As the year draws to a close, market signals for land in the southern region of the country are becoming increasingly clear. Secondary land plots with available land titles are being snapped up quickly by investors with ready funds, who are seeking to buy land at good prices and wait for the market to sell at a premium.

While land transactions in the western part of Ho Chi Minh City have slowed down, the eastern region, particularly in District 9 and Nhon Trach, is experiencing a surge in investment activities. Several investment groups from the northern region have entered the market, buying up land and waiting to “cash in” by 2025.

According to Mr. Nguyen Duc Hoa, a veteran real estate investor in Ho Chi Minh City, land prices in District 9 have already increased by 10-20% compared to the same period last year. Investors are anticipating future demand, and prices are expected to rise further in 2025 when the new laws on land subdivision and sale take effect. Mr. Hoa believes that in the long run, land prices will continue to rise, depending on the area, and there will still be demand for this segment.

Mr. Tran Khanh Quang, an experienced real estate investor, recently shared that in the next six months, land prices in Ho Chi Minh City are expected to increase by 15-20%, and in the short term, the surrounding provinces will also experience minimum growth of 10-15%.

Mr. Quang noted that Ho Chi Minh City is showing positive signs following the Hanoi market, with strong transaction volumes since the beginning of the year. There is still a significant demand for real estate among the populace, while many projects in the city have yet to be launched. Additionally, southern investors are accustomed to using financial leverage and are willing to take out loans to purchase real estate immediately.

“With the three real estate laws coming into force, the supply of housing and land will become increasingly limited. As a result, the remaining products from the previous period have an advantage and will be in demand in the coming time,” emphasized Mr. Quang.

Photo: TB

The 2023 Law on Real Estate Business, which came into effect on August 1, prohibits land subdivision and sale in 105 cities and towns, an increase of 81 localities compared to the current regulations. This helps curb rampant and illegal land subdivision and speculation, bringing stability to the real estate market. This crackdown has created a psychological effect, with investors expecting the land market to recover by the end of this year.

However, for the law to take effect in practice, implementing decrees and circulars are necessary. Therefore, according to experts, it will take at least 6-12 months for the land market to recover. Thus, until the second quarter of 2025, the land market will not see much change, and prices will remain relatively stable. It is only in the third quarter of 2025 that land prices are expected to surge, and liquidity in this segment will improve.

Nonetheless, some experts predict that from the third quarter to the end of 2025, the land market will only improve in areas close to the centers of cities or peri-urban areas. Land in remote and far-flung locations is unlikely to recover or create a “frenzy” as in previous years.

Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the southern region, believes that the ban on land subdivision and sale under the new law will reduce buying power in these markets, but land in metropolitan areas will attract stronger capital inflows. For now, central markets will continue to attract investment due to the evident increase in investment demand.

However, land investors need to exercise caution when investing in land plots in areas undergoing a transition under the new Real Estate Business Law or Housing Law, especially in areas where land subdivision and sale are prohibited. Buyers must ensure that the land plot they are investing in has a land title. Additionally, investors should choose areas with well-developed infrastructure, consistent GDP growth, and those that attract residents and foreign investors.

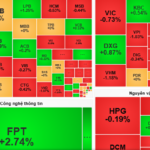

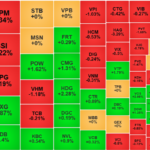

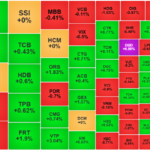

Stock Market Blog: Just an Intraday Adjustment, the Market is Strong

It appears that there are visible shifts in the behavior of those with purchasing power. Buyers have now accepted higher prices after multiple instances of the market “dipping” rather than taking a significant downturn. The market is trending in a direction where procrastinating with caution will only lead to worse buying opportunities.

The Big Sell-Off Hasn’t Happened Yet, Foreign Investors Bet Big on FPT

The afternoon session witnessed a slight uptick in liquidity, rising nearly 6% from the morning session, yet it remained relatively low. Trading was stable, and even the breadth was better than the morning. The VN-Index closed with a minor loss of 0.16 points, indicating a maintained balance. The market has not witnessed any significant selling pressure thus far.