There are visible changes in the behavior of investors. Buyers have agreed to increase prices after several instances of the market only ‘dipping’ instead of falling sharply. The market is evolving, and the more we hesitate, the worse the buying opportunity becomes.

Intraday adjustments often indicate a strong market. The simple principle is that each price change depends on which side is stronger and more determined. If sellers are stronger and willing to lower prices to match immediately, prices will move downward. Conversely, if buyers raise prices, prices will move upward. Liquidity in this situation depends on the available balance at each price level.

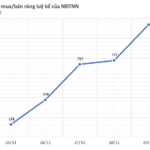

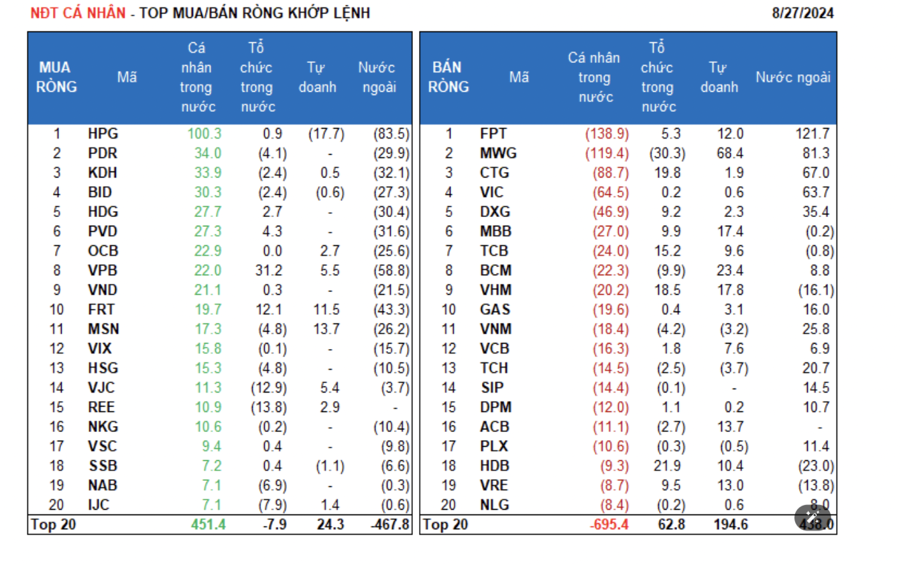

Prolonged low liquidity indicates that money is still predominantly cautious. However, as mentioned several times, the problem lies with the sellers. If most of the goods are retained, the volume readily available for sale can hardly affect prices, or if it does, only for a short time. The situation shifts to which side will lose patience first and place orders proactively? Today’s developments, especially in the afternoon session, indicate that buyers are taking the initiative.

Although this is just a change in one session, it still signals a shift in psychological pressure towards investors. Waiting for the market to adjust before buying is not a bad strategy, but it’s just a probabilistic scenario. On the other hand, the situation varies across stocks, and many codes do not adjust as expected but only fluctuate narrowly. Placing buy orders at low prices is essentially betting on the ability of sellers to push prices down to that level. When understanding that deciding on a price is also a form of gambling, it is normal for the market not to perform as expected and prices not to fall to the anticipated level.

The matched orders of HSX and HNX on the last day of the week were about 12.3k billion, still very low but the highest in seven sessions. This week, the two exchanges even had sessions matching below 10k billion, with an average of only about 10.8k billion/day. This type of increase is called “increasing with doubt” because there are always reasons to be cautious, but market developments are the opposite.

