To avoid finding yourself in a similarly distressing situation, it’s crucial not only to diligently pay off your debts on time but also to regularly check and monitor your credit report to identify any issues or errors and address them promptly.

The Vietnam National Credit Information Center (CIC) serves as the repository of credit information for individuals and organizations nationwide. Through this system, users can effortlessly review their credit history, encompassing current debts, payment status, and any adverse credit notes.

CIC allows each individual and organization to access a basic credit report free of charge once a year. From the second information retrieval onwards in the same year or for more detailed reports, a fee is applicable.

Users can obtain their credit information for free through the CIC by following these steps:

- Visit the official website of CIC (https://cic.gov.vn) or download the CIC Credit Connect app from App Store (iOS) or Google Play (Android).

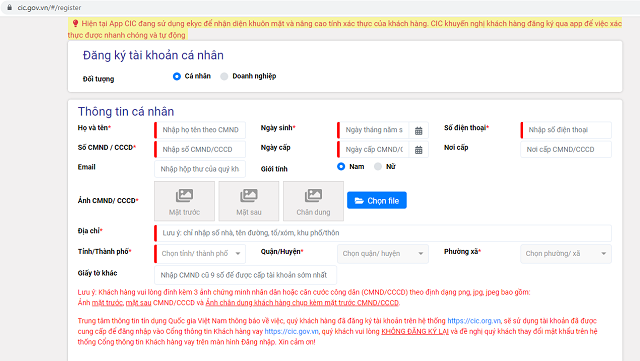

- Register an account:

- If you don’t already have an account, click on “Register” and provide personal information such as your full name, ID number, phone number, email address, and any other required details.

- After registering, you will receive an OTP via SMS for verification.

- Complete the registration process and wait for your account to be approved.

- Log in to the system: Once your account has been approved, use your login credentials to access the system.

- Retrieve credit information:

- After logging in, select the option to retrieve personal credit information.

- Fill in all the information accurately and proceed with verification to obtain your credit report.

- Receive the credit report: Upon completing the above steps, the system will provide your personal credit report. This report encompasses personal information, details of your loans and credit debts (mortgages, secured and unsecured loans, car loans, and credit cards), credit limits, outstanding balances and loan durations, payment history (late or on-time payments), adverse credit status, credit score, and information about lending organizations you have borrowed from or are currently borrowing from.

What to Do If You Have Adverse Credit?

According to Clause 1, Article 10 of Circular No. 11/2021/TT-NHNN, debts are classified into 5 groups based on the quantitative method as follows:

- Group 1 debt, also known as standard debt: This refers to debts that are less than 10 days overdue and are assessed to be collectible.

- Group 2 debt, also known as attention-worthy debt: This includes debts that are between 10 and 90 days overdue and are assessed to be fully collectible, including overdue interest.

- Group 3 debt, also known as substandard debt: This covers debts that are between 91 and 180 days overdue.

- Group 4 debt, also known as doubtful debt: This pertains to debts that are between 181 and 360 days overdue.

- Group 5 debt, also known as loss debt: This includes debts that are over 360 days overdue.

Adverse credit or bad debt refers to situations where the borrower is unable to repay their debts as agreed upon in the loan contract. According to Clause 8, Article 3 of Circular No. 11/2021/TT-NHNN, bad debts fall under groups 3, 4, and 5.

There is no instant way to “erase” bad debt other than paying it off entirely. The time required to remove bad debt from the CIC system depends on the debt group and the borrower’s repayment status.

For bad debts (groups 3, 4, and 5), the adverse credit information will remain in the CIC system for 5 years from the date of full debt repayment. This means that even after settling your debts, the history of bad credit will persist in your credit report for 5 years, potentially impacting your ability to secure new loans during this period.

For attention-worthy debts (group 2), the information will be retained for 12 months from the date of full debt repayment.

As the basic credit report already provides comprehensive information about an individual’s loans, it is advisable to periodically check and monitor your credit report annually (to avoid incurring fees) to detect any errors or discrepancies early on. This proactive approach enables timely rectification of any issues and empowers individuals to make more informed financial decisions for the future.

The Central Bank Governor: We Will Intervene in the Foreign Exchange Market During Times of Significant Volatility

Governor Nguyen Thi Hong affirmed that the State Bank of Vietnam (SBV) remains steadfast in its commitment to flexible exchange rate management, adapting to market fluctuations. The exchange rate is currently allowed to fluctuate within a band of +/- 5%. “In the event of significant market volatility, the State Bank will consider selling foreign currencies to stabilize and meet the needs of the people,” she added.

The Rising Tide of Bad Debt: A Major Challenge for the Banking Sector

The sharp rise in non-performing loans in Q3 2024, coupled with a decline in lending, presents a significant challenge for the banking industry. This worrying trend is a red flag, indicating that without swift and effective action, the banking system could be facing substantial financial risks in the near future.

“Overcoming a Financial Stigma: How I Rose Above a $500 Debt Rejection”

Mr. Quang is currently classified as a subprime borrower, but he continues to face rejection from banks when seeking a mortgage. This is due to a previous bad debt of VND 5 million, which he has since fully repaid as of 2022. Despite this, the shadow of his past financial misstep continues to haunt him, leaving him struggling to secure the loan he needs.

The Inspector General’s Report: Unraveling the High Rate of Non-Performing Loans at An Giang Development Investment Fund

The latest lending data from An Giang Province’s Investment and Development Fund reveals a worrying trend. In 2022 and 2023, non-performing loan rates surged to alarming levels. By the end of 2023, total outstanding debt had climbed to over 80 billion VND, with non-performing loans accounting for a staggering 43.6 billion VND – that’s over 54% of the total debt. This presents a significant challenge and underscores the urgent need for effective strategies to address this issue.