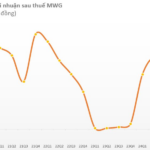

Abnormal costs in Q3 2024 were mainly related to the mobile and appliance business, including (1) costs associated with closing Dien May Xanh/The Gioi Di Dong/An Khang stores, amounting to VND 252 billion, (2) VND 100 billion in losses due to Storm Yagi, and (3) VND 93 billion in amortization of commercial advantages related to Tran Anh subsidiary.

Excluding these abnormal items, SSI Research estimates that MWG’s core consolidated pre-tax profit for Q3 2024 could reach VND 1,500 billion, only an 11% decrease from the previous quarter due to seasonality.

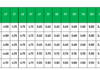

According to SSI Research’s assessment, the performance of the mobile and appliance division (The Gioi Di Dong/Dien May Xanh – TGDĐ/DMX & Topzone) improved significantly in the first three quarters of 2024, mainly due to (1) recovering consumption, (2) cost optimization, and (3) less inventory clearance pressure due to lower inventory levels.

MWG aims to grow its network from 86 stores currently to 150 stores by December 2025 and 500 stores by December 2027, targeting $1 billion in revenue by 2027 (equivalent to about 27% of MWG’s mobile and appliance revenue in Vietnam). SSI Research estimates Erablue’s revenue for 2024-2025 to be VND 3,900 billion and VND 7,400 billion (+91% yoy), with net profits of VND 2 billion and VND 37 billion, respectively.

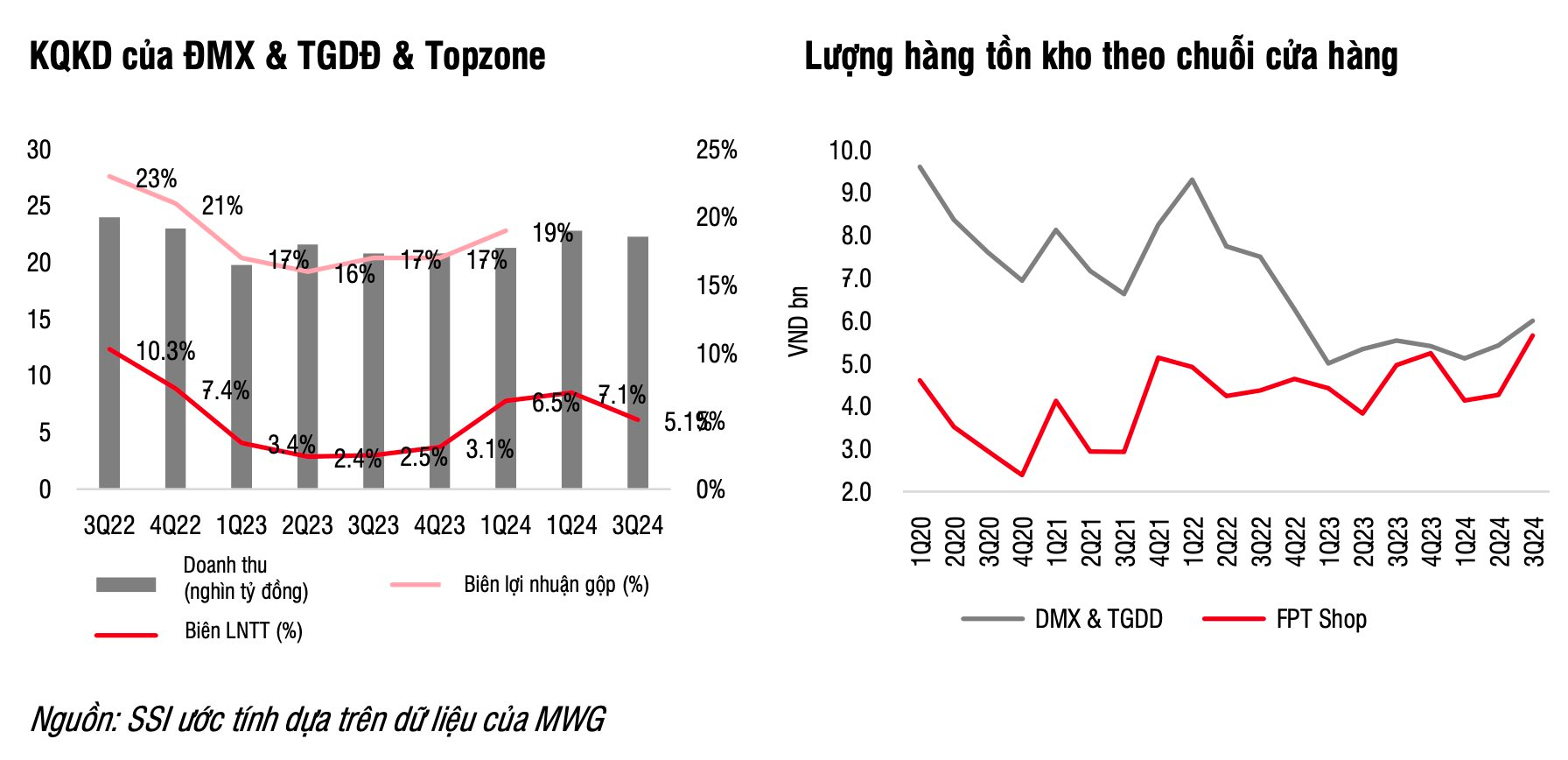

Regarding Bach Hoa Xanh (BHX), SSI Research expects monthly revenue per store to stabilize around VND 2.1 billion in the future. MWG will focus on network expansion (opening 50-200 new stores in 2024-2025) and profit margin improvement by reducing food spoilage, digitizing repetitive tasks, and optimizing labor and logistics costs.

With BHX’s expansion into new provinces in Q4 2024, SSI Research has upwardly adjusted revenue forecasts but lowered net profit estimates due to initial logistics and warehousing costs in these new locations. BHX’s revenue for 2024-2025 is now projected at VND 41,000 billion (+30% yoy) and VND 46,000 billion (+13% yoy), while net profits are estimated at VND 138 billion and VND 542 billion, respectively.

For An Khang Pharmacy, even with store closures, SSI Research maintains its 2024 revenue estimate of VND 2,500 billion (+16% yoy) but adjusts the 2025 revenue forecast downward to VND 2,000 billion (-21% yoy). The analysis team notes that MWG continues to face challenges with its pharmacy business model, and An Khang may continue to incur losses of VND 369 billion and VND 232 billion in 2024-2025.

The Mobile World (MWG) Reaps Rewards with its Indonesia Expansion

As of the end of September, the electronics chain in the Indonesian market continued its rapid expansion, boasting an impressive 76 stores—a remarkable feat, considering it’s double the number from just last year.

The Hunt for Shark Money: Proprietary Trading Buys for the 6th Straight Session, Foreigners Continue Selling Streak

Self-managed securities firms recorded their sixth consecutive net-buying session in the October 8 session, with a value of over 94 billion VND, while foreign investors offloaded over 389 billion VND worth of shares, marking their third straight net-selling session.