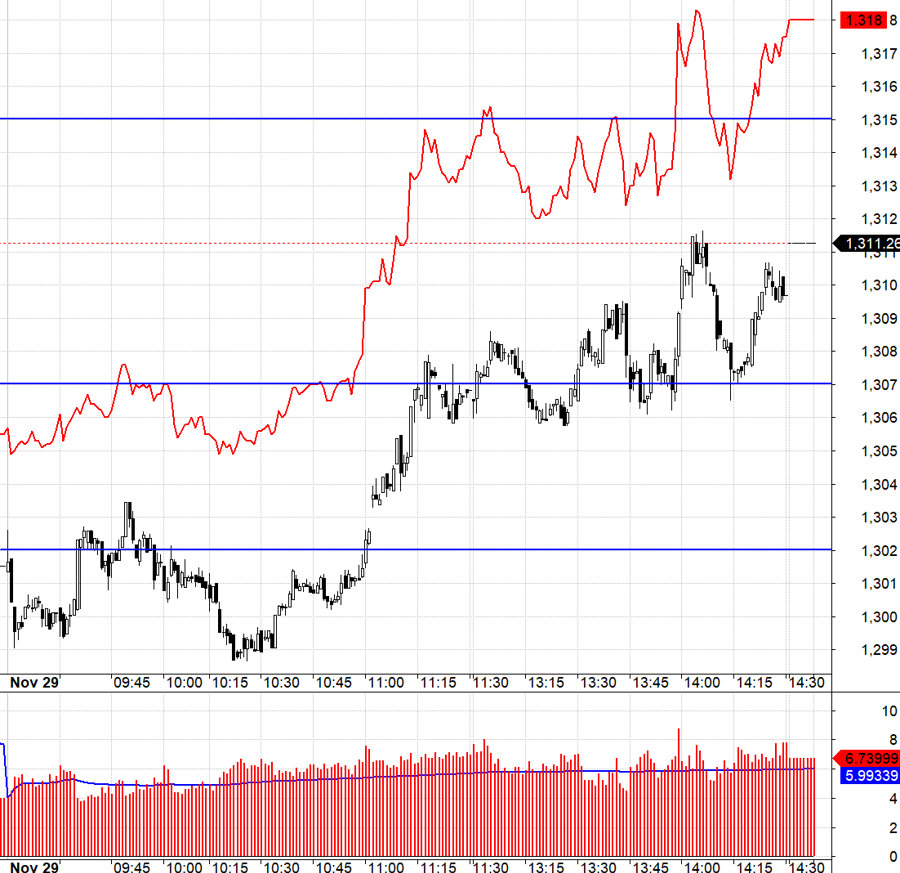

Today, the derivatives market continued to be challenging because the basis difference was too wide. VN30 failed to test the 1302.xx mark at the beginning of the day and retreated, with the F1 basis advantageous by nearly six points for Short, but the efficiency was very low because VN30 did not have a downward momentum (the expected level was 1296.xx), and the basis expanded again. When VN30 recovered to over 1302.xx, the basis differed by nearly eight points, making Long very unfavorable. The same situation occurred during the afternoon session around 1307.xx. Today is a typical example of a good setup not always being effective.

Given the current stock retention, the possibility of a market adjustment is low, and if there is, it needs a pillar of influence. Changes are becoming more apparent from investors, and liquidity is likely to increase from next week. The strategy is to be Long/Short flexible with derivatives.

VN30 closed today at 1311.26. The nearest resistance for the next session is 1316; 1326; 1333; 1340; 1347. Support is at 1307; 1302; 1296; 1290; 1284; 1277.

“Stock Market Blog” is personal and does not represent the opinions of VnEconomy. The views and evaluations are those of the individual investors, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues related to the investment evaluations and opinions published.

The Flow of Funds: Why Stockholders are Holding On – What Incentives are Driving the Money Holders?

The market climbed for another week, with indices outperforming the previous week’s numbers. However, liquidity took a significant dip, falling to a record low in the last one and a half years. Experts suggest that this upward trend is being supported by supply rather than cash flow, and even those with money are unsure whether to jump in at this point.

Tomorrow’s Stock Market Insights: Riding the Waves of Which Stock Groups?

Although the stock market was relatively subdued on November 27th, investors can still take advantage of any volatility to invest in the next session.

The Great Bank Borrow: Why Are Banks Rushing to Borrow from the State Bank of Vietnam?

Over the past month, the State Bank of Vietnam’s offering of OMO (Open Market Operations) has been consistently snapped up by commercial banks, with a high level of participation among member banks.