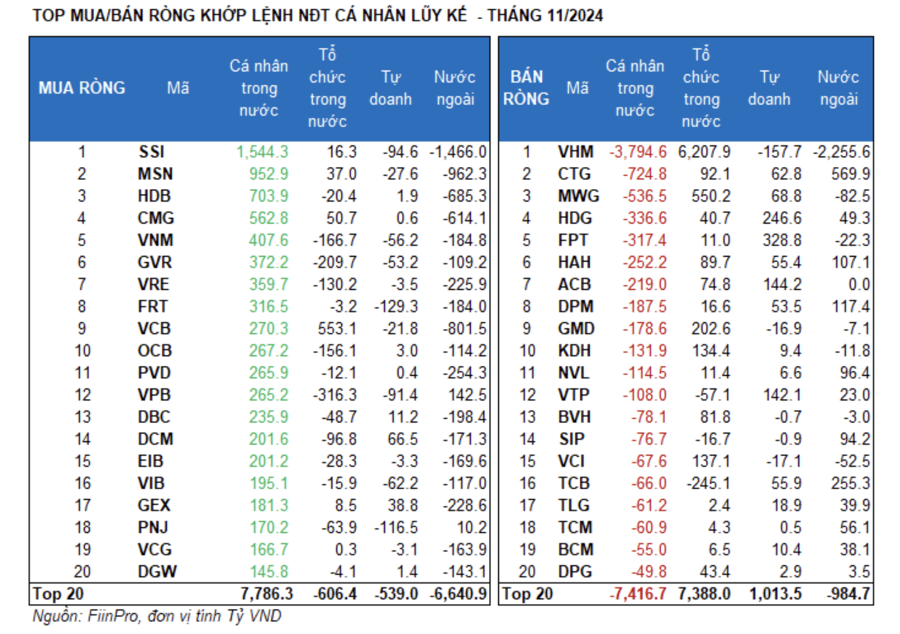

In terms of matched orders, foreign investors sold extensively, with a net sell volume nearly four times higher than in November. The sectors most impacted by this selling were Real Estate, Food, Securities, and Banking. Domestic organizations were the main net buyers, primarily due to VHM’s repurchase of treasury stock. Individuals continued to buy extensively, except in Real Estate.

Considering market capitalization, cash flow proportions decreased again in the large-cap VN30 group while increasing in the mid-cap VNMID and small-cap VNSML groups.

Foreign investors net sold 12,004.3 billion VND, and for matched orders, they net sold 9,453.8 billion VND.

The main sectors where foreign investors net bought on a matched basis were Personal & Household Goods, Electricity, Water & Gas, and Oil & Coal. The top stocks they net bought were CTG, TCB, VPB, DPM, HAH, NVL, SIP, TCM, HDG, and CTR.

On the net sell side, foreign investors focused on the Real Estate sector. The top stocks they net sold were VHM, SSI, MSN, VCB, HDB, HPG, PVD, GEX, and VRE.

Individual investors net bought 2,396.6 billion VND, including 2,396.6 billion VND in matched orders. In terms of matched orders, they net bought in 13 out of 18 industries, mainly in Financial Services. The top stocks purchased by individual investors included SSI, MSN, HDB, CMG, VNM, GVR, VRE, FRT, VCB, and OCB.

On the net sell side, they net sold in 5 out of 18 industries, mainly in Real Estate and Industrial Goods & Services. The top stocks they net sold included VHM, CTG, MWG, HDG, FPT, HAH, DPM, GMD, and KDH.

Proprietary trading net bought 244.3 billion VND, and for matched orders, they net bought 705.5 billion VND.

Considering matched orders only, proprietary trading net bought in 7 out of 18 industries. The sectors with the highest net buys were Banking and Information Technology. The top stocks net bought by proprietary trading today included FPT, MBB, HDG, ACB, VTP, MWG, DCM, CTG, TCB, and HAH.

The top net sell sector was Financial Services. The top net sold stocks included VHM, FRT, PNJ, SSI, VPB, HCM, GAS, VIB, VNM, and GVR.

Domestic organizations net bought 7,958.6 billion VND, and for matched orders, they net bought 6,351.7 billion VND.

In terms of matched orders, domestic organizations net sold in 10 out of 18 industries, with the highest value in Banking. The top net sold stocks were MBB, VPB, TCB, GVR, CTR, VNM, OCB, POW, VRE, and DCM.

The sectors with the highest net buys were Real Estate. The top net bought stocks included VHM, VCB, MWG, HPG, GMD, VCI, KDH, CTG, DGC, and HAH.

On a monthly basis, cash flow proportions decreased in Banking, Securities, Steel, Food, Retail, and Oil & Gas while increasing in Real Estate, Information Technology, Chemicals, Construction, Agriculture & Fisheries, Textiles, and Aviation.

Considering market capitalization, cash flow proportions decreased again in the large-cap VN30 group while increasing in the mid-cap VNMID and small-cap VNSML groups.

The cash flow proportion in the large-cap VN30 group fell to 50.1% in November 2024, down from its peak in the previous month (54.4%). Meanwhile, the mid-cap VNMID and small-cap VNSML groups saw their proportions increase from their lows, reaching 37.4% and 9.6%, respectively.

In terms of cash flow size, the average trading value per session decreased in the large-cap VN30 group (-1,556 billion VND/-20.9%) and the mid-cap VNMID group (-443 billion VND/-8.6%). Conversely, the average trading value per session slightly increased in the small-cap VNSML group (+35 billion VND/+2.9%).

Regarding price movements, all three indexes declined, with the VN30 index experiencing the sharpest drop (-2.04%), followed by VNMID (-1.6%) and VNSML (-0.22%).