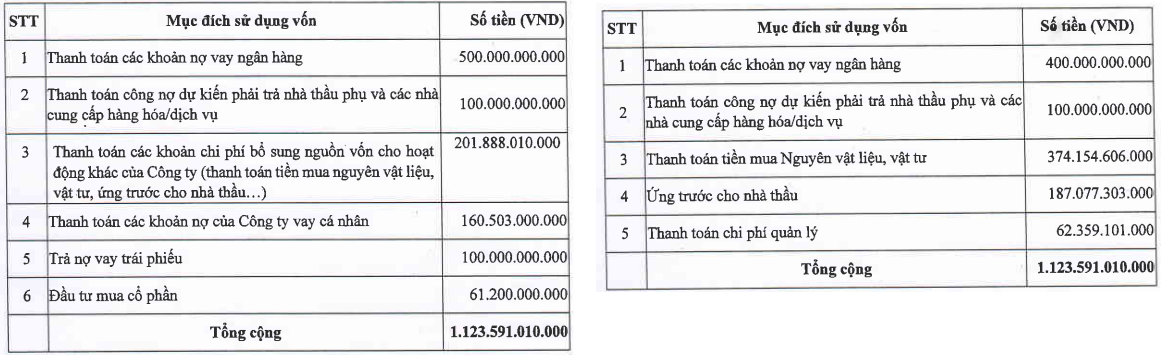

In the two aforementioned capital increases, in 2022 (ending March 3, 2022) and 2023 (ending May 9, 2023), C4G raised nearly VND 1,124 billion each time, initially intended for various purposes but mainly to repay bank loans.

However, according to a recent change in plans, C4G intends to use up to VND 555 billion of temporarily idle funds for short-term deposits/lending/purchasing certificates of deposit at financial institutions to enhance the efficiency of capital utilization from the issuances.

|

C4G’s old capital utilization plan for the 2022 issuance (left) and 2023 (right)

Source: C4G

|

This change in plans follows the conclusion of an inspection by the SSC on October 11, which highlighted, among other things, that in both issuances, C4G lent over 50% of the proceeds to Trustlink Service and Investment JSC without obtaining approval from the General Meeting of Shareholders. The company also altered its capital utilization plan, exceeding 50% of the proceeds without shareholder approval and failing to report these changes to the SSC.

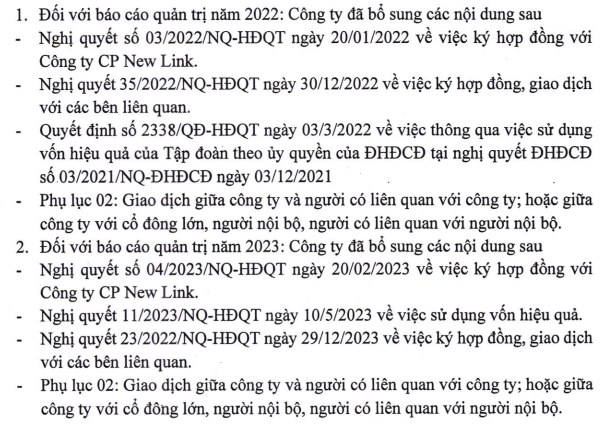

On November 26, C4G supplemented and completed the 2022 and 2023 Board of Management Reports with a series of documents related to contracts with New Link JSC, transactions with related parties, and efficient capital utilization following the inspection findings.

|

C4G supplements and completes the 2022 and 2023 Board of Management Reports

Source: C4G

|

Notably, shortly after the inspection conclusion, on October 31, C4G was fined a total of nearly VND 700 million by the SSC for various violations.

CIENCO4 Fined Nearly VND 700 Million for Multiple Violations in 2023 Capital Raising

In the market, C4G’s stock price has been on a downward trend, falling from around VND 15,500/share in September 2023 to VND 7,700/share at the close of November 27, 2024, a 50% decline.

| C4G extends its downward trend |

The Struggling Seafood Company: A Tale of Woes and Penalties

The seafood processing company, Ut Xi, continues its bleak financial performance with a loss of VND 14 billion in the last 9 months, extending its dreary business days from 2020 until now.

The Power of Vincom Retail’s “Deep Pockets”: Investing in Shophouse Projects in Vũ Yên and Quảng Ninh

As of the end of September 2024, VRE had deposited VND 14,220 billion for business activities with Vingroup, Vinhomes, and related parties